- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Germany CPI, m/m (Finally) August 0.2% 0% 0.0%

06:00 Germany CPI, y/y (Finally) August 0.2% 0.2% 0.2%

09:00 Eurozone ECOFIN Meetings

11:30 United Kingdom MPC Member Forbes Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. PPI is expected to decrease 0.1% in August, after a 0.2% rise in July.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in August, after a 0.3 gain in July.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to fall to 91.2 in September from a final reading of 91.9 in August.

The euro traded lower against the U.S. dollar after the mostly negative economic data from the Eurozone. Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

The British pound traded lower against the U.S. dollar after the release of the weak construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

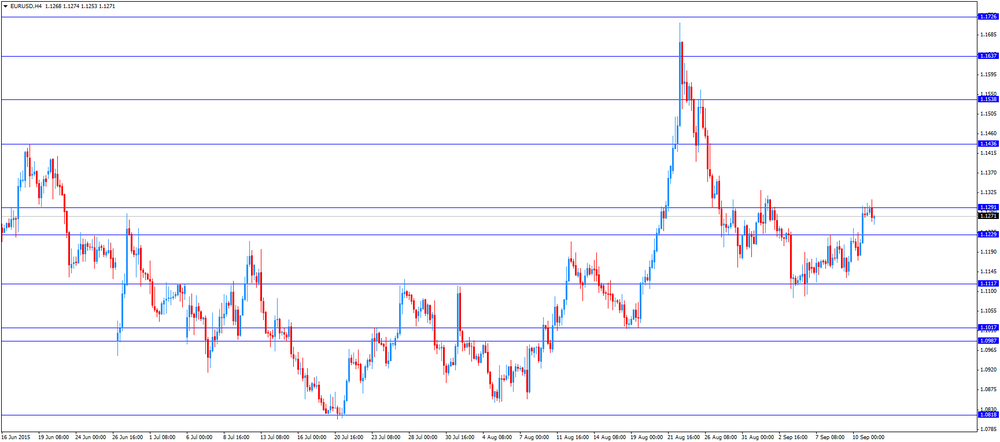

EUR/USD: the currency pair fell to $1.1253

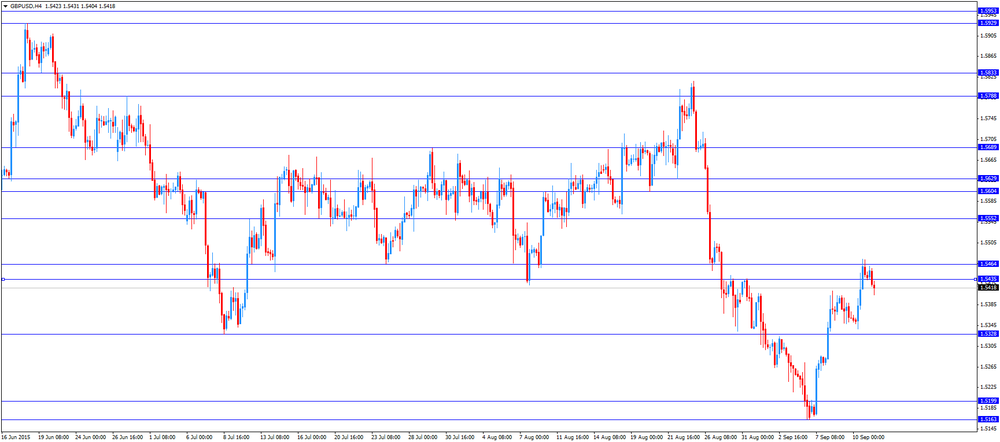

GBP/USD: the currency pair declined to $1.5404

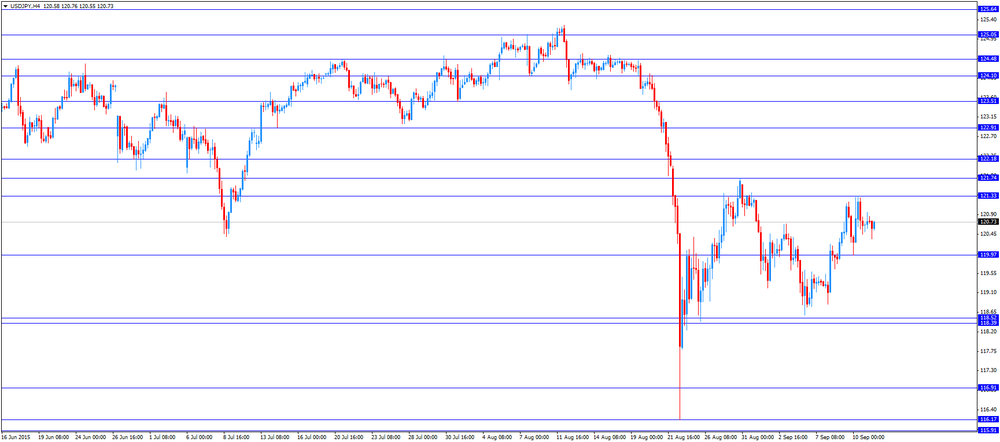

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m August 0.2% -0.1%

12:30 U.S. PPI, y/y August -0.8% -0.9%

12:30 U.S. PPI excluding food and energy, m/m August 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y August 0.6% 0.7%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) September 91.9 91.2

18:00 U.S. Federal budget August -149.2 -81.5