- Foreign exchange market. European session: the euro traded lower against the U.S. dollar ahead of the speech by the European Central Bank President Mario Draghi

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar ahead of the speech by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) November +2.6% -1.7%

00:01 United Kingdom Rightmove House Price Index (YoY) November +7.6% +8.5%

00:30 Australia New Motor Vehicle Sales (MoM) October +2.9% +1.6%

00:30 Australia New Motor Vehicle Sales (YoY) October +0.8% -0.5%

10:00 Eurozone Trade Balance s.a. September 15.4 16.2 17.7

10:00 Germany Bundesbank Monthly Report

The U.S. dollar rose against the most major currencies ahead of the U.S. industrial production and NY Fed Empire State manufacturing index. The greenback increased against the most major currencies as Japan's preliminary gross domestic product declined in the third quarter. Japan's gross domestic product dropped by an annual rate of 1.6% in the third quarter, after a 7.3% fall in the previous quarter. Analysts had expected a 2.1% gain.

The U.S. industrial production is expected to rise 0.2% in October, after a 1.0% increase in September.

The NY Fed Empire State manufacturing index is expected to climb to 12.1 in October from 6.2 in September.

The euro traded lower against the U.S. dollar ahead of the speech by the European Central Bank President Mario Draghi. Eurozone's trade surplus widened to €17.7 billion in September from €15.4 billion in August, exceeding expectations for a rise to €16.2 billion. August's figure was revised down from a surplus of €15.8 billion.

The British pound fell against the U.S. dollar. The Rightmove house price index for the U.K. declined 1.7% in November, after a 2.6% gain in October.

The Canadian dollar traded lower against the U.S. dollar ahead of foreign securities purchases from Canada. Foreign securities purchases in Canada are expected to rise by C$11.32 billion in September, after a C$10.28 increase in August.

EUR/USD: the currency pair fell to $1.2481

GBP/USD: the currency pair declined to $1.5618

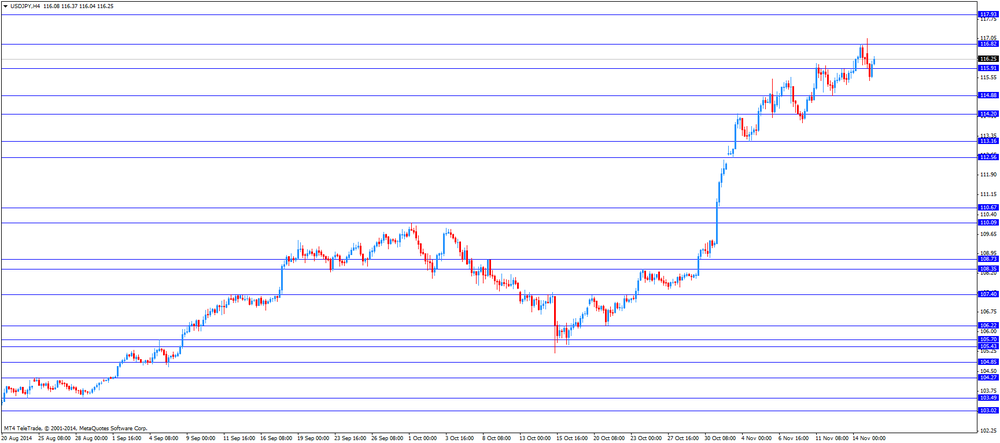

USD/JPY: the currency pair climbed to Y116.37

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases September 10.28 11.32

13:30 U.S. NY Fed Empire State manufacturing index October 6.2 12.1

14:00 Eurozone ECB President Mario Draghi Speaks

14:15 U.S. Industrial Production (MoM) October +1.0% +0.2%

14:15 U.S. Capacity Utilization October 79.3% 79.3%