- WSE: Session Results

Market news

WSE: Session Results

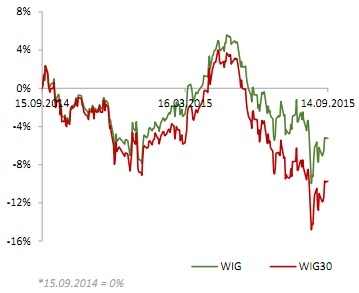

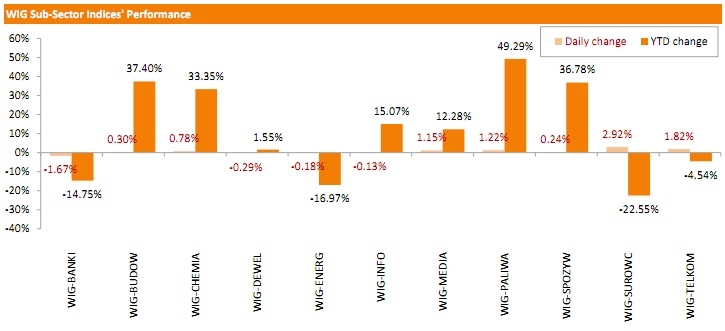

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, slid down 0.07%. Sector-wise, materials (+2.92%) outperformed, while banking sector (-1.67%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, edged up 0.08%. BOGDANKA (WSE: LWB) was the standout performer in the WIG30 Index basket, skyrocketing by 24.12% on media report that ENEA (WSE: ENA; +1.21%) offered PLN 1.48 bln (USD 398mln) for a 64.6-stake in the company. This implied a share price of PLN 67.39, or nearly 29% above LWB's Friday close. Other notable gainers were JSW (WSE: JSW), KERNEL (WSE: KER) and HANDLOWY (WSE: BHW), returning 6.45%, 2.03% and 2.02% respectively. On the other side of the ledger, banking names PEKAO (WSE: PEO), PKO BP (WSE: PKO), ING BSK (WSE: ING) and BZ WBK (WSE: BZW) were hit the hardest, tumbling 1.28-3.28% on speculations regarding the conversion of CHF-denominated loans. They were followed by PGE (WSE: PGE) and GTC (WSE: GTC), losing 1.17% and 1.04% respectively.