- Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y January -0.4% +0.2%

00:30 Australia National Australia Bank's Business Confidence January 2 3

00:30 Australia House Price Index (QoQ) Quarter IV +1.4% Revised From +1.5% +2.0% +1.9%

00:30 Australia House Price Index (YoY) Quarter IV +9.1% +6.8%

01:30 China PPI y/y January -3.3% -3.7% -4.3%

01:30 China CPI y/y January +1.5% +1.1% +0.8%

06:45 Switzerland Unemployment Rate January 3.1% Revised From 3.2% 3.2% 3.1%

07:45 France Industrial Production, m/m December -0.2% Revised From -0.3% +0.3% +1.5%

07:45 France Industrial Production, y/y December -2.6% -0.1%

08:00 G20 G20 Meetings

08:15 Switzerland Consumer Price Index (MoM) January -0.5% -0.4% -0.4%

08:15 Switzerland Consumer Price Index (YoY) January -0.3% -0.6% -0.5%

09:30 United Kingdom Industrial Production (MoM) December 0.0% Revised From -0.1% +0.3% -0.2%

09:30 United Kingdom Industrial Production (YoY) December +1.1% +0.8% +0.5%

09:30 United Kingdom Manufacturing Production (MoM) December +0.8% Revised From +0.7% +0.3% +0.1%

09:30 United Kingdom Manufacturing Production (YoY) December +3.0% Revised From +2.7% +2.0% +2.4%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 4.99 million in December from 4.97 million in November.

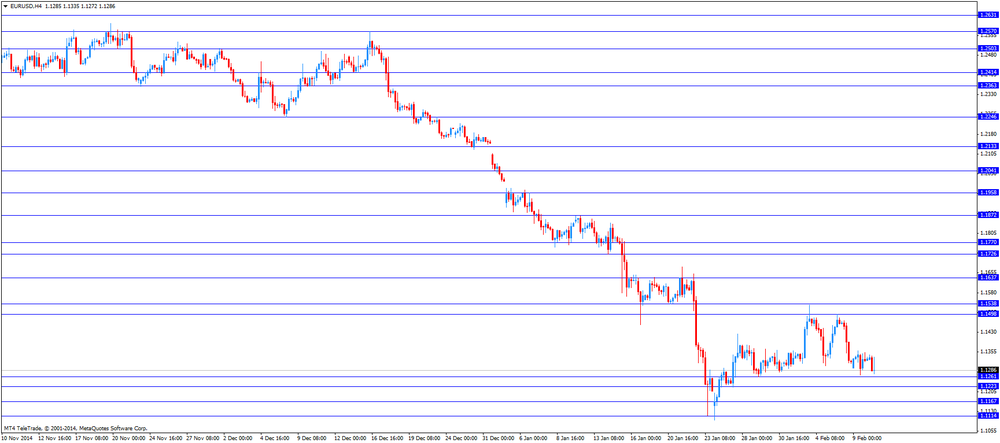

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro.

Industrial production in France climbed 1.5% in December, exceeding expectations for a 0.3% gain, after a 0.2% drop in November. November's figure was revised up from a 0.3% decline.

The British pound traded lower against the U.S. dollar after the mostly weaker-than expected manufacturing output data from the U.K. Manufacturing production in the U.K. rose 0.1% in December, missing expectations for a 0.3% rise, after a 0.8% increase in November. November's figure was revised up from a 0.7% gain.

On a yearly basis, manufacturing production in the U.K. increased 2.4% in December, beating expectations for a 2.0% gain, after a 3.0% rise in November. November's figure was revised up from a 2.7% increase.

Industrial production in the U.K. decreased 0.2% in December, missing forecasts of a 0.3% rise, after a flat reading in November. November's figure was revised up from a 0.1% decrease.

The decline was driven by falls in mining and energy sectors.

On a yearly basis, industrial production in the U.K. rose 0.5% in December, missing expectations for a 0.8% increase, after a 1.1% gain in November.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index dropped 0.4% in January, in line with expectations, after a 0.5% decline in December.

On a yearly basis, Switzerland's consumer price index declined to -0.5% in January from -0.3% in December, beating expectations for a 0.6% drop.

These figures have added to concerns over deflation in Switzerland.

Switzerland's unemployment rate remained unchanged at 3.1% in January. December's figure was revised up from 3.2%. Analysts had expected the unemployment rate to rise to 3.2%.

EUR/USD: the currency pair fell to $1.1272

GBP/USD: the currency pair decreased to $1.5195

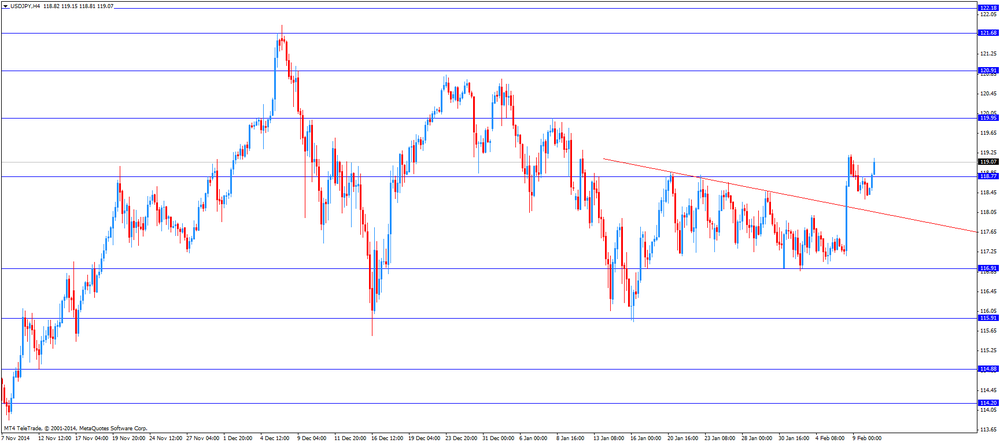

USD/JPY: the currency pair rose to Y119.15

The most important news that are expected (GMT0):

13:20 U.S. FOMC Member Laker Speaks

15:00 United Kingdom NIESR GDP Estimate January +0.6%

15:00 U.S. JOLTs Job Openings December 4970 4992

17:45 Canada Gov Council Member Wilkins Speaks

23:30 Australia Westpac Consumer Confidence February +2.4%