- Foreign exchange market. Asian session: the greenback traded steadily

Market news

Foreign exchange market. Asian session: the greenback traded steadily

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m June -0.5% 0.3%

The U.S. dollar traded in a narrow range as investors were cautious ahead of July U.S. consumer prices report and release of Fed Meeting Minutes. These data are likely to give investors clues on the timing of a rate increase by the Federal Reserve.

The yen slightly rose against the U.S. dollar. Before the session's beginning the USD/JPY pair was steady due to favorable data on U.S. housing market: seasonally adjusted housing starts rose by 0.2% m/m in July to 1.21 million per year. This is the highest level since October 2007.

Today Japan published its July trade balance report. The deficit expanded to -¥268.1 billion from -¥69.0 in June. Economists expected the deficit to decline to -¥56.7. Exports rose by 7.6% y/y as demand from the U.S. offset sluggish exports to China. Meanwhile imports fell by 3.2% amid low oil prices.

EUR/USD: the pair rose to $1.1050 in Asian trade

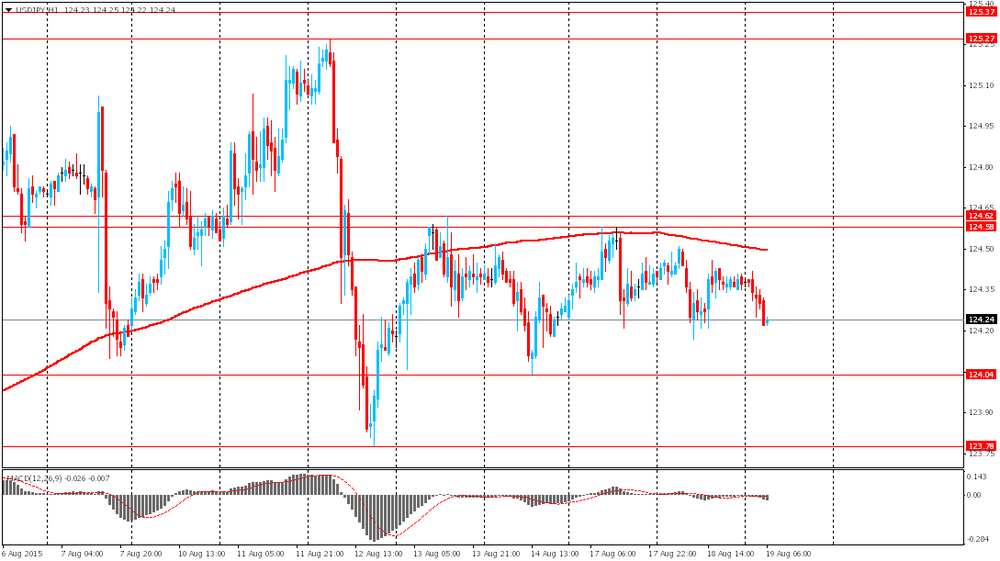

USD/JPY: the pair fell to Y124.20

GBP/USD: the pair rose to $1.5675

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Current account, unadjusted, bln June 3.4

12:30 U.S. CPI, m/m July 0.3% 0.2%

12:30 U.S. CPI, Y/Y July 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, m/m July 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July 1.8% 1.8%

14:30 U.S. Crude Oil Inventories August -1.682 -0.6

18:00 U.S. FOMC meeting minutes