- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the results of the German parliament's vote on a new Greek bailout programme

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the results of the German parliament's vote on a new Greek bailout programme

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Conference Board Australia Leading Index May -0.3% 0.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The U.S. consumer price inflation is expected to rise to 0.1% in June from 0.0% in May.

The U.S. consumer price index excluding food and energy is expected to increase to 1.8% in June from 1.7% in May.

Housing starts in the U.S. are expected to climb to 1.110 million units in June from 1.036 million units in May.

The number of building permits is expected to fall to 1.150 million units in June from 1.275 million units in May.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to climb to 96.4 in July from a final reading of 96.1 in June.

The greenback remained supported by yesterday's comments by Fed Chair Janet Yellen. She repeated that the Fed could raise its interest rate "at some point this year".

The euro traded lower against the U.S. dollar after the results of the German parliament's vote on a new Greek bailout programme. The German parliament voted for negotiations on the Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

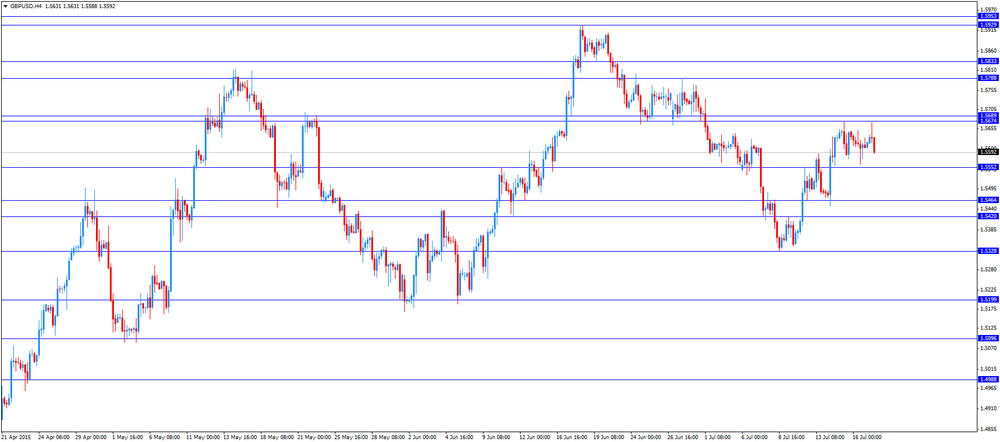

The British pound traded lower against the U.S. dollar in the absence of any major economic report from the U.K.

The Bank of England (BoE) Governor Mark Carney said on Thursday that the central bank could start raising its interest rate by the end of the year. He expects the interest rate to increase to about 2.0% over the next three years.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian consumer price inflation data. The consumer price index in Canada is expected to rise to 1.0% in June from 0.9% in May.

The core consumer price index in Canada is expected to remain unchanged at 2.2% in June.

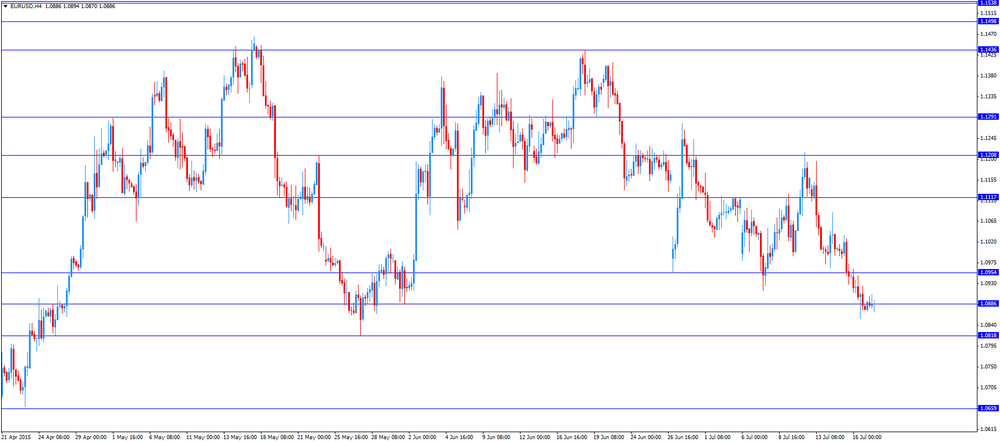

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5588

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m June 0.6% 0.2%

12:30 Canada Consumer price index, y/y June 0.9% 1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June 2.2% 2.2%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June 0.4%

12:30 U.S. Housing Starts June 1036 1110

12:30 U.S. Building Permits June 1275 1150

12:30 U.S. CPI excluding food and energy, m/m June 0.1% 0.2%

12:30 U.S. CPI, m/m June 0.4% 0.3%

12:30 U.S. CPI, Y/Y June 0.0% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y June 1.7% 1.8%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 96.1 96.4

14:00 U.S. FED Vice Chairman Stanley Fischer Speaks