- Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the solid data from Germany

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the solid data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m October 0.0% 3%

00:00 Australia Private Capital Expenditure Quarter III +1.1% -1.6% +0.2%

08:55 Germany Unemployment Change November -23 Revised From -22 -1 -14

08:55 Germany Unemployment Rate s.a. November 6.6% Revised From 6.7% 6.7% 6.6%

09:00 OPEC OPEC Meetings

09:00 Eurozone M3 money supply, adjusted y/y October +2.5% +2.6% +2.5%

09:00 Eurozone Private Loans, Y/Y October -1.2% -1.0% -1.1%

10:00 Eurozone Business climate indicator November 0.06 Revised From 0.05 0.18

10:00 Eurozone Economic sentiment index November 100.7 100.3 100.8

10:00 Eurozone Industrial confidence November -5.1 -5.4 -4.3

12:00 Germany Gfk Consumer Confidence Survey December 8.5 8.6 8.7

The U.S. dollar mixed to higher against the most major currencies. Markets in the U.S. are closed for a public holiday.

The euro traded lower against the U.S. dollar despite the solid data from Germany. German preliminary consumer price index was flat in November, in line with expectations, after a 0.3% decline in October.

The number of unemployed people in Germany declined by 14,000 in November, beating expectations for a 1,000 decline, after a 23,000 drop in October. October's figure was revised up from a 22,000 decrease.

Germany's adjusted unemployment rate remained unchanged at 6.6% in November, beating expectations for an increase to 6.7%. October's figure was revised down from 6.7%.

The Gfk German consumer confidence index increased to 8.7 in December from 8.5 in November, beating forecasts for a rise to 8.6.

Eurozone's adjusted M3 money supply remained unchanged 2.5% in October, missing expectations for a 2.6% increase.

Eurozone's private loans fell 1.1% in October, missing forecasts of a 1.0% decrease, after a 1.2% drop in September.

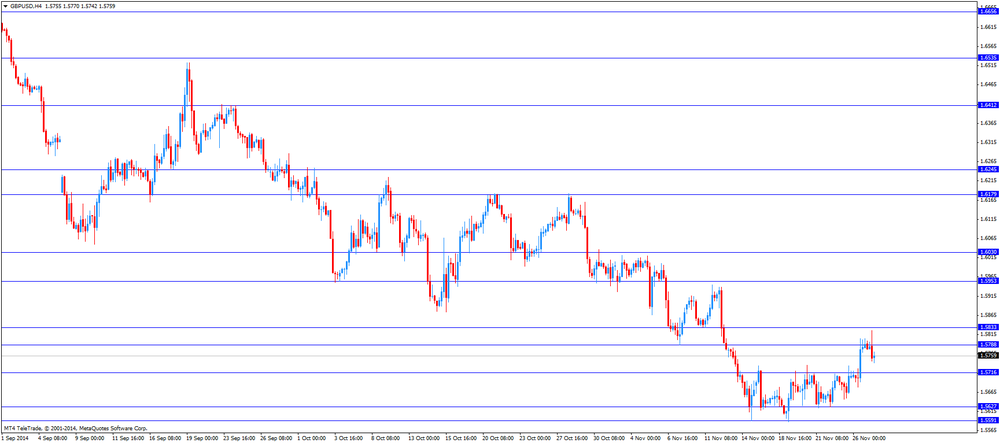

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian current account data. Canadian current account deficit is expected to narrow to C$10.3 billion in the third quarter from a deficit of C$11.9 billion in the second quarter.

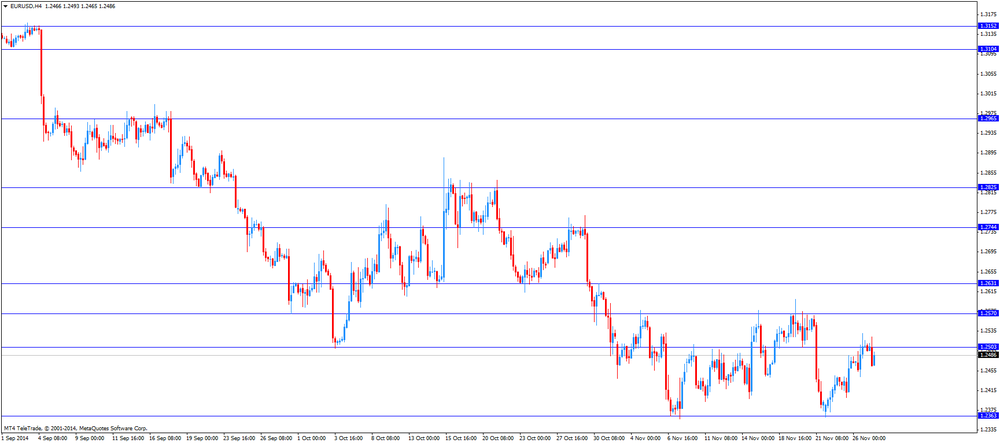

EUR/USD: the currency pair fell to $1.2464

GBP/USD: the currency pair declined to $1.5742

USD/JPY: the currency pair rose to Y117.55

The most important news that are expected (GMT0):

13:30 Canada Current Account, bln Quarter III -11.9 -10.3

13:30 U.S. Bank holiday

21:45 New Zealand Building Permits, m/m October -12.2%

23:30 Japan Household spending Y/Y October -5.6% -4.8%

23:30 Japan Unemployment Rate October 3.6% 3.6%

23:30 Japan Tokyo Consumer Price Index, y/y November +2.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y November +2.5% +2.3%

23:30 Japan National Consumer Price Index, y/y October +3.2% +3.1%

23:30 Japan National CPI Ex-Fresh Food, y/y October +3.0% +2.9%

23:50 Japan Retail sales, y/y October +2.3% +1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) October +2.9% -0.4%

23:50 Japan Industrial Production (YoY) (Preliminary) October +0.8% -0.2%