- Foreign exchange market. Asian session: the New Zealand dollar gained

Market news

Foreign exchange market. Asian session: the New Zealand dollar gained

The euro advanced slightly against the U.S. dollar after Greece's parliament approved the second pack of reforms in order to receive financial aid. Lawmakers voted 230-63 in favor of changes to judiciary and banking systems. Greek finance minister Euclid Tsakalotos earlier told parliament the vote would clear the way for negotiations on the new €86 billion bailout to begin on Friday with the target of completing a deal by August 18-20.

The New Zealand dollar advanced despite a 25 basis point rate cut. The central bank did not say that the exchange rate was unjustified, and this persuaded investors to buy the NZD. The bank also said that monetary policy might ease further. Economists expect the RBNZ to continue lowering rates in the coming months to help stimulate inflation and support the economy amid sharp declines in dairy product prices (New Zealand's key exports).

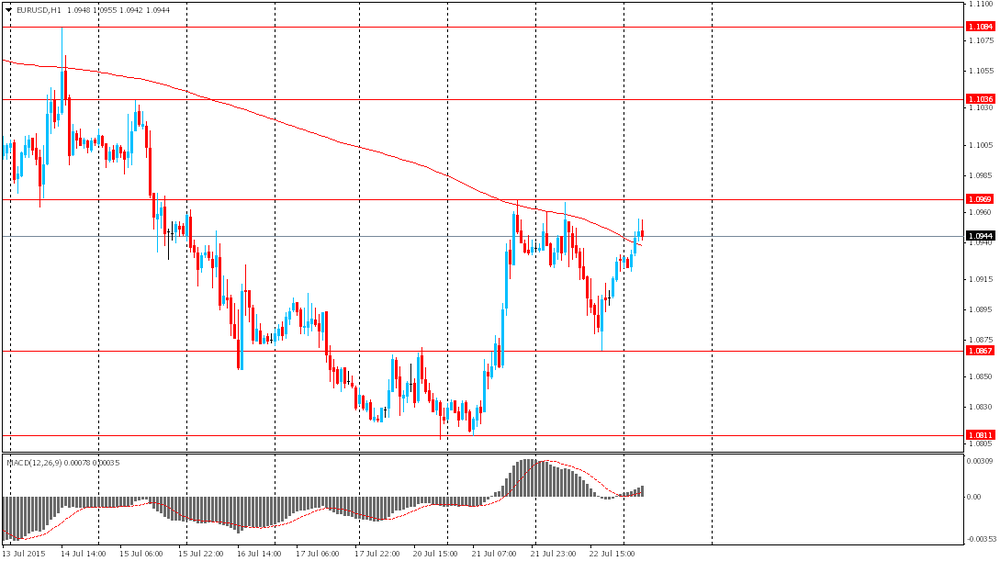

EUR/USD: the pair rose to $1.0955 in Asian trade

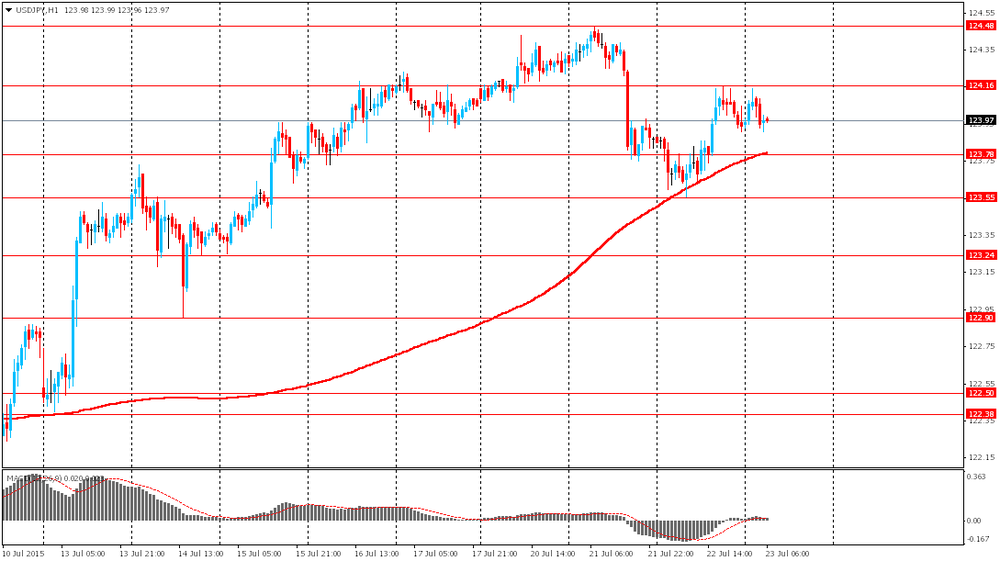

USD/JPY: the pair traded around Y123.90-15

GBP/USD: the pair traded around $1.5615

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom BBA Mortgage Approvals June 42.5

08:30 United Kingdom Retail Sales (MoM) June 0.2% 0.3%

08:30 United Kingdom Retail Sales (YoY) June 4.6% 4.9%

12:30 Canada Retail Sales, m/m May -0.1% 0.5%

12:30 Canada Retail Sales YoY May 1.7%

12:30 Canada Retail Sales ex Autos, m/m May -0.6% 0.8%

12:30 U.S. Continuing Jobless Claims 2215 2225

12:30 U.S. Initial Jobless Claims July 281 280

14:00 Eurozone Consumer Confidence (Preliminary) July -5.6 -5.68

14:00 U.S. Leading Indicators June 0.7% 0.2%

14:15 Eurozone ECB's Jens Weidmann Speaks

22:45 New Zealand Trade Balance, mln June 350 100