- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October 3.2% 3.5%

00:30 Australia New Motor Vehicle Sales (MoM) September -1.7% Revised From -1.6% 5.5%

00:30 Australia New Motor Vehicle Sales (YoY) September 2.6% Revised From 2.1% 7.7%

00:30 Australia Unemployment rate September 6.2% 6.3% 6.2%

00:30 Australia Changing the number of employed September 18 Revised From 17.4 5 -5.1

04:30 Japan Industrial Production (MoM) (Finally) August -0.8% -0.5% -1.2%

04:30 Japan Industrial Production (YoY) (Finally) August 0.0% 0.2% -0.4%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. consumer price inflation is expected to decline to -0.1% year-on-year in September from 0.2% in August.

The U.S. consumer price index excluding food and energy is expected to remain unchanged 1.8% year-on-year in September.

The number of initial jobless claims in the U.S. is expected to rise by 7,000 270,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -1.0 in October from -6.0 in September.

The FOMC member Dudley will speak at 14:30 GMT.

The euro traded lower against the U.S. dollar on comments by the European Central Bank (ECB) Governing Council Member Ewald Nowotny. He said on Thursday that further stimulus measures are needed as the central bank's inflation target will be missed.

"In my view, it's quite obvious that additional sets of instruments are necessary," he said.

Nowotny added that additional instruments should include structural reforms and measures to stimulate demand.

The central bank's inflation target is 2%. The ECB expects the inflation to be 0.1% this year.

The ECB Vice President Vitor Constancio said in a speech in Hong Kong on Thursday that the exit from the zero interest rate policy may have spillover on other countries in the short terms.

"We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates," he said.

Constancio added that the spillover from US monetary policy is larger than those from the Eurozone, due to "the dominance of the US dollar in global financial markets".

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

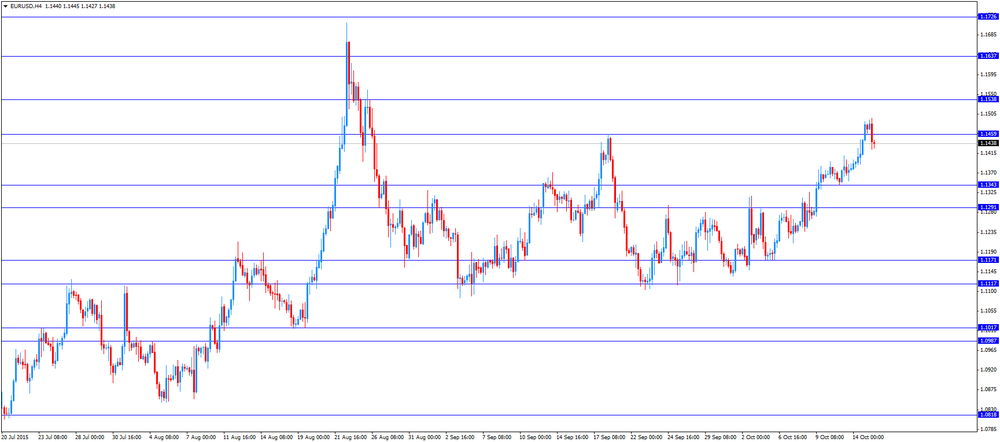

EUR/USD: the currency pair fell to $1.1424

GBP/USD: the currency pair traded mixed

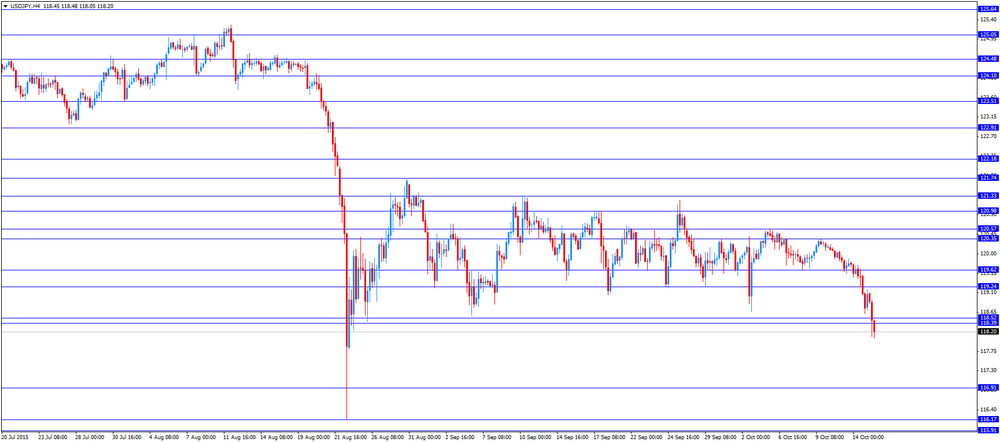

USD/JPY: the currency pair declined to Y118.05

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index October -14.67 -8

12:30 U.S. Initial Jobless Claims October 263 270

12:30 U.S. CPI, m/m September -0.1% -0.2%

12:30 U.S. CPI, Y/Y September 0.2% -0.1%

12:30 U.S. CPI excluding food and energy, m/m September 0.1% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y September 1.8% 1.8%

14:00 U.S. Philadelphia Fed Manufacturing Survey October -6.0 -1

14:30 U.S. FOMC Member Dudley Speak

21:45 New Zealand CPI, q/q Quarter III 0.4% 0.2%

21:45 New Zealand CPI, y/y Quarter III 0.4% 0.3%