- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the weak economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Financial Stability Review

06:35 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Trade balance unadjusted August 31.4 11.2

09:00 Eurozone Harmonized CPI September 0.0% 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September 0.1% -0.1% -0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) September 0.9% 0.9% 0.9%

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. industrial production is expected to decline 0.2% in September, after a 0.4% drop in August.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 89.0 in October from a final reading of 87.2 in September.

Job openings in the U.S. are expected to decline to 5.625 million in August from 5.753 million in July.

The euro traded lower against the U.S. dollar on the weak economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index rose 0.2% in September, in line with the preliminary reading, after a flat reading in August.

On a yearly basis, Eurozone's final consumer price inflation fell to -0.1% in September from 0.1% in August, in line with the preliminary reading.

Restaurants and cafés prices were up 0.12% year-on-year in September, vegetables prices rose by 0.11%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.71%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.06%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in September, in line with the preliminary reading.

Eurozone's unadjusted trade surplus dropped to €11.12 billion in August from €31.4 billion in July.

Exports rose at an annual rate of 6.0% in August, while imports increased by 3.0%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Canada's manufacturing shipments are expected to decrease 1.0% in August, after a 1.7% gain in July.

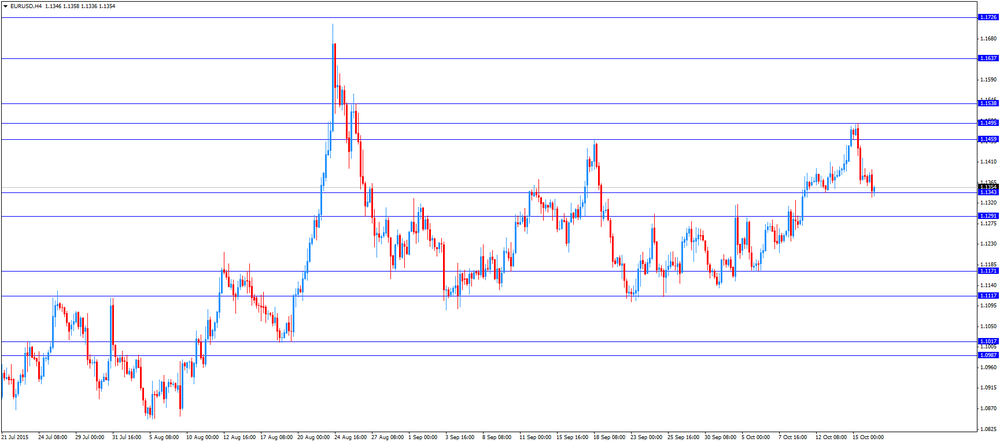

EUR/USD: the currency pair fell to $1.1333

GBP/USD: the currency pair decreased to $1.5433

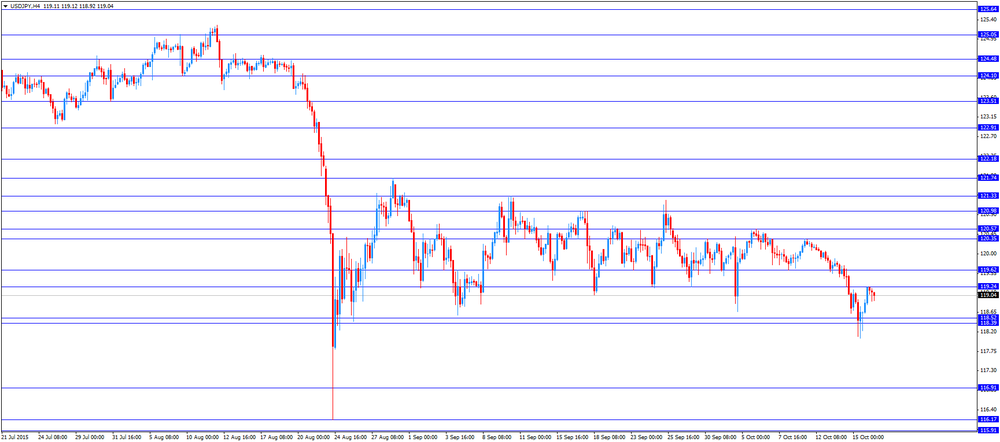

USD/JPY: the currency pair declined to Y118.92

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) August 1.7% -1%

12:30 Canada Foreign Securities Purchases August -10.12

13:15 U.S. Capacity Utilization September 77.6% 77.4%

13:15 U.S. Industrial Production (MoM) September -0.4% -0.2%

13:15 U.S. Industrial Production YoY September 0.9%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 87.2 89

14:00 U.S. JOLTs Job Openings August 5.753 5.625

20:00 U.S. Net Long-term TIC Flows August 7.7

20:00 U.S. Total Net TIC Flows August 141.9