- WSE: Session Results

Market news

WSE: Session Results

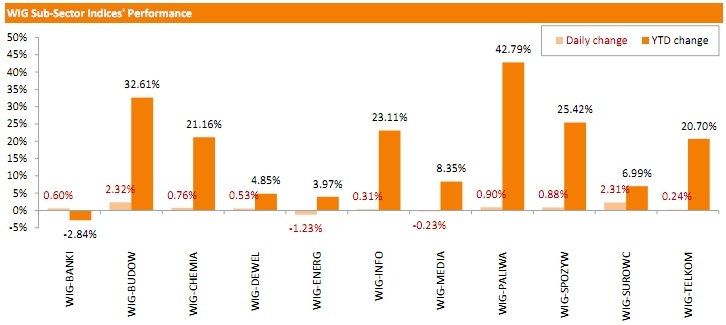

Polish equity market recorded a marginal rise on Monday. The broad market benchmark - the WIG index added 0.13%. Sector-wise, utilities and media sectors were the only decliners, with corresponding measures - the WIG-ENERG index and the WIG-MEDIA index dropping by 1.23% and 0.23% respectively.

The large-cap stocks measure - the WIG30 index underperformed the broad market indicator, inching down 0.02%. Clothing retailer LPP (WSE: LPP) led the decliners, losing 5.53% on repot the company's May gross margin fell 10pp Y/Y. The news the insurer PZU (WSE: PZU) agreed to buy a 25% stake in the banking name ALIOR (WSE: ALR) to build a top-five banking group in Poland dragged down the quotations of both companies: the former lost 2.72% on fears the company's plans may limit its dividend payout, while the latter fell by 1.02% as the agreed deal value indicated a price tag of PLN 89.25 per share compared to the bank's closing price on Friday of PLN 92.96. Besides, notable losses were generated by PGE (WSE: PGE; -1.95%), HANDLOWY (WSE: BHW; -1.47%) and ING BSK (WSE: ING; -1.38%). At the same time, BZ WBK (WSE: BZW) outperformed, advancing 3.44%. It was followed by KGHM (WSE: KGH), gaining 2.82% on the back of higher copper prices. GTC (WSE: GTC) went up by 2.45% as the WSE announced requirements for the company for its stock to be withdrawn from the market. The action is aimed to protect the rights of minority shareholders.