- WSE: Session Results

Market news

WSE: Session Results

The Polish equity market reacted bearish to the presidential vote win by Andrzej Duda, a candidate from the opposition Law and Justice Party, which is considered less business-friendly than the governing Civic Platform. As a result, the broad market benchmark - the WIG index dropped 1.53% and the large liquid companies measure - the WIG30 index declined 1.54%.

PKO BP (WSE: PKO) was the sharpest decliner among WIG30 index components, slumping 4.63% on fears the new Polish president plans to back a conversion of mortgages denominated in Swiss francs into Polish zlotys at historical exchange rates and to introduce a new tax on bank assets. Other banking sector names suffered to a lesser extent with HANDLOWY (WSE: BHW), MBANK (WSE: MBK), ING BSK (WSE: ING) and BZ WBK (WSE: BZW) falling in a range between 1.77% and 3.41%. Besides, noticeable losses were posted by GTC (WSE: GTC) and PKN ORLEN (WSE: PKN), which dropped 4.43% and 2.15% respectively. Among the session's few gainers, JSW (WSE: JSW) outperformed, generating a 1.67% return. It was fallowed by ASSECO POLAND (WSE: ACP) and TAURON PE (WSE: TPE), adding 0.87% and 0.86% respectively.

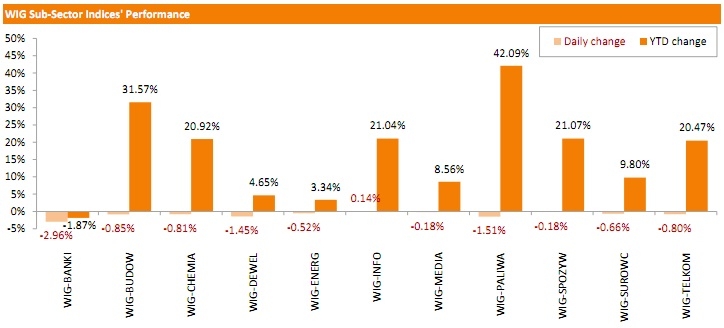

Almost all of the WIG sub-sector indices posted negative returns. The IT-sector benchmark - the WIG-INFO index was the only exception, closing higher by 0.14%. At the same time, the banking names measure - the WIG-BANKI index lagged, declining 2.96%. The oil and gas companies benchmark - the WIG-PALIWA index as well as the developers measure the WIG-DEWEL index lost nearly 1.5% each.