- Foreign exchange market. Asian session: the New Zealand dollar fell after a rate cut

Market news

Foreign exchange market. Asian session: the New Zealand dollar fell after a rate cut

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Changing the number of employed August 39.2 Revised From 37.9 5 17.4

01:30 Australia Unemployment rate August 6.3% 6.2% 6.2%

01:30 China PPI y/y August -5.4% -5.5% -5.9%

01:30 China CPI y/y August 1.6% 1.8% 2.0%

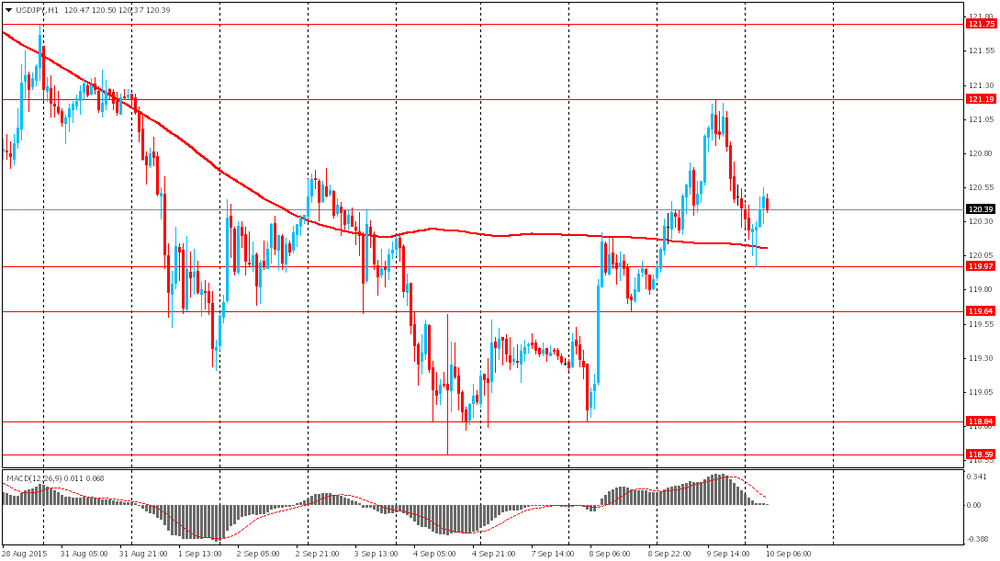

The yen fell against the U.S. dollar after senior LDP lawmaker Yamamoto unexpectedly said that the Bank of Japan should expand its asset purchases by ¥10 trillion at its meeting on October 30. He added that reaching the 2% inflation target in the first half of 2016 is BOJ's top priority. Earlier Japan Prime Minister Abe also noted the need for additional stimulating measures. His words have great influence on markets as his party will stay in charge for the coming three years.

The Australian dollar advanced against the greenback amid positive employment data. The unemployment rate came in at 6.2% in August. The reading matched expectations and slid below the 6.3% level seen in July.

The New Zealand dollar fell against the U.S. dollar after the Reserve Bank of New Zealand cut its benchmark rate by 25 basis points to 2.75% and signaled that further easing is possible. RBNZ Governor Wheeler said that lower official cash rate was needed to cushion drop in export prices

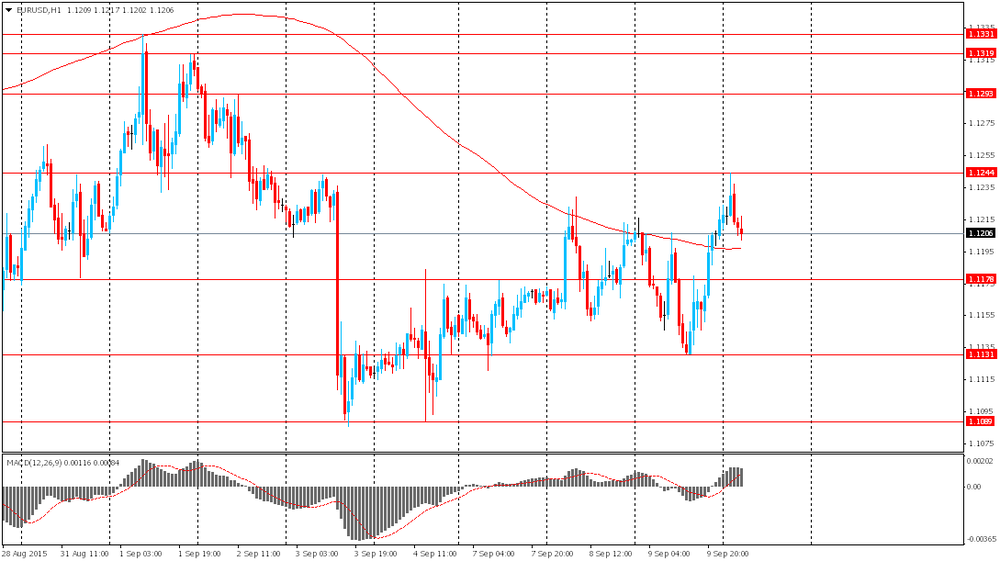

EUR/USD: the pair fluctuated within $1.1195-45 in Asian trade

USD/JPY: the pair rose to Y121.30

GBP/USD: the pair traded within $1.5350-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Industrial Production, m/m July -0.1% 0.2%

06:45 France Industrial Production, y/y July 1.0%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility

11:00 United Kingdom MPC Rate Statement

12:30 Canada Capacity Utilization Rate Quarter II 82.7% 81.7%

12:30 Canada New Housing Price Index, MoM July 0.3% 0.2%

12:30 U.S. Import Price Index August -0.9% -1.6%

12:30 U.S. Continuing Jobless Claims August 2257 2250

12:30 U.S. Initial Jobless Claims September 282 275

14:00 U.S. Wholesale Inventories July 0.9% 0.3%

15:00 U.S. Crude Oil Inventories September 4.667 0.2

23:50 Japan BSI Manufacturing Index Quarter III -6