- Foreign exchange market. Asian session: the Australian dollar rose on China's rate cut

Market news

Foreign exchange market. Asian session: the Australian dollar rose on China's rate cut

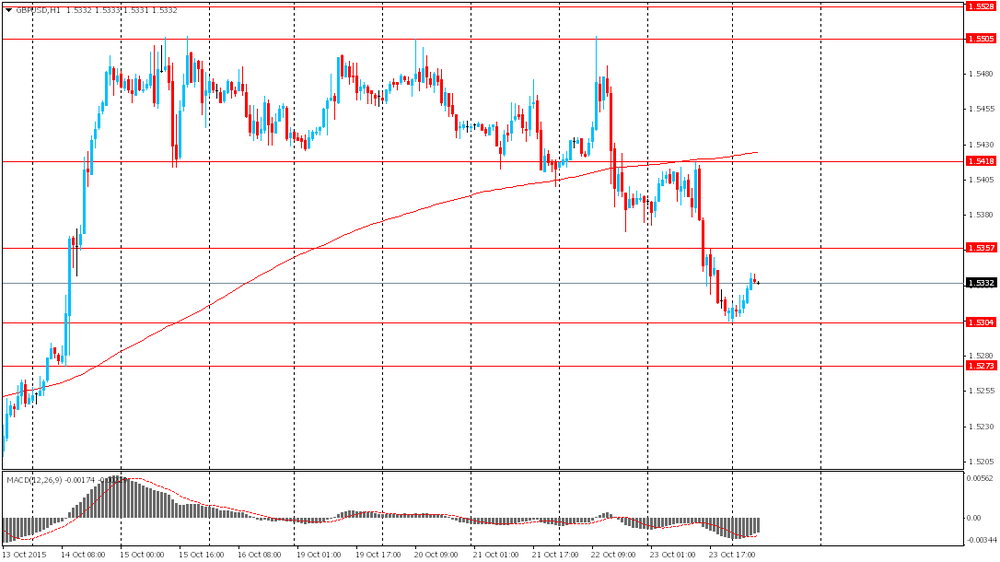

The pound rose on an interview with Bank of England Governor Mark Carney. He said that a rate hike is probable, but not determined yet. Carney added that when the consumer price index rises the central bank will warn about its intention to raise the benchmark rate and only after that proceeds to action. He underlined that increase in interest rates would be modest and gradual.

The Australian dollar rose amid a rate cut by the central bank of China (the fifth cut this year). The People's Bank of China lowered its one-year deposit rate by 25 basis points to 1.5% and its one-year lending rate by 25 basis points to 4.35%. The reserve requirement ratio was lowered by 50 basis points. China is Australia's major trading partner, that's why positive news supports the AUD.

This week is full of economic data and important events. Tomorrow the Federal Reserve will start its monetary policy meeting and announce its decision on Wednesday. Not many experts expect to see changes in policymakers' statements.

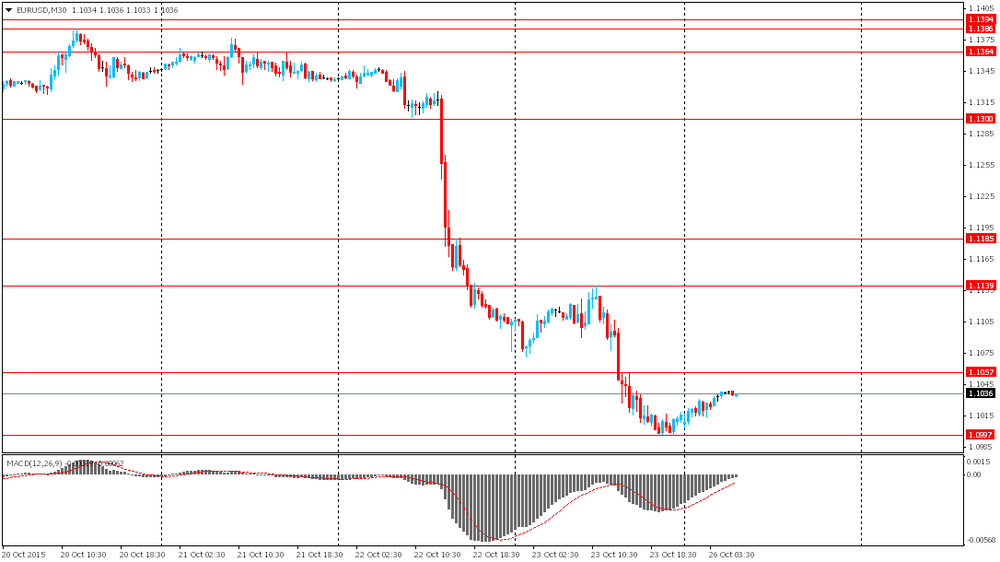

EUR/USD: the pair rose to $1.1040 in Asian trade

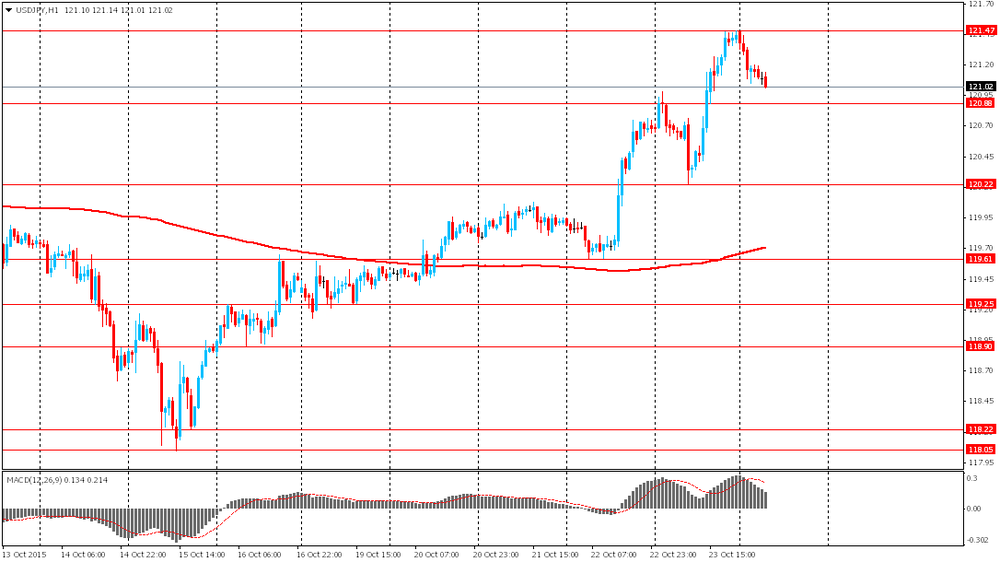

USD/JPY: the pair fell to Y121.00

GBP/USD: the pair rose to $1.5340

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Germany IFO - Expectations October 103.3 102.4

09:00 Germany IFO - Current Assessment October 114 113.5

09:00 Germany IFO - Business Climate October 108.5 107.8

09:30 United Kingdom BBA Mortgage Approvals September 46.74

14:00 U.S. New Home Sales September 552 550

21:45 New Zealand Trade Balance, mln September -1035 -800