- Foreign exchange market. Asian session: the dollar strengthened

Market news

Foreign exchange market. Asian session: the dollar strengthened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia House Price Index (QoQ) Quarter II 1.6% 4.7%

06:00 Switzerland Trade Balance August 3.74 2.87

The U.S. dollar climbed against the euro amid hawkish comments from Fed officials. Three policy makers said yesterday that they expect higher rates by the end of 2015. The dollar rose amid speculation that the U.S. economy was ready for a rate hike.

The pound is under pressure ahead of publication of UK budget deficit data, scheduled for this week. The deficit is expected to post an increase in August compared to the previous month. However higher revenues from taxes might have decreased the deficit compared to the same period last year.

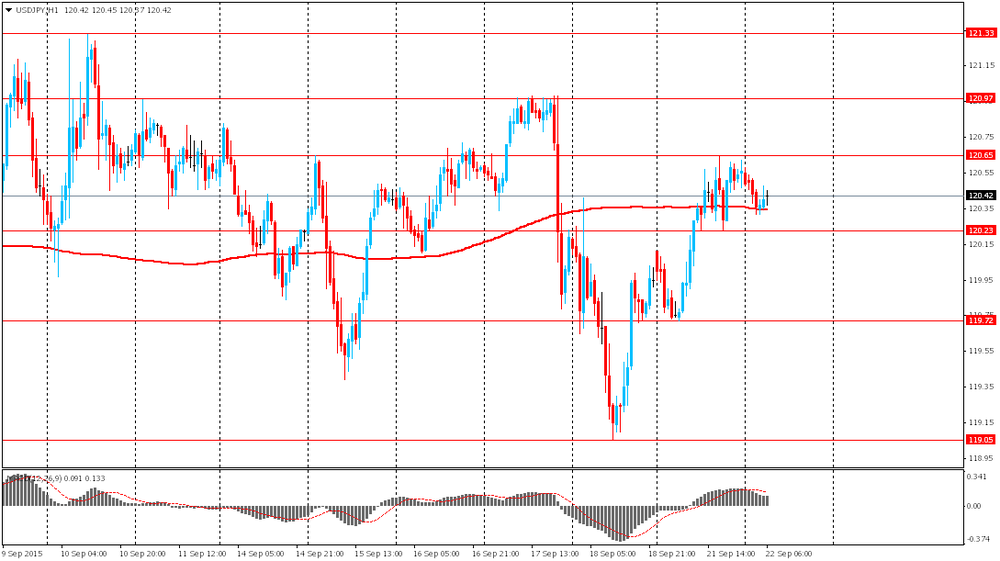

The yen climbed after yesterday's decline. Dealers from Asia said that Japanese exporters placed sell orders above Y120.50, which weigh on the greenback and support the yen. These orders used to be at Y121.00 and higher. However exporters moved them lower. Japanese stock markets are closed due to the National Day holiday.

EUR/USD: the pair fluctuated within $1.1180-95 in Asian trade

USD/JPY: the pair fell to Y120.30

GBP/USD: the pair rose to $1.5530

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PSNB, bln August 2.07 -8.65

10:00 United Kingdom CBI industrial order books balance September -1 0

13:00 U.S. Housing Price Index, m/m July 0.2%

14:00 Eurozone Consumer Confidence (Preliminary) September -6.9 -7

14:00 U.S. Richmond Fed Manufacturing Index September 0

20:30 U.S. API Crude Oil Inventories September -3.1

22:30 U.S. FOMC Member Dennis Lockhart Speaks