- Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September +1.5% +0.9%

06:00 Germany Factory Orders s.a. (MoM) August +4.6% -2.4% -5.7%

06:00 Germany Factory Orders n.s.a. (YoY) August +4.9% -1.3%

08:30 Eurozone Sentix Investor Confidence October -9.8 -11.3 -13.7

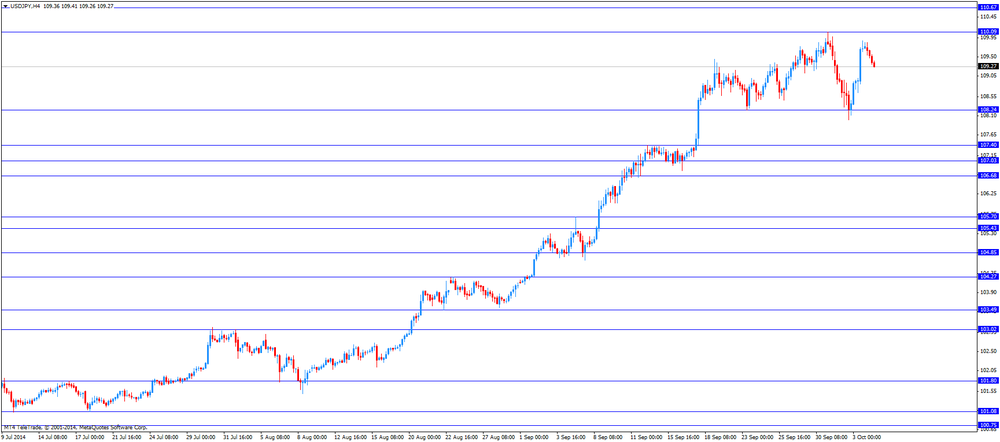

The U.S. dollar traded lower against the most major currencies, but remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August. August's figure was revised up from 142,000 jobs.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008. Analysts had expected the unemployment rate to remain unchanged at 6.1%.

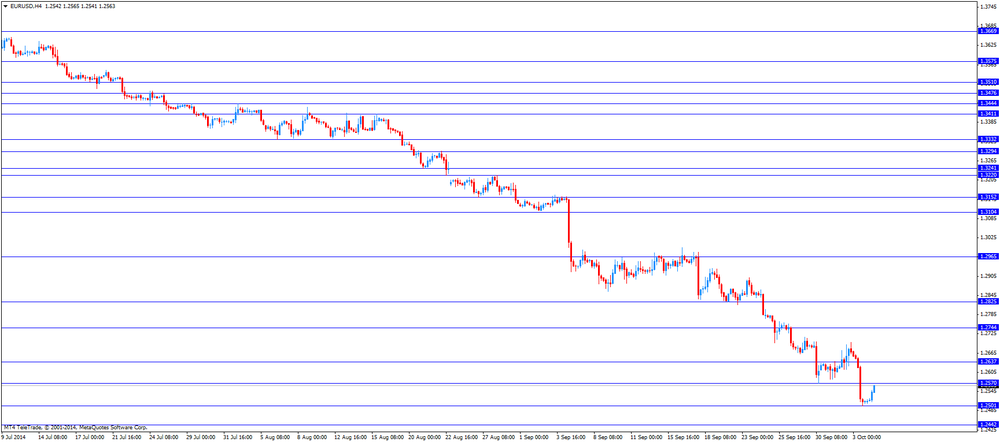

The euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone. German factory orders declined 5.7% in August, beating expectations for a 2.4% decrease, after a 4.9% gain in July. July's figure was revised up from a 4.6% rise. That was the largest drop since 2009.

The Sentix investor confidence index for the Eurozone dropped to -13.7 in October from -9.8 in September. Analysts had expected the index to decline to -11.3.

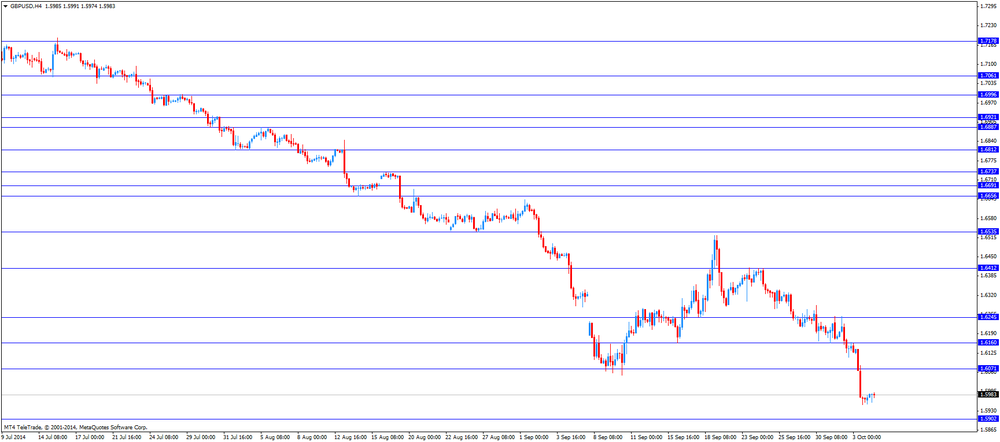

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

EUR/USD: the currency pair increased to $1.2565

GBP/USD: the currency pair rose to $1.5991

USD/JPY: the currency pair declined to Y109.26

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index September 50.9 53.4

21:00 New Zealand NZIER Business Confidence Quarter III 32