- Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies as the Fed’s interest rate decision weighed on the greenback

Market news

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies as the Fed’s interest rate decision weighed on the greenback

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, unadjusted, bln July 30.6 33.8

11:05 United Kingdom MPC Member Andy Haldane Speaks

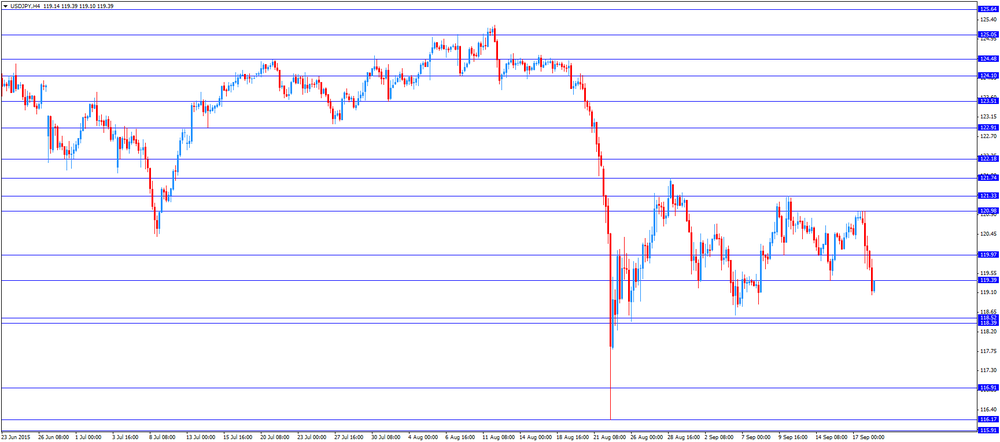

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. leading indicators. The U.S. leading economic index is expected to climb by 0.2% in August, after a 0.2% decrease in July.

Yesterday's interest rate decision weighed on the greenback. The Fed kept its interest rate unchanged at 0.00%-0.25%.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

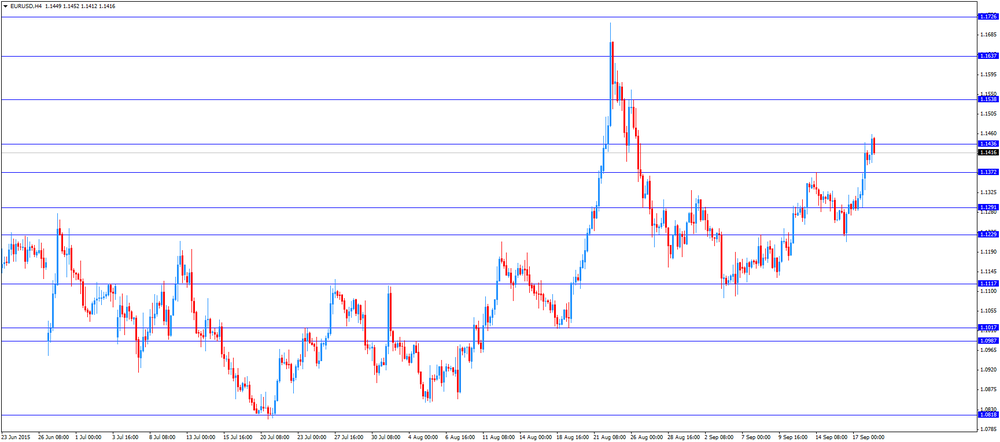

The euro traded higher against the U.S. dollar despite the slight decline in the Eurozone's current account surplus. Eurozone's current account surplus fell to a seasonally adjusted €22.6 billion in July from €24.9 billion in June. June's figure was revised down from a surplus of €25.4 billion.

The trade surplus rose to €26.9 billion in July from €26.6 billion in July, while primary income increased to €2.8 billion from €1.2 billion.

The surplus on services declined to €3.6 billion in July from €5.6 billion in June, while the secondary income increased to €10.7 billion from €8.4 billion.

Eurozone's unadjusted current account surplus soared to €33.3 billion in July from EUR 30.6 billion in June. June's figure was revised down from a surplus of €31.1 billion.

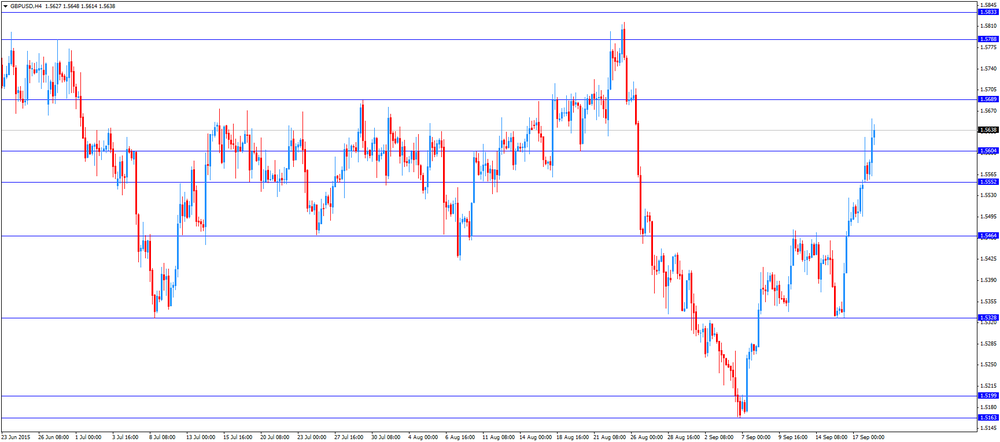

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the consumer price inflation data from Canada. The consumer price index in Canada is expected to remain unchanged at 1.3% year-on-year in August.

The core consumer price index in Canada is expected to decline to 2.1% year-on-year in August from 2.4% in July.

EUR/USD: the currency pair increased to $1.1459

GBP/USD: the currency pair rose to $1.5657

USD/JPY: the currency pair declined to Y119.05

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m August 0.1% 0%

12:30 Canada Consumer price index, y/y August 1.3% 1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August 2.4% 2.1%

14:00 U.S. Leading Indicators August -0.2% 0.2%