- Foreign exchange market. Asian session: the Australian dollar rose amid Chinese data

Market news

Foreign exchange market. Asian session: the Australian dollar rose amid Chinese data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Industrial Production y/y September 6.1% 6% 5.7%

02:00 China Retail Sales y/y September 10.8% 10.8% 10.9%

02:00 China Fixed Asset Investment August 10.9% 10.8% 10.3%

02:00 China GDP y/y Quarter III 7.0% 6.8% 6.9%

The Australian dollar climbed on Chinese data. National Bureau of Statistics of China reported that the country's GDP rose by 6.9% y/y in the third quarter compared to expectations for a 6.8% rise. The bureau noted some downward pressure on China's economy, although the economy still functioned reasonably. Retail sales rose by 10.9% y/y in September compared to 10.8% reported previously.

The euro climbed against the U.S. dollar after a five-day decline, which was triggered by U.S. industrial production data and expectations for a rate hike. Data showed that the industrial production index fell by 0.2% in September. August reading was revised to -0.1% from -0.4%.

Diversion of monetary policies in the U.S., Japan and the euro zone support the greenback.

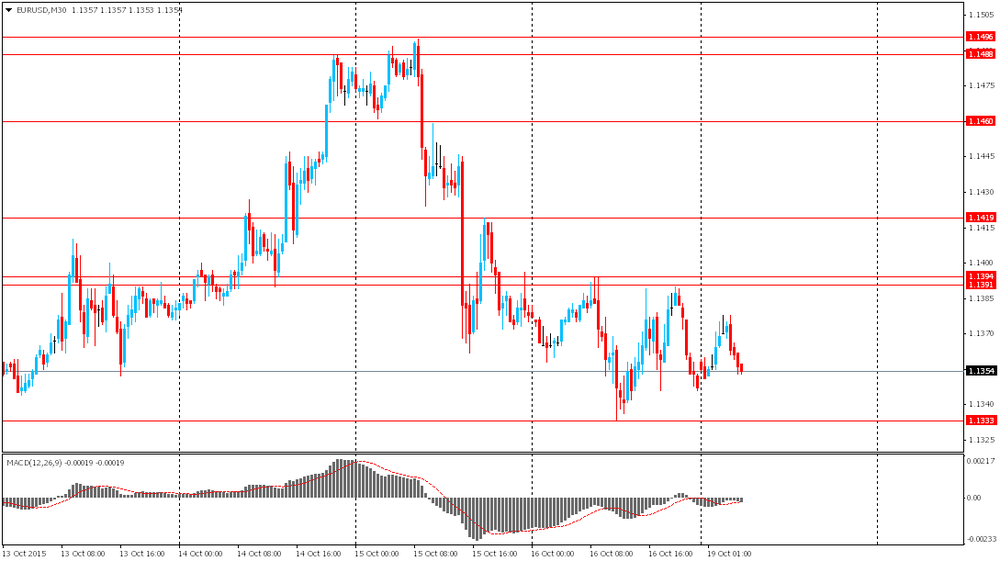

EUR/USD: the pair rose to $1.1380 in Asian trade

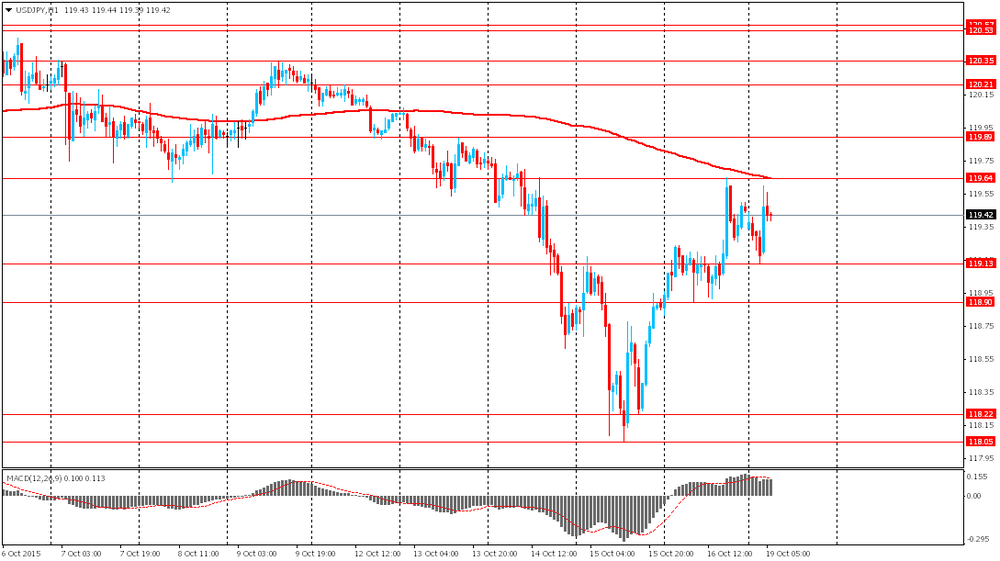

USD/JPY: the pair traded within Y119.15-60

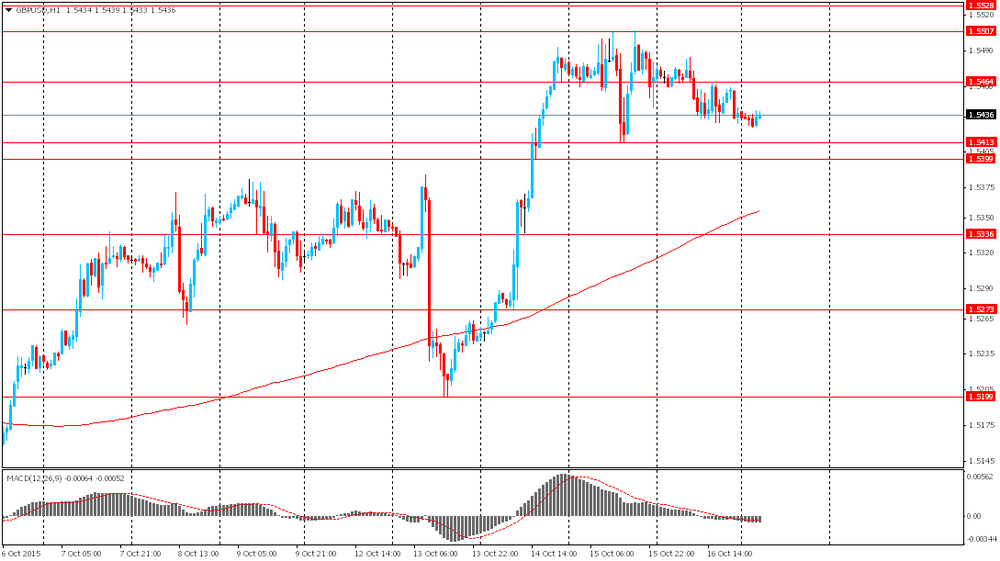

GBP/USD: the pair traded within $1.5425-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Construction Output, y/y August 1.8%

10:00 Germany Bundesbank Monthly Report

14:00 U.S. NAHB Housing Market Index October 62 62

16:00 U.S. FOMC Member Laсker Speaks