- Oil prices traded higher ahead of U.S. oil inventories data

Market news

Oil prices traded higher ahead of U.S. oil inventories data

Oil prices traded higher ahead of U.S. oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data today, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 4 rigs to 642 last week, the lowest weekly level since August 2010. It was the 26th consecutive weekly fall.

The weaker-than-expected inflation data from China added to speculation on that the Chinese government will add further stimulus measures to boost the economy. The Chinese consumer price index (CPI) rose at annual rate of 1.2% in May, missing expectations for a 1.3% increase, after a 1.5% gain in April.

The Chinese producer price index (PPI) dropped 4.6% in May, missing forecasts of a 4.5% fall, after a 4.6% decline in April.

China is the largest net oil importer in the world.

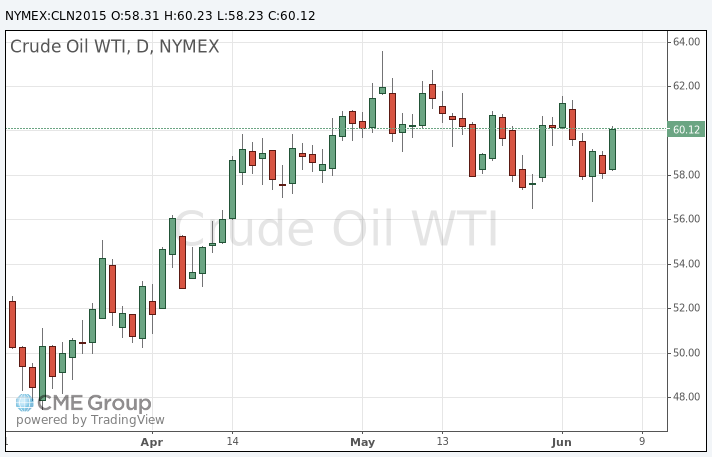

WTI crude oil for July delivery increased to $60.23 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $64.23 a barrel on ICE Futures Europe.