- Foreign exchange market. European session: the British pound rose against the U.S. dollar after the better-than-expected labour market data from the U.K.

Market news

Foreign exchange market. European session: the British pound rose against the U.S. dollar after the better-than-expected labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:30 United Kingdom Average Earnings, 3m/y December +1.8% Revised From +1.7% +1.7% +2.1%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December +1.8% +1.7%

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom Claimant count January -35.8 Revised From -29.7 -25.2 -38.6

09:30 United Kingdom Claimant Count Rate January 2.6% 2.5%

09:30 United Kingdom ILO Unemployment Rate December 5.8% 5.8% 5.7%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -10.8 -73.0

The U.S. dollar traded mixed against the most major currencies ahead the U.S. economic data. Housing starts in the U.S. are expected to decline to 1.070 million units in January from 1.089 million units in December.

The number of building permits is expected to remain unchanged at 1.060 million units in January.

The U.S. PPI is expected to decline 0.4% in January, after a 0.3% decrease in December.

The U.S. industrial production is expected to rise 0.5% in January, after a 0.1% fall in December.

The Fed will release minutes of its last meeting. Investors expect signs when the Fed will start to hike its interest rate.

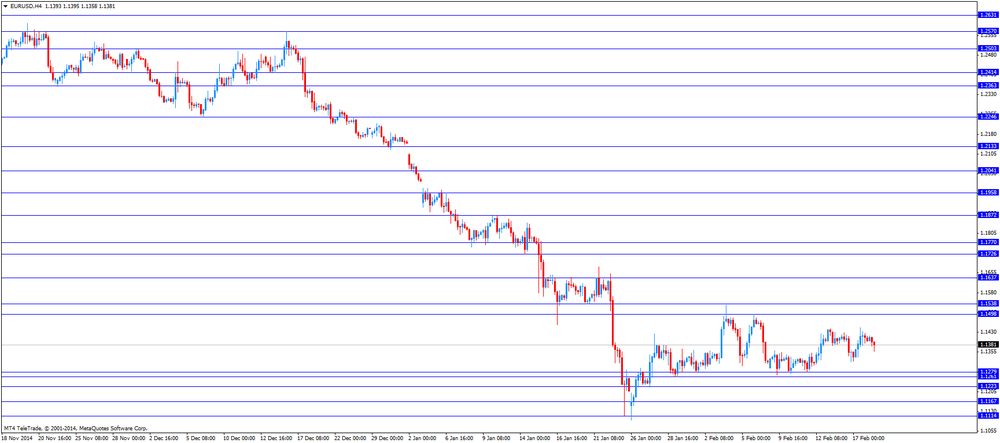

The euro fell against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

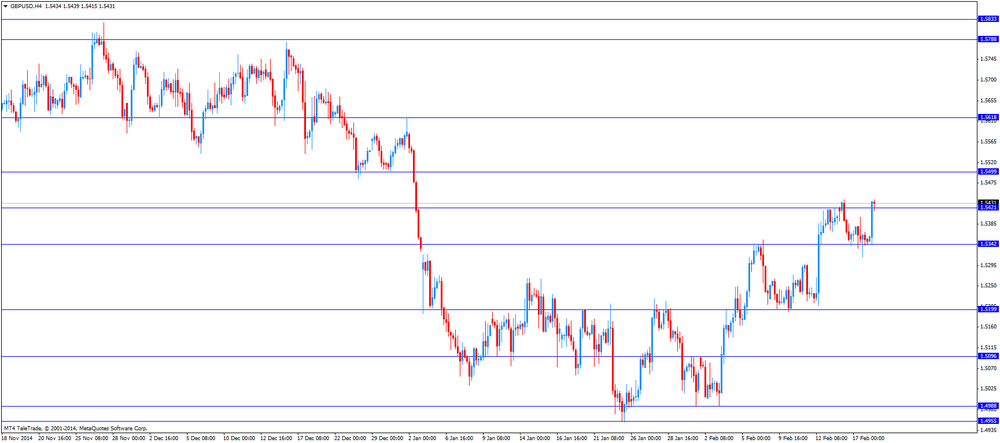

The British pound rose against the U.S. dollar after the better-than-expected labour market data from the U.K. The U.K. unemployment rate fell to 5.7% in the October to December quarter from 5.8% in the three months to September. Analysts had expected the unemployment rate to remain unchanged.

That was the lowest level since August 2008.

The claimant count decreased by 38,600 people in January, exceeding expectations for a drop of 25,200 people, after a decrease of 35,800 people in December. December's figure was revised from a decline of 29,700.

Average weekly earnings, excluding bonuses, climbed by 2.1%.

Average weekly earnings, including bonuses, rose by 1.7%.

Wage growth outpaced inflation for the first time since 2009. Inflation was 0.3% last month.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The Swiss franc traded lower against the U.S. dollar after the weak survey by the ZEW Institute and Credit Suisse Group. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index dropped to -73.0 points in February from -10.8 points in January.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian wholesales data. Wholesale sales in Canada are expected to climb 0.4% in December, after a 0.3% drop in November.

EUR/USD: the currency pair declined to 1.1377

GBP/USD: the currency pair rose to $1.5439

USD/JPY: the currency pair climbed to Y119.41

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m December -0.3% +0.4%

13:30 U.S. Building Permits, mln January 1060 Revised From 1032 1060

13:30 U.S. Housing Starts, mln January 1089 1070

13:30 U.S. PPI, m/m January -0.3% -0.4%

13:30 U.S. PPI, y/y January +1.1%

13:30 U.S. PPI excluding food and energy, m/m January +0.3% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y January +2.1%

14:15 U.S. Industrial Production (MoM) January -0.1% +0.5%

14:15 U.S. Capacity Utilization January 79.7% 79.9%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.5% -0.2%

21:45 New Zealand PPI Output (QoQ) Quarter IV -1.1% -0.3%

22:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Adjusted Merchandise Trade Balance, bln January -712.1 -600.0