- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the Sentix index from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the Sentix index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

05:00 Japan Consumer Confidence July 41.7 40.3

08:00 Eurozone Sentix Investor Confidence July 18.5 18.4

11:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed against the most major currencies after comments by the Fed Vice Chairman Stanley Fischer. He said on Monday that inflation in the U.S. is very low, but it is temporary. Fischer pointed out that inflation was low due to declines in oil prices and in raw materials.

The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 215,000 jobs in July, missing expectations for a rise of 223,000 jobs, after a gain of 231,000 jobs in June. June's figure was revised up from a rise of 223,000 jobs.

The U.S. unemployment rate remained unchanged at 5.3% in July, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings rose 0.2% in July, in line with forecasts, after a flat reading in June.

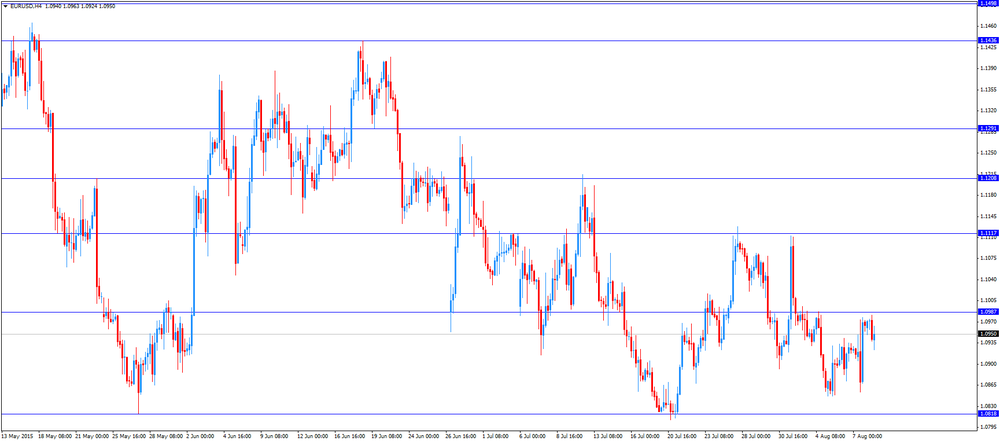

The euro traded lower against the U.S. dollar after the release of the Sentix index from the Eurozone. Sentix investor confidence index for the Eurozone fell to 18.4 in August from 18.5 in July.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Despite the global headwinds, the euro zone's economy appears to be in relatively good form. The euro zone has swallowed the turmoil surrounding Greece and a further collapse in economic momentum there relatively well," Manfred Huebner from Sentix said.

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.3% in the third quarter.

The second quarter's forecast was revised down to a 0.2% rise from a 0.3% gain.

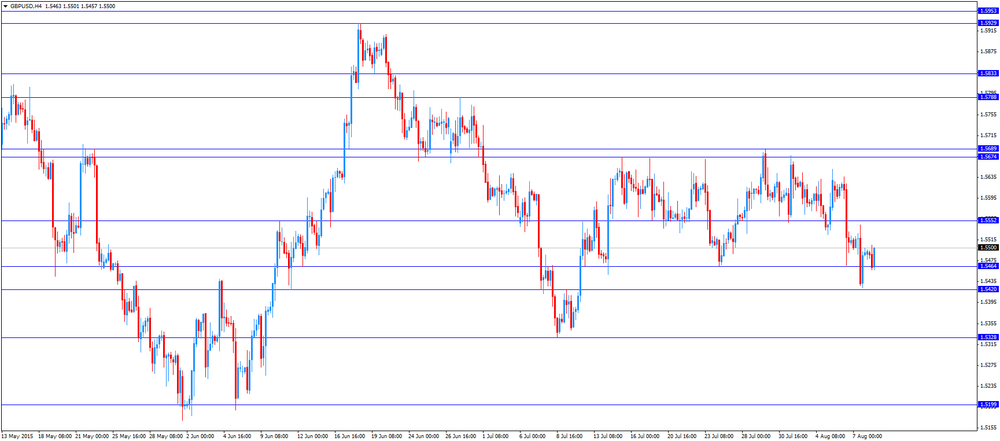

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair decreased to $1.0924

GBP/USD: the currency pair traded mixed

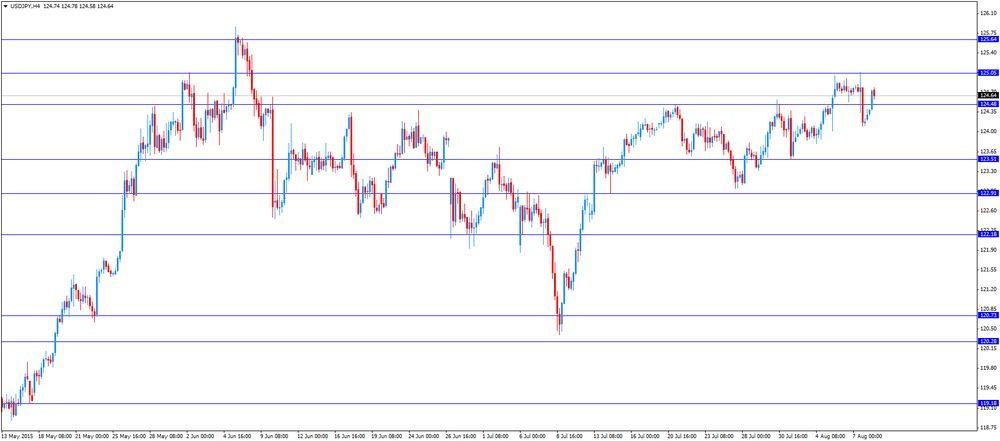

USD/JPY: the currency pair rose to Y124.78

The most important news that are expected (GMT0):

13:00 U.S. FOMC Member Dennis Lockhart Speaks

16:25 U.S. FOMC Member Dennis Lockhart Speaks