- WSE: Session Results

Market news

WSE: Session Results

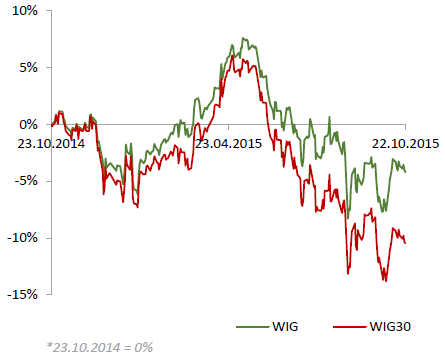

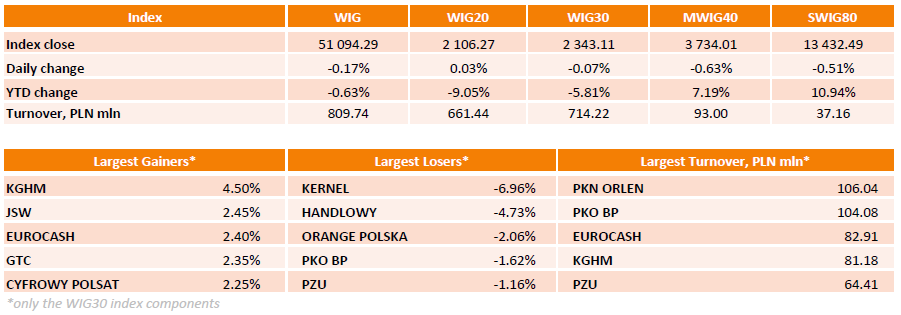

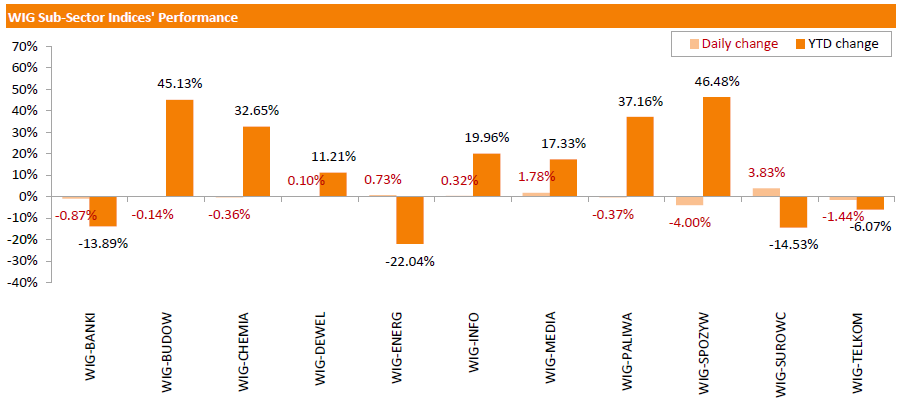

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, lost 0.17%. Sector-wise, materials (+3.83%) fared the best, while food sector (-4%) lagged behind.

The large-cap stocks' benchmark, the WIG30 Index, inched down 0.07%. Within the WIG30 Index components, KERNEL (WSE: KER) topped the list of underperformers as its stock collapsed by 6.96% after the company posted worse-than-expected FY2015 financials and weak Q1 FY2016 operational update. Other major laggards included financials names HANDLOWY (WSE: BHW), PKO BP (WSE: PKO) and PZU (WSE: PZU), slumping by 1.16%-4.73%. Elsewhere, ORANGE POLSKA (WSE: OPL) fell sharply, down 2.06%, after the company stated it might cut its dividend by half in 2016 after it agreed to pay the equivalent of nearly all its 2014 core profit for new mobile broadband frequencies. PKN ORLEN (WSE: PKN) plunged by 0.84% as the company's Q3 FY 2015 profit missed forecasts. On the contrary, KGHM (WSE: KGH) led the gainers pack with a 4.5% advance, supported by uptick in copper prices. It was followed by JSW (WSE: JSW), EUROCASH (WSE: EUR), GTC (WSE: GTC) and CYFROWY POLSAT (WSE: CPS), adding 2.25%-2.45%.