- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt problem

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt problem

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ Interest Rate Decision 0% 0%

05:00 Japan Bank of Japan Monetary Base Target 275 275

05:00 Japan BoJ Monetary Policy Statement

06:30 Japan All Industry Activity Index, m/m April -1.4% Revised From -1.3% 0.1%

07:00 Japan Coincident Index (Finally) April 109.2 111.1 111.0

07:00 Japan Leading Economic Index (Finally) April 106.0 107.2 106.4

08:00 Germany Producer Price Index (MoM) May 0.1% 0.2% 0.0%

08:00 Germany Producer Price Index (YoY) May -1.5% -1.1% -1.3%

08:30 Japan BOJ Press Conference

10:00 Eurozone Current account, unadjusted, bln April 24.4 Revised From 24.9 20.4

10:30 United Kingdom PSNB, bln May -5.46 Revised From -6.04 -10.5 -9.35

11:00 Eurozone ECOFIN Meetings

The U.S. dollar traded higher against the most major currencies. There will be released no major economic data in the U.S. today.

Yesterday's economic data from the U.S. supported the greenback

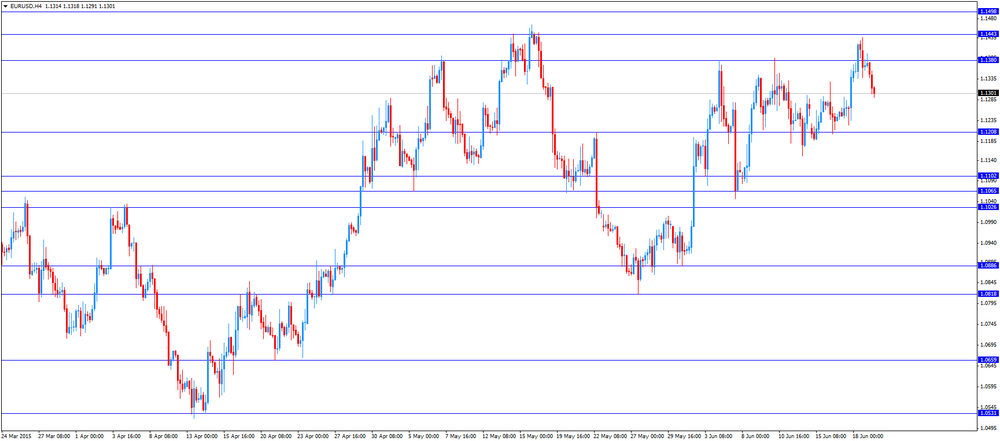

The euro traded lower against the U.S. dollar on the uncertainty over the Greek debt problem. Yesterday's debt talks were unsuccessful. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels.

"It is time to urgently discuss the situation of Greece at the highest political level," he said.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

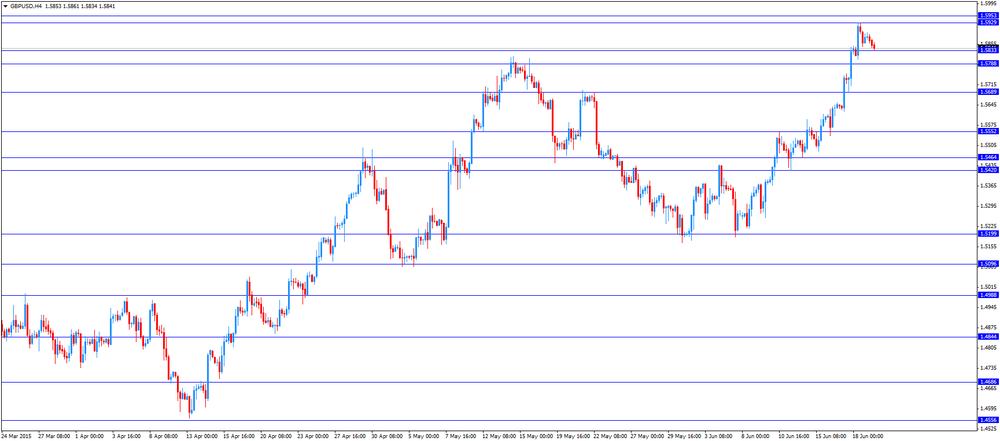

The British pound traded higher against the U.S. dollar after the release of the economic data from the U.K. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion. April's figure was revised down from £6.04 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. The consumer price index in Canada is expected to remain unchanged at 0.8% in May.

The core consumer price index in Canada is expected to decline to 2.1% in May from 2.3% in April.

Canadian retail sales are expected to increase 0.7% in April, after a 0.7% rise in March.

EUR/USD: the currency pair decreased to $1.1291

GBP/USD: the currency pair fell to $1.5834

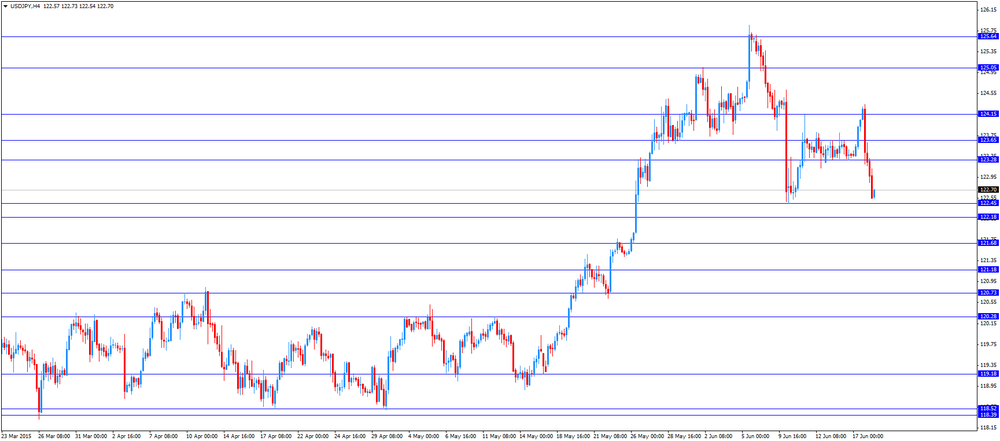

USD/JPY: the currency pair rose to Y123.19

The most important news that are expected (GMT0):

14:30 Canada Retail Sales, m/m April 0.7% 0.7%

14:30 Canada Retail Sales YoY April 3.1%

14:30 Canada Consumer Price Index m / m May -0.1% 0.5%

14:30 Canada Consumer price index, y/y May 0.8% 0.8%

14:30 Canada Bank of Canada Consumer Price Index Core, y/y May 2.3% 2.1%

14:30 Canada Bank of Canada Consumer Price Index Core, m/m May 0.0%

18:00 U.S. FOMC Member Mester Speaks