- Foreign exchange market. Asian session: Australian dollar rose

Market news

Foreign exchange market. Asian session: Australian dollar rose

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

---

Australian dollar rose as China steps up economy help with reduced bank reserve ratios. China's leaders swung into stimulus mode, cutting the amount of cash lenders must set aside as reserves by the most since the global financial crisis just days after a report showed the slowest economic growth in six years. The reserve-requirement ratio was lowered 1 percentage point effective Monday, the People's Bank of China said. While that was the second reduction this year, the new level of 18.5 percent is still high by global standards. The move puts China more firmly in the easing camp with the European Central Bank and the Bank of Japan and follows a vow by Premier Li Keqiang to step in if the economy's slowdown hurts jobs as well as PBOC Governor Zhou Xiaochuan's weekend comment that China has room to act. The cut will allow banks to boost lending, unleashing about 1.2 trillion yuan ($194 billion).

EUR / USD: during the Asian session the pair traded in the range of $1.0785-20

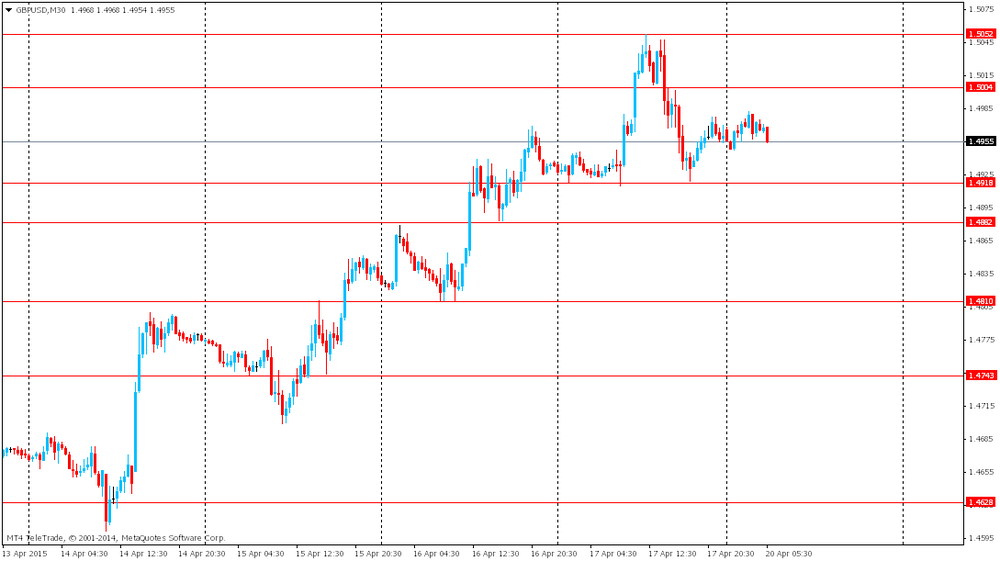

GBP / USD: during the Asian session the pair traded in the range of $1.4945-80

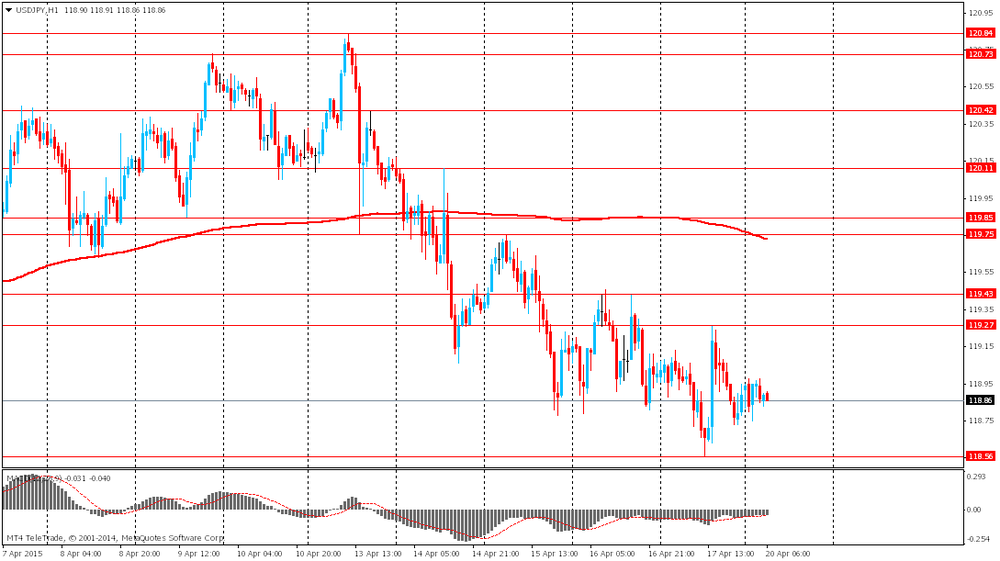

USD / JPY: during the Asian session the pair traded in the range Y118.75-00

A data light day in the UK Monday with attention turning to Wednesday's BOE Minutes, followed Thursday by UK borrowing numbers and retail sales. Upcoming General Election also in focus and seen as a counter for sterling strength, though some reports suggest this may be dissipating.