- Foreign exchange market. European session: the Swiss franc traded mixed against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision

Market news

Foreign exchange market. European session: the Swiss franc traded mixed against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation December 4.1% 3.4%

00:01 United Kingdom RICS House Price Balance November 20% 15% 13%

00:30 Australia Changing the number of employed November +13.7 Revised From +24.1 +15.2 +42.7

00:30 Australia Unemployment rate November 6.2% 6.3% 6.3%

07:00 Germany CPI, m/m (Finally) November 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y November +0.5% +0.5% +0.6%

07:45 France CPI, m/m November 0.0% +0.2% -0.2%

07:45 France CPI, y/y November +0.5% +0.5% +0.4%

08:30 Switzerland SNB Interest Rate Decision 0.25% 0.25% 0.25%

08:30 Switzerland SNB Monetary Policy Assessment

08:30 Switzerland SNB Press Conference

09:00 Eurozone ECB Monthly Report

10:15 Eurozone Targeted LTRO 82.6 129.8

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. retail sales are expected to rise 0.3% in November, after a 0.3% decline in October.

Retail sales excluding automobiles are expected to climbs 0.1% in November, after a 0.3% rise in October.

The number of initial jobless claims in the U.S. is expected to increase by 2,000 to 299,000.

The euro traded mixed against the U.S. dollar after the targeted longer-term refinancing operation (TLTRO) from the Eurozone and consumer price inflation from Germany and France. 306 banks borrowed 129.84 billion euros in the auction.

Germany's final consumer price index was flat in November.

On a yearly basis, German final consumer price index rose 0.6% in October, higher than the previous reading of 0.5% gain.

France's consumer price inflation declined 0.2% in November, missing expectations for a 0.2% increase, after a flat reading in October.

On a yearly basis, French consumer price index fell to 0.4% in November from 0.5% in October. Analysts had expected the consumer inflation to remain at 0.5%.

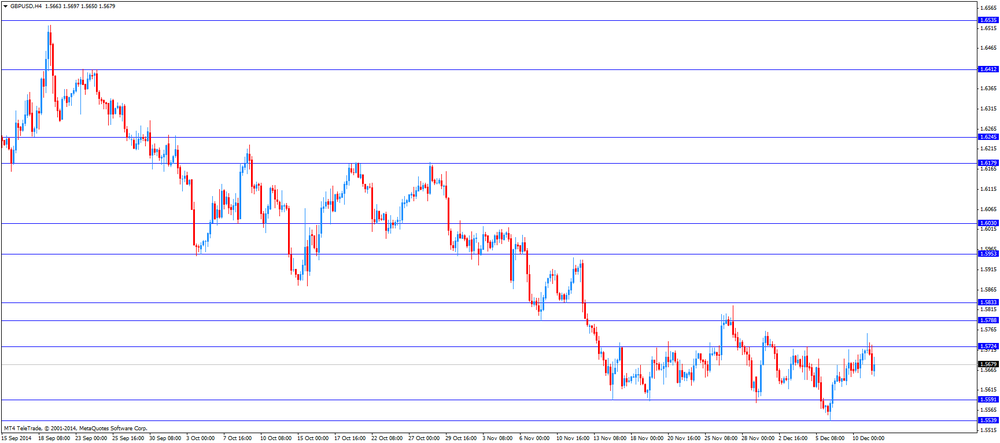

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in October, after a 0.1% gain in September.

The Swiss franc traded mixed against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The SNB kept its interest rate unchanged at 0.00 - 0.25% and also kept the exchange rate floor unchanged at 1.20 francs per euro.

The SNB reiterated that it will defend the 1.20 francs per euro exchange rate floor. The central bank also said that consumer inflation will decline next year and the risk of deflation has risen.

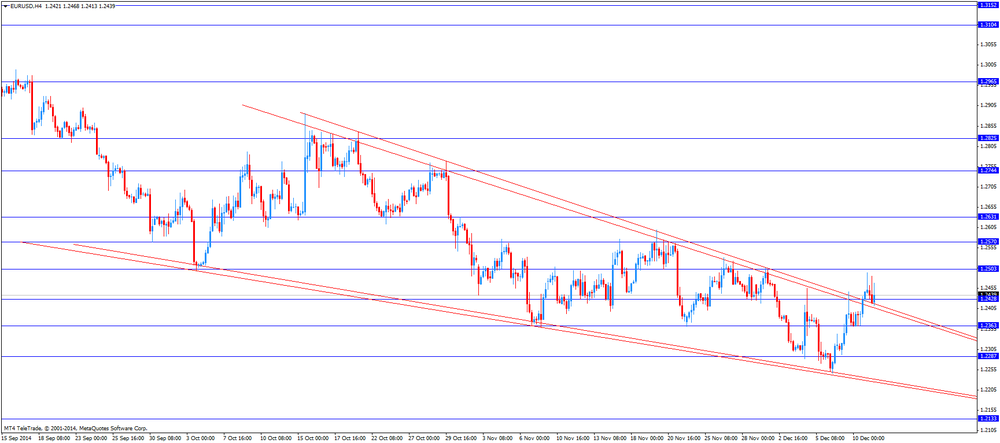

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5650

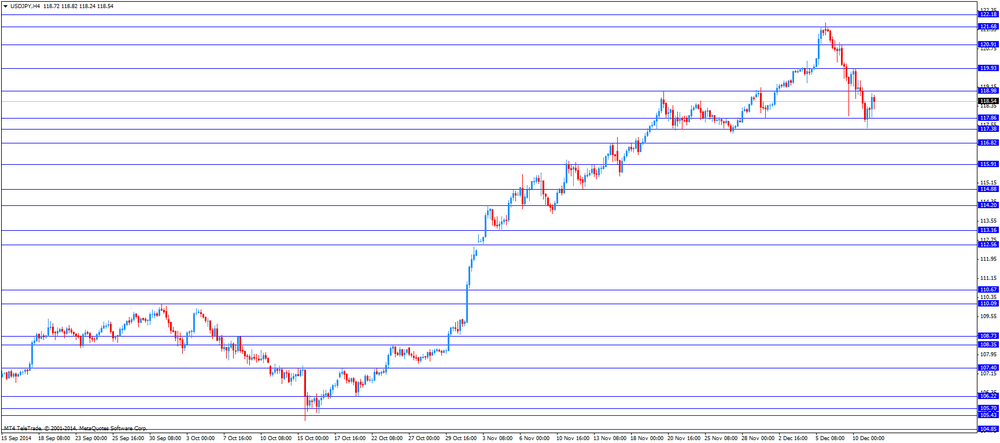

USD/JPY: the currency pair rose to Y118.88

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index October +0.1% +0.2%

13:30 U.S. Retail sales November +0.3% +0.3%

13:30 U.S. Retail sales excluding auto November +0.3% +0.1%

13:30 U.S. Initial Jobless Claims December 297 299

13:30 U.S. Import Price Index December -1.3% -1.7%

15:00 U.S. Business inventories October +0.3% +0.2%

21:30 New Zealand Business NZ PMI November 59.3