- WTI crude rises ahead the Fed’s interest rate decision, while Brent crude oil declines

Market news

WTI crude rises ahead the Fed’s interest rate decision, while Brent crude oil declines

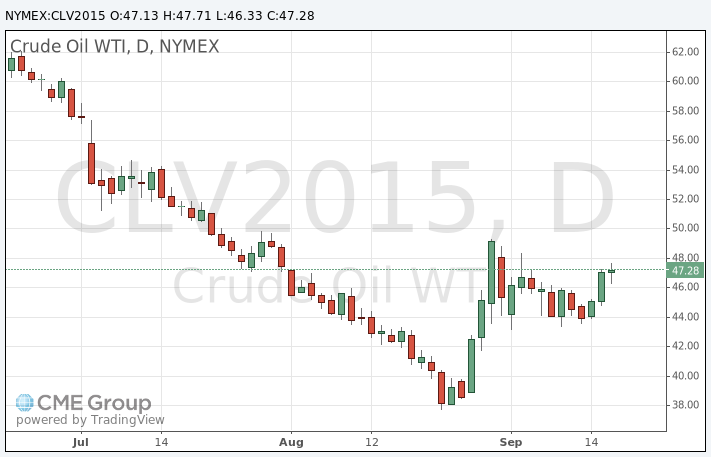

WTI crude oil rose ahead the Fed's interest rate decision, while Brent crude oil declined. The U.S. oil was supported by the initial jobless claims data. The number of initial jobless claims in the week ending September 12 in the U.S. declined by 11,000 to 264,000 from 275,000 in the previous week. Analysts had expected the initial jobless claims to remain unchanged at 275,000.

Yesterday's U.S. oil inventories data also supported WTI crude oil. U.S. crude inventories fell by 2.1 million barrels to 455.9 million in the week to September 11.

Concerns over the slowdown in the economy in Asia weighed on Brent crude. The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit widened to ¥569.7 billion in August from a deficit of ¥268.1 billion in July. Analysts had expected a deficit of ¥541.3 billion.

Exports rose 3.1% year-on-year, while imports dropped 3.1%

WTI crude oil for October delivery rose to $47.71 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $49.65 a barrel on ICE Futures Europe.