- Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar despite the weak National Australia Bank's business confidence index and comment by the Reserve Bank of Australia assistant governor Guy Debelle

Market news

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar despite the weak National Australia Bank's business confidence index and comment by the Reserve Bank of Australia assistant governor Guy Debelle

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence September 7 Revised From 8 5

06:45 France CPI, m/m September +0.4% -0.3% -0.4%

06:45 France CPI, y/y September +0.5% +0.4% +0.4%

07:15 Switzerland Producer & Import Prices, m/m September -0.2% +0.3% -0.1%

07:15 Switzerland Producer & Import Prices, y/y September -1.2% -1.4% -1.4%

08:30 United Kingdom Retail Price Index, m/m September +0.4% +0.3% +0.2%

08:30 United Kingdom Retail prices, Y/Y September +2.4% +2.3% +2.3%

08:30 United Kingdom Producer Price Index - Input (MoM) September -0.6% -0.4% -0.6%

08:30 United Kingdom Producer Price Index - Input (YoY) September -7.2% -6.6% -7.4%

08:30 United Kingdom RPI-X, Y/Y September +2.5% +2.3%

08:30 United Kingdom Producer Price Index - Output (MoM) September -0.1% -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) September -0.3% -0.4% -0.4%

08:30 United Kingdom HICP, m/m September +0.4% +0.3% +0.0%

08:30 United Kingdom HICP, Y/Y September +1.5% +1.4% +1.2%

08:30 United Kingdom HICP ex EFAT, Y/Y September +1.9% +1.8% +1.5%

09:00 Eurozone ZEW Economic Sentiment October 14.2 7.1 4.1

09:00 Eurozone Industrial production, (MoM) August +1.0% -1.5% -1.8%

09:00 Eurozone Industrial Production (YoY) August +2.2% -0.9% -1.9%

09:00 Eurozone ECOFIN Meetings

09:00 Germany ZEW Survey - Economic Sentiment October 6.9 0.2 -3.6

The U.S. dollar traded mixed against the most major currencies on comments. No major economic reports were released in the U.S. yesterday. The U.S. bond market was closed for the Columbus Day holiday.

The New Zealand dollar traded higher against the U.S. dollar as the People's Bank of China lowered a 14-day repo rate. That could be signs that China's central bank is willing to boost the economy. Bloomberg reported that the People's Bank of China sold 20 billion yuan of 14-day repurchase agreements at 3.4% (a 14-day repo rate was 3.5% last week).

No major economic reports were released in New Zealand.

The Australian dollar traded higher against the U.S. dollar despite the weak National Australia Bank's business confidence index and comment by the Reserve Bank of Australia (RBA) assistant governor Guy Debelle.

The National Australia Bank's business confidence index fell to 5 in September from 7 in August. August's figure was revised down from 8.

The RBA assistant governor Guy Debelle said at the Citi Annual Australian and New Zealand investment conference in Sydney that the Aussie was still too high despite the decline in September. He also said that the next sell-off in global fixed-income markets could be "relatively violent".

The Japanese yen traded mixed against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair rose to $1.2697

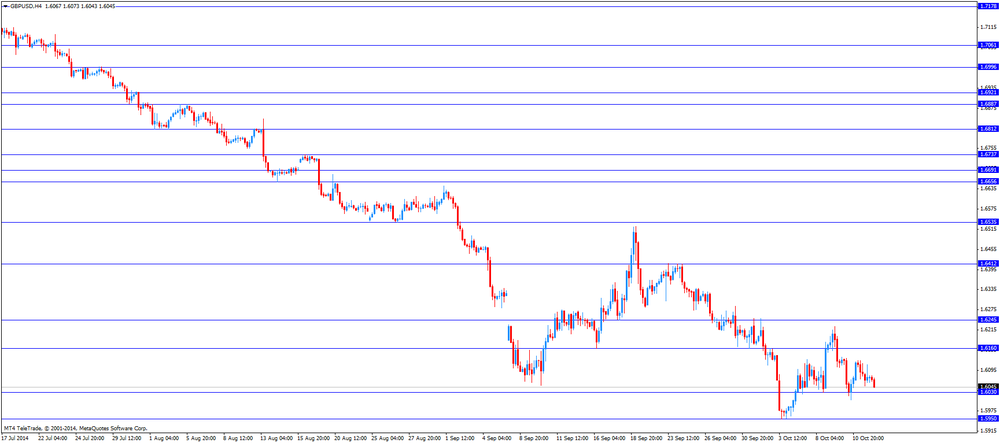

GBP/USD: the currency pair increased to $1.6120

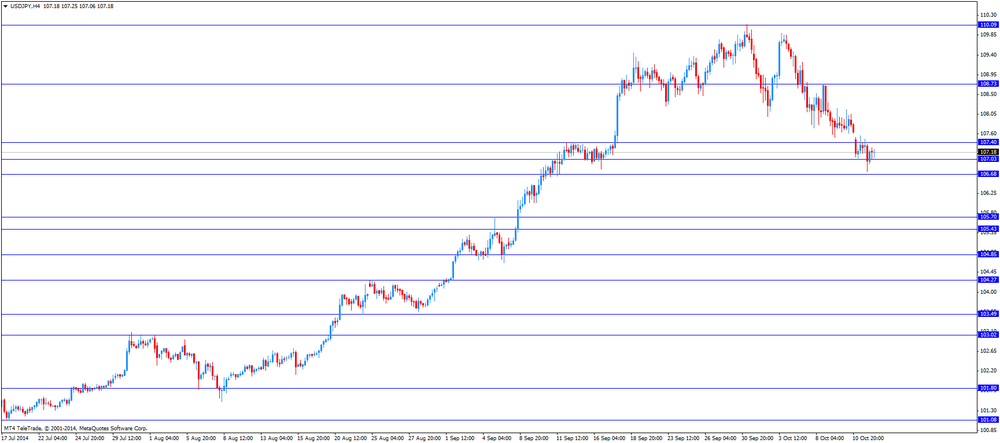

USD/JPY: the currency pair fell to Y107.05

The most important news that are expected (GMT0):

23:30 Australia Westpac Consumer Confidence October -4.6%