- Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Market news

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

04:30 Japan All Industry Activity Index, m/m December +0.1% -0.2% -0.3%

05:00 Japan BoJ monthly economic report

07:00 Switzerland Trade Balance January 1.52 1.23 3.43

07:45 France CPI, m/m January +0.1% -0.9% -1.1%

07:45 France CPI, y/y January +0.1% -0.4%

09:00 Eurozone Current account, adjusted, bln December 19.9 Revised From 18.1 23.3 17.8

11:00 United Kingdom CBI industrial order books balance February 4 7 10

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded higher against the most major currencies ahead the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 1,000 to 305,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to rise to 8.8 in February from 26.3 in January.

The Fed released its minutes of last meeting. The Fed is concerned about to increase its interest rate too soon.

The euro fell against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The ECB released its minutes of January meeting, for the first time. According to the minutes, the most Governing Council members voted a EUR60 billion a month bond-purchase programme, mostly government bonds, to increase inflation and to spur economic growth in the Eurozone.

One member wants to consider buying corporate bonds.

The rejection of Greek loan proposal by Germany weighed on the euro. Greece submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Eurozone's adjusted current account surplus fell to €17.8 billion in December from €19.9 billion in November. November's figure was revised up from a surplus of €18.1 billion. Analysts had expected a surplus of €23.3 billion.

The British pound traded slightly lower against the U.S. dollar despite the better-than-expected CBI industrial order books balance data from the U.K. The CBI industrial order books balance climbed to +10% in February from +4% in January.

Analysts expected the CBI industrial order books balance to increase to +7%.

Volume of output for the next three months climbed to +25 in February, the highest level since September 2014, up from +13 in January.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected trade data from Switzerland. Switzerland's trade surplus widened to CHF3.43 billion in January from CHF1.51 billion in December. December's figure was revised down from CHF1.52 billion.

Analysts had expected the trade surplus to narrow to CHF1.23 billion.

Exports rose 2.9% in January, while imports declined 2.2%.

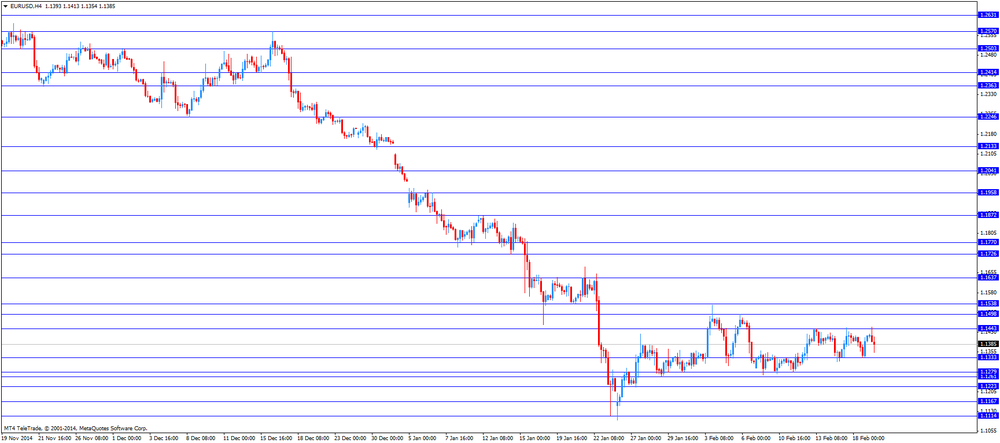

EUR/USD: the currency pair declined to 1.1354

GBP/USD: the currency pair fell to $1.5416

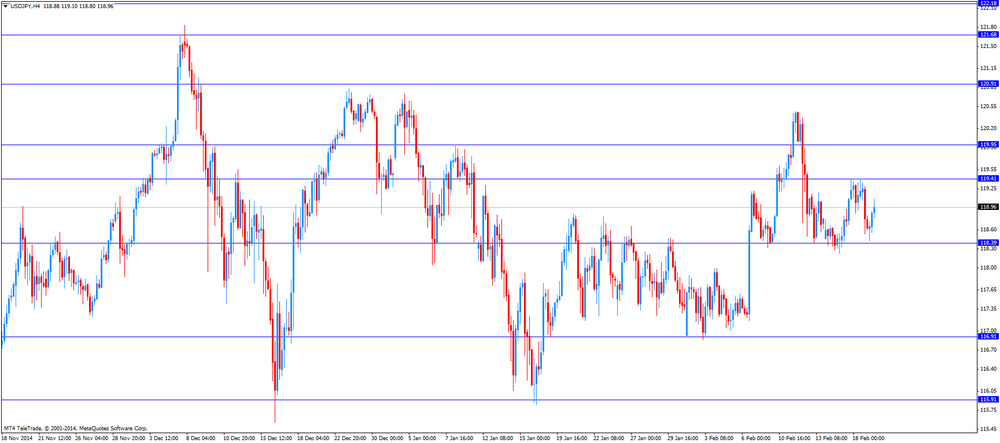

USD/JPY: the currency pair climbed to Y119.10

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims February 304 305

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Philadelphia Fed Manufacturing Survey February 6.3 8.8