- Foreign exchange market. Asian session: the Australian dollar gained

Market news

Foreign exchange market. Asian session: the Australian dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans August -0.3% Revised From 0.3% 5% 2.9%

The U.S. dollar little changed after release of minutes of the latest FOMC meeting. The minutes pointed to policymakers' concerns over inflation and the ability of the U.S. economy to handle higher rates in the coming months. Many members of the committee noted that their confidence in stable inflation had not grown. The Federal Reserve expects inflation to reach the 2% target level by the end of 2018.

The Australian dollar rose amid gains in Asian stocks and iron ore prices, which rose 0.7% to $54.80 yesterday as Chinese markets reopened after a holiday. This commodity is one of Australia's key export products and its price affects the country's budget and the AUD exchange rate. Meanwhile home loans data weighed on the currency. Data showed that home loans rose only by 2.9% in August compared with economists' expectations for a 5% rise. The previous reading was revised to -0.3% to 0.3%.

EUR/USD: the pair fluctuated within $1.1265-90 in Asian trade

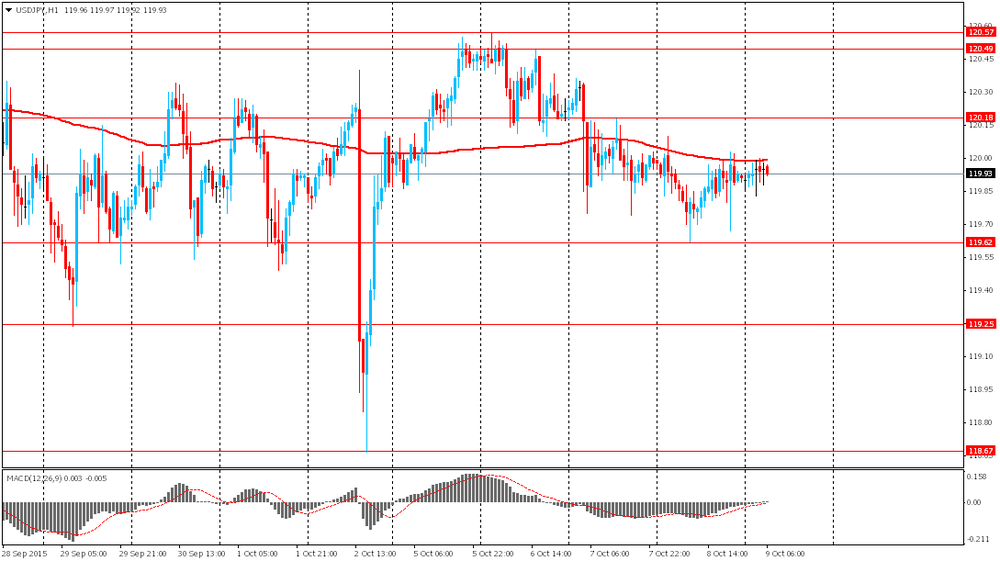

USD/JPY: the pair traded within Y119.80-00

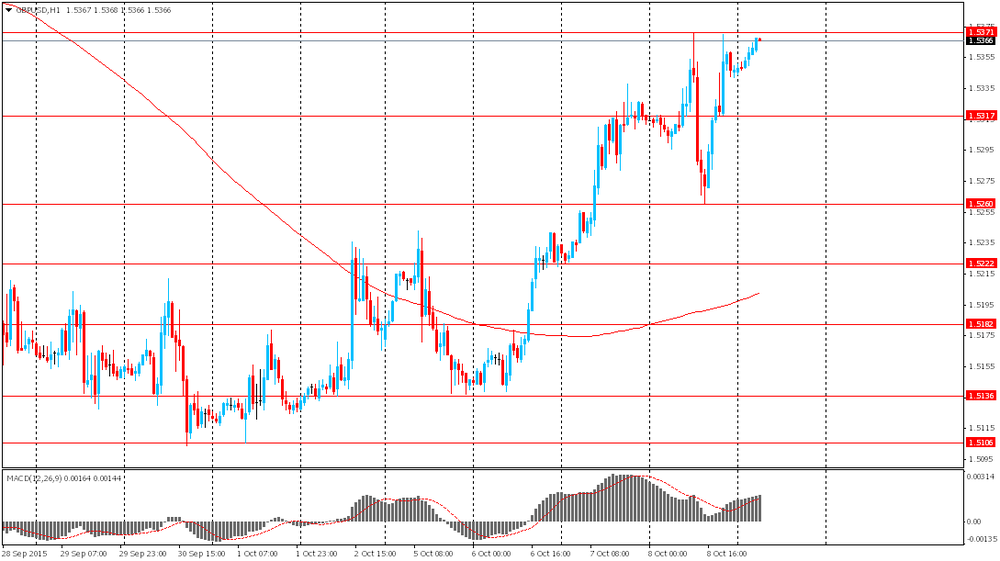

GBP/USD: the pair rose to $1.5370

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Industrial Production, m/m August -0.8% 0.5%

06:45 France Industrial Production, y/y August 0.7%

08:30 United Kingdom Total Trade Balance August -3.37

12:30 Canada Unemployment rate September 7% 6.9%

12:30 Canada Employment September 12 10

12:30 U.S. Import Price Index September -1.8% -0.5%

13:10 U.S. FOMC Member Dennis Lockhart Speaks

14:00 U.S. Wholesale Inventories August -0.1% 0%

14:30 Canada Bank of Canada Business Outlook Survey

17:30 U.S. FOMC Member Charles Evans Speaks