- Foreign exchange market. Asian session: the Australian dollar declined

Market news

Foreign exchange market. Asian session: the Australian dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 China Non-Manufacturing PMI August 53.9 53.4

01:00 China Manufacturing PMI August 50 49.7 49.7

01:30 Australia Current Account, bln Quarter II -13.5 Revised From -10.7 -15.8 -19.0

01:30 Australia Building Permits, m/m July -5.2% Revised From -8.2% 2.5% 4.2%

01:35 Japan Manufacturing PMI (Finally) August 51.2 51.9 51.7

01:45 China Markit/Caixin Services PMI August 53.8 53.9 51.5

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

The Australian dollar declined against the U.S. dollar after the Reserve Bank of Australia announced that it had left its interest rate unchanged at 2%. The central bank aimed at stimulating activity in such spheres as retail sales and housing construction, which drove growth earlier. Meanwhile the RBA is concerned about the overheating housing market, which can lead to risky investments and undermine fragile recovery. The AUD was also influenced by data from its main trade partner China. The Federation of Logistics and Purchasing reported that China's manufacturing PMI fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction.

The yen rose against the dollar as declines in Asian stocks boosted demand for this safe-haven currency.

Earlier the euro declined against the greenback amid euro zone inflation data. Consumer prices rose by 0.2% in August, just like in July. Analysts expected price growth to slow down to 0.1%. Inflation growth has remained below 1% for 21 months. Prices of food, alcohol and tobacco rose 1.2% compared to +0.9% in July. Prices of services rose by 1.2%. Energy costs fell by 7.1%.

EUR/USD: the pair rose to $1.1275 in Asian trade

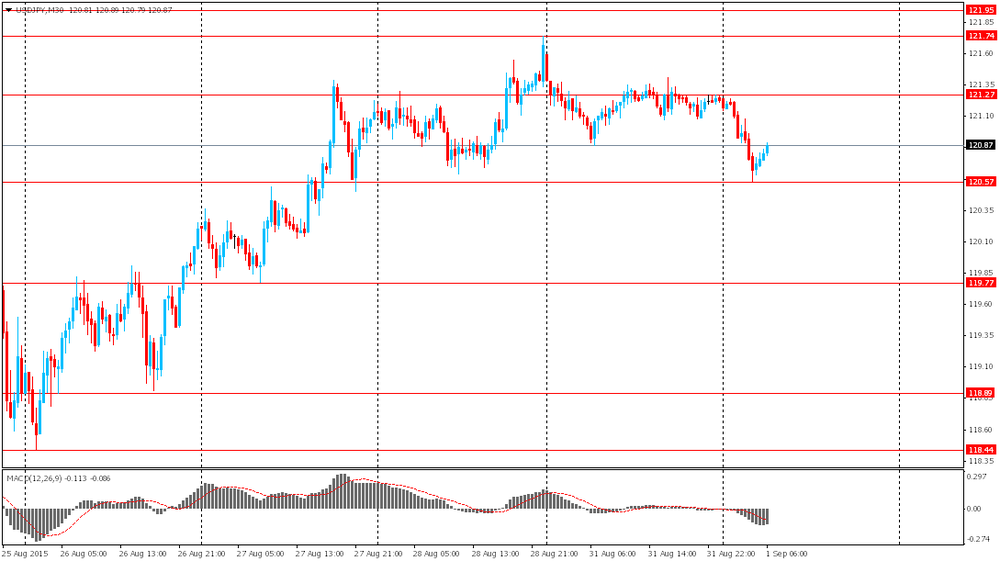

USD/JPY: the pair fell to Y120.55

GBP/USD: the pair rose to $1.5405

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland Manufacturing PMI August 48.7 49.7

07:50 France Manufacturing PMI (Finally) August 49.6 48.6

07:55 Germany Manufacturing PMI (Finally) August 51.8 53.2

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change August 9 -2

08:00 Eurozone Manufacturing PMI (Finally) August 52.4 52.4

08:30 United Kingdom Consumer credit, mln July 1220 1200

08:30 United Kingdom Net Lending to Individuals, bln July 3.8 3.9

08:30 United Kingdom Purchasing Manager Index Manufacturing August 51.9 52

08:30 United Kingdom Mortgage Approvals July 66.58 68

09:00 Eurozone Unemployment Rate July 11.1% 11.1%

12:30 Canada GDP (m/m) June -0.2% 0.2%

12:30 Canada GDP QoQ Quarter II -0.1% 0.2%

12:30 Canada GDP (YoY) Quarter II -0.6% -1%

13:45 U.S. Manufacturing PMI (Finally) August 53.8 52.9

14:00 U.S. Construction Spending, m/m July 0.1% 0.6%

14:00 U.S. ISM Manufacturing August 52.7 52.6

20:30 U.S. API Crude Oil Inventories August -7.3

20:45 U.S. Total Vehicle Sales, mln August 17.55 17.3