- Oil prices traded higher after the release of U.S. oil inventories data

Market news

Oil prices traded higher after the release of U.S. oil inventories data

Oil prices traded higher after the release of U.S. oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 6.81 million barrels to 470.6 million in the week to June 05. It was the sixth consecutive weekly decline, and the biggest weekly drop since July 2014.

Analysts had expected a decline of 1.7 million barrels.

Gasoline inventories were down by 2.9 million barrels last week, according to the EIA.

U.S. oil production climbed to 9.6 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 1,024 million barrels.

U.S. crude oil imports declined by 750,000 barrels per day to 6.93 million barrels per day.

Refineries in the U.S. were running at 94.6% of capacity, down from 93.2% the previous week.

The American Petroleum Institute (API) said on Tuesday that U.S. oil inventories declined by 6.7 million barrels.

The Organization of the Petroleum Exporting Countries (OPEC) said on Wednesday that demand for its crude remains unchanged this year, but it expects the current oversupply will ease in the second half of the year.

The OPEC estimated oil demand growth in 2015 at 1.18 million barrels a day. It expects the rise in non-OPEC crude oil output to remain unchanged at 680,000 barrels a day in 2015 - one-third of the increase recorded in 2014.

The OPEC also said that oil output increased by 24,000 barrels per day due to rises in Iraq, Angola and Saudi Arabia. Iraq produced 3.8 million barrels a day in May, while Saudi Arabia produced 10.333 million barrels.

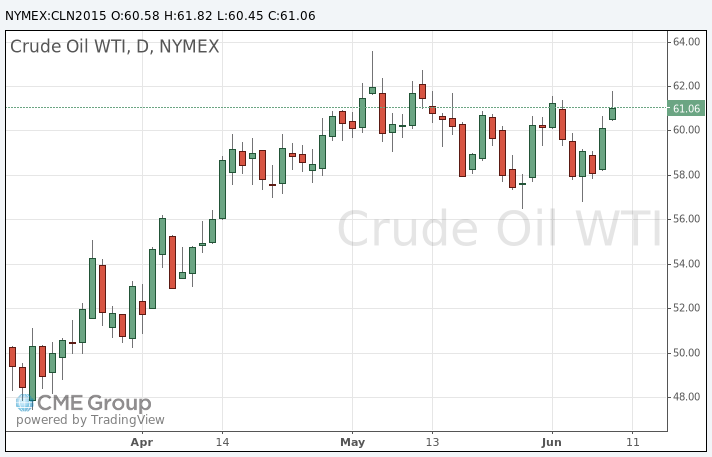

WTI crude oil for July delivery increased to $61.82 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $65.93 a barrel on ICE Futures Europe.