- Gold price hits 3-months-high

Market news

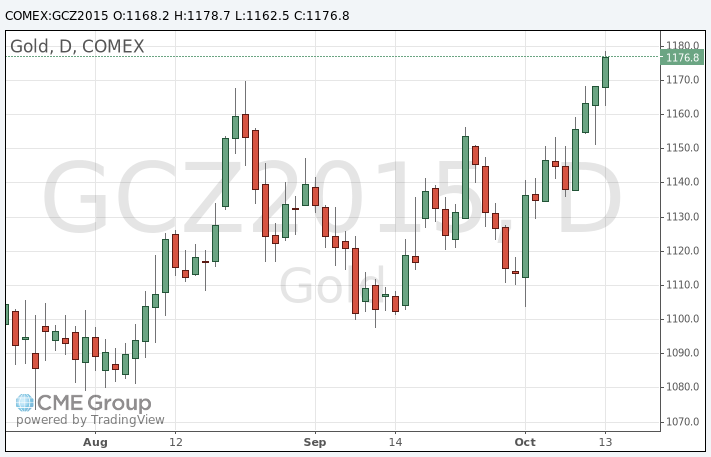

Gold price hits 3-months-high

Gold price increased on a weaker U.S. dollar. The greenback declined against other currencies after the release of the weaker-than-expected U.S. retail sales data. The U.S. Commerce Department released the retail sales data on Wednesday. The U.S. retail sales climbed 0.1% in September, missing expectations for a 0.2% decrease, after a flat reading in August.

The increase was mainly driven by higher automobiles purchases. Automobiles and car parts sales rose 1.7% in September.

Retail sales excluding automobiles decreased 0.3% in September, missing forecasts of a 0.1% decline, after a 0.1% fall in August.

These figures could mean that the Fed will not start raising its interest rate this year.

Earlier, the weak Chinese inflation data supported gold price. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in September, missing expectations for a 1.8% increase, after a 2.0% gain in August.

The Chinese producer price index (PPI) dropped 5.9% in September, in line with expectations, after a 5.9% decline in August. It was the biggest decline since 2009.

December futures for gold on the COMEX today climbed to 1178.70 dollars per ounce.