- Gold declined amid prospects of a rate hike in the U.S.

Market news

Gold declined amid prospects of a rate hike in the U.S.

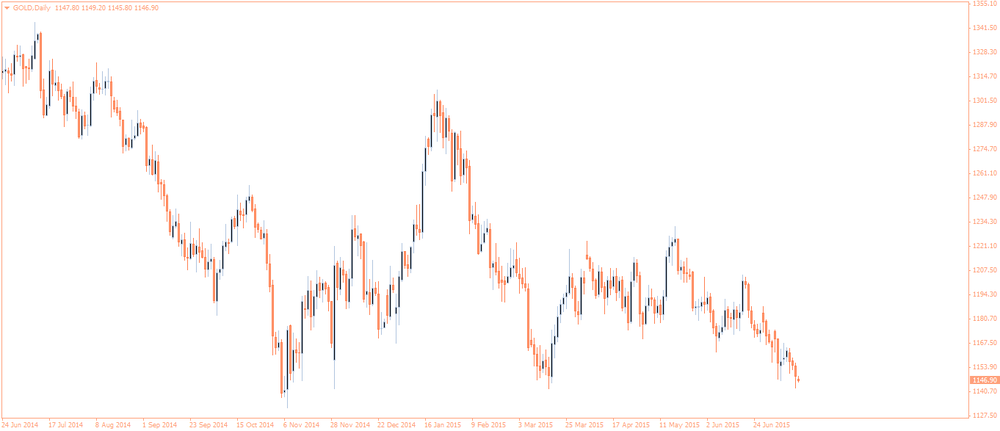

Gold is currently near a four-month low at $1,146.30 (-0.10%) an ounce as the Federal Reserve is preparing to raise its key interest rate from the current level of 0.25% within this year. Yesterday Fed Chair Yellen said that labor markets were expected to steadily improve and turmoil abroad unlikely to harm the U.S. economy.

HSBC analyst James Steel marked that a potential U.S. rate hike had been discussed by market participants as early as 2013, and gold has already fallen on this speculation. "This leads us to conclude that most of gold's declines based on a rate rise have already occurred, and that gold's reaction to the rate hike - whenever it comes - and subsequent hikes, may be muted or short-lived," Steel said.

Physical demand remains sluggish. India's trade ministry reported that imports to this country (second-biggest consumer of gold after China) fell 37% in June compared to a year earlier.