- Foreign exchange market. Asian session: the euro remained under pressure

Market news

Foreign exchange market. Asian session: the euro remained under pressure

The euro remained under pressure after Fed Chair Yellen's speech boosted the U.S. dollar. Janet Yellen said yesterday that the central bank would raise rates by the end of the year and noted that inflationary pressures are likely to grow in the coming years. Nevertheless she said that the decision had not been made yet and it depends on the labor market and price stability.

The yen had a mixed session. On one hand it was weighed by inflation data. The core consumer price index fell by 0.1% in August compared to the same period last year. The index has fallen for the first time since 2013. On the other hand the yen was supported by speeches of Japan economy minister and Bank of Japan Governor. Both officials said that GDP growth trend was intact and that the core CPI fell because of low energy costs. Excluding energy the index rose by 1.1%.

EUR/USD: the pair slid to $1.1165 in Asian trade

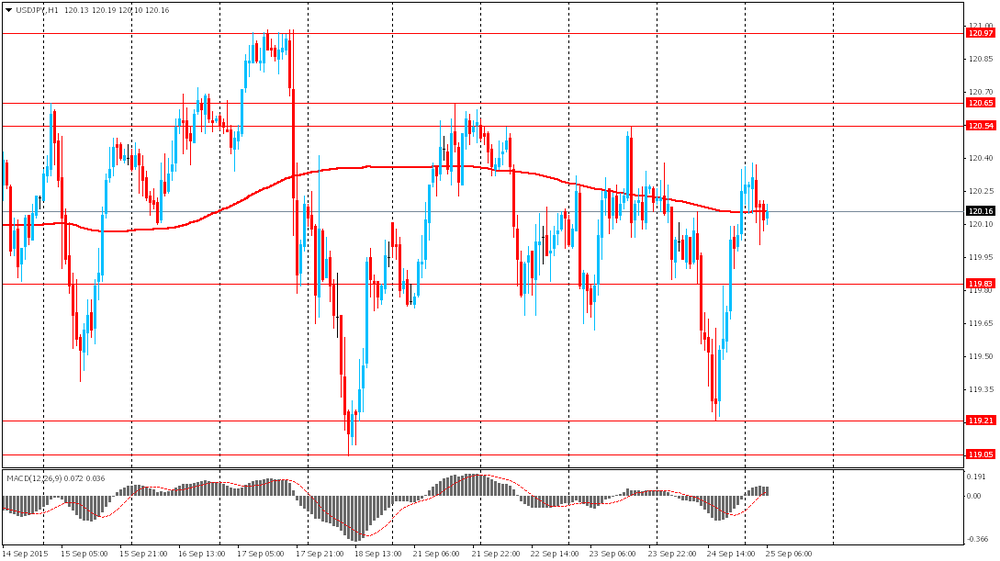

USD/JPY: the pair is currently at Y120.34

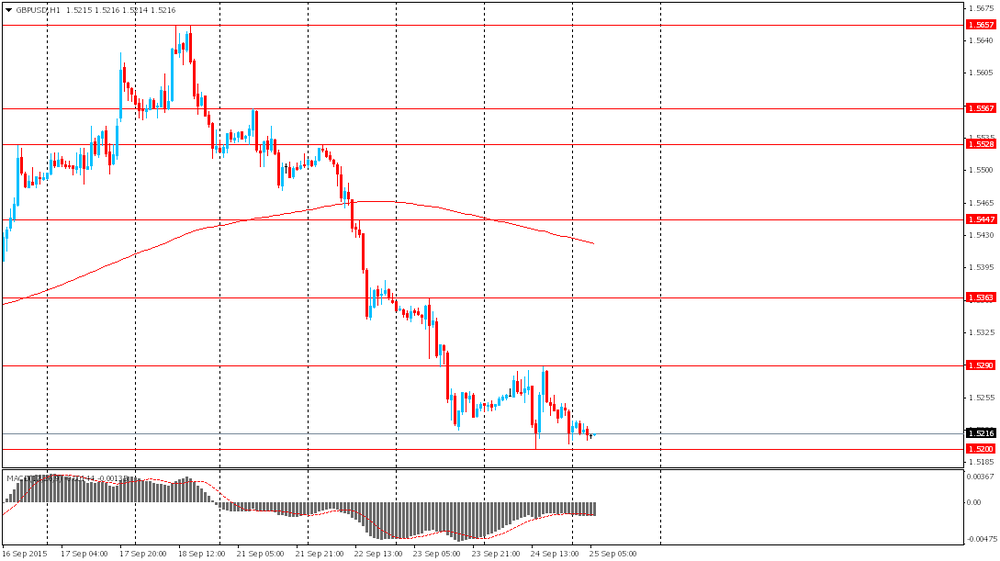

GBP/USD: the pair is currently at $1.5225

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence September 93 94

07:00 Eurozone ECB's Jens Weidmann Speaks

08:00 Eurozone Private Loans, Y/Y August 0.9% 1.1%

08:00 Eurozone M3 money supply, adjusted y/y August 5.3% 5.3%

12:30 U.S. GDP, q/q (Finally) Quarter II 0.6% 3.7%

13:45 U.S. Services PMI (Preliminary) September 56.1 55.6

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 91.9 86.7

16:30 Eurozone ECB's Jens Weidmann Speaks