- European session review: the pound rose

Market news

European session review: the pound rose

The pound rose after the release of UK data on GDP. The growth rate of the UK economy in the 2nd quarter accelerated to improve the prospects for the second half of the year, but the question is how long the Bank of England will keep interest rates at record lows.

According to data released on Tuesday the National Bureau of Statistics, the UK GDP in the 2nd quarter increased by 0.7% compared with the previous quarter and by 2.8% compared to the same period of the previous year. These data are preliminary, but they point to the UK's economic recovery after a slowdown in Q1, when GDP growth was only 0.4%.

Restoring growth in the UK was due to strong activity in the services sector, which is a little disappointing in the beginning of the year, but now, apparently, will be supported by rising incomes and low inflation.

The strong recovery of activity was also observed in the manufacturing sector as the mining industry in the North Sea demonstrates the recovery period after months of very low oil prices. Growth in the mining industry have been the most rapid in more than 25 years, said the ONS, helped by the introduction in March of tax breaks for oil and gas producers.

The US dollar rose against most major currencies, recovering from a fall in the previous session on the eve of the start of the two-day meeting to determine the monetary policy of the Federal Reserve later today. The dollar regained positions, as investors have focused on the upcoming Wednesday statement, the Federal Reserve's monetary policy, expecting to get any indication as possible rise in interest rates. The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate. On Thursday scheduled publication of US statistics on economic growth for the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The dollar also strengthened after the sell-off in the Chinese stock markets undermined demand for risky assets. On Monday, shares in Shanghai collapsed maximum session pace in eight years, and continued to decline on Tuesday, despite expectations of additional stimulus from the government.

EUR / USD: during the European session the pair fell to $ 1.1021

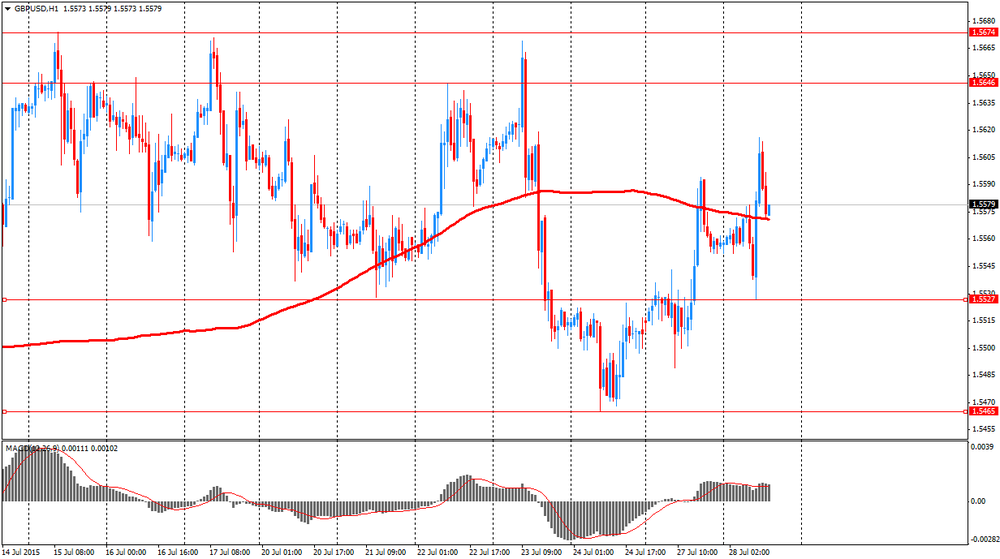

GBP / USD: during the European session the pair rose to $ 1.5616

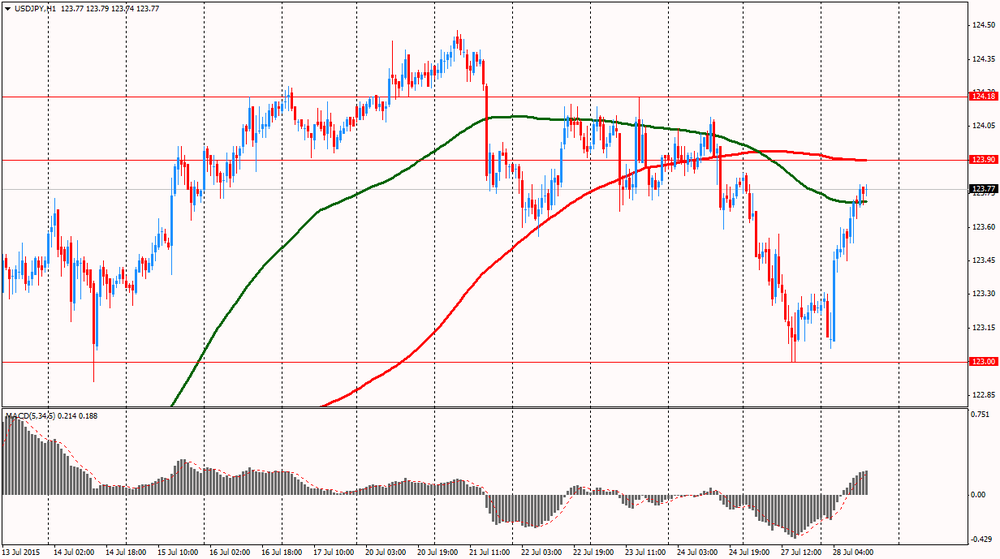

USD / JPY: during the European session the pair rose to Y123.79

В 12:30 GMT Канада представит индекс цен на сырье за июнь. В США в 13:00 GMT выйдет индекс цен на жилье от S&P/Case-Shiller за май, в 13:45 GMT - индекс деловой активности для сферы услуг от Markit за июль, в 14:00 GMT - индикатор уверенности потребителей за июль. Завершит день в 23:50 GMT Япония данными по розничным продажам за июнь.