- Foreign exchange market. Asian session: the yen declined

Market news

Foreign exchange market. Asian session: the yen declined

The yen declined against the U.S. dollar as investors remained cautious ahead of a two-day FOMC meeting, which starts later today. Earlier this month Fed Chair Janet Yellen said that she expected the central bank to start raising rates within 2015. However some market participants believe that recent sharp drops in Chinese stocks will make the Fed very careful.

The euro little changed against the dollar after reaching its two-week high on Monday. Strong euro zone data supported the single currency. IFO reported that German business climate improved to 108.0 from July reading of 107.5. Economists expected the index to come in at 107.5.

The Australian dollar slightly advanced. Data showed that confidence of Australian consumers improved and the corresponding index rose by 0.6% to 112.5 in a week ending July 26. Worries over Greece's debt crisis faded and contributed to this growth. Nevertheless the index is still 3.2% below level seen a year ago.

EUR/USD: the pair fluctuated around $1.1080 in Asian trade

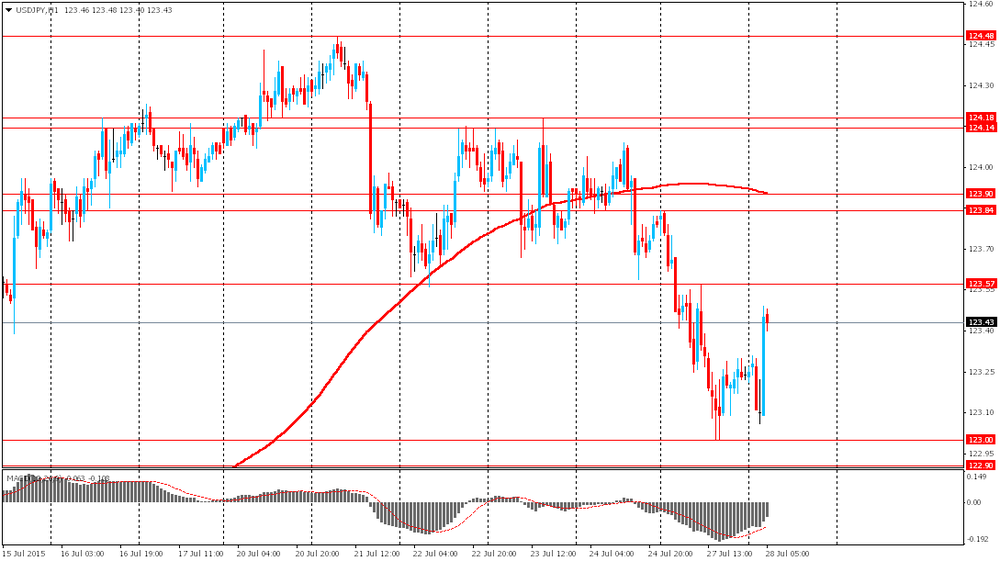

USD/JPY: the pair rose to Y123.50

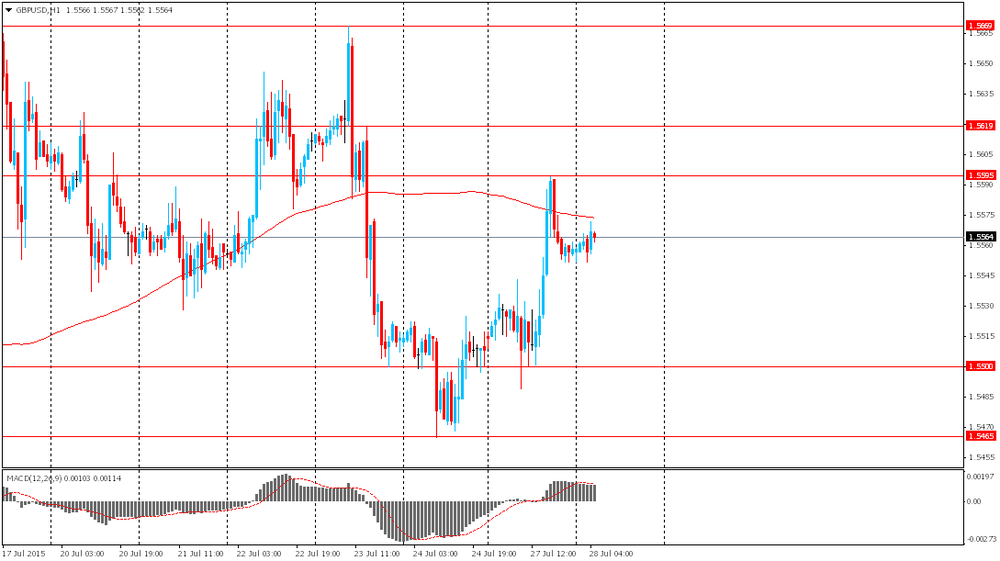

GBP/USD: the pair traded around $1.5550-70

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2.9% 2.6%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.7%

12:30 Canada Industrial Product Price Index, y/y June -1.3%

12:30 Canada Industrial Product Price Index, m/m June 0.5% 0.4%

12:30 Canada Raw Material Price Index June 4.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y May 4.9% 5.6%

13:45 U.S. Services PMI (Preliminary) July 54.8 55.0

14:00 U.S. Richmond Fed Manufacturing Index July 6 6

14:00 U.S. Consumer confidence July 101.4 100

20:30 U.S. API Crude Oil Inventories July 2.3

23:50 Japan Retail sales, y/y June 3.0% 0.5%