- Foreign exchange market. Asian session: the yen advanced against the U.S. dollar

Market news

Foreign exchange market. Asian session: the yen advanced against the U.S. dollar

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Import Price Index, q/q Quarter III 1.4% 1.6% 1.4%

00:30 Australia Export Price Index, q/q Quarter III -4.4% 0.5% 0.0%

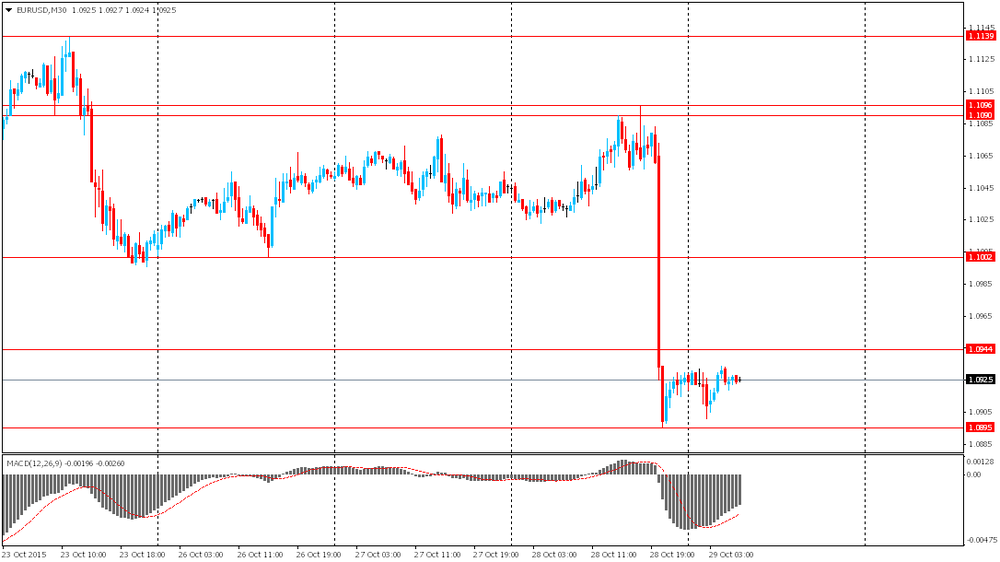

The U.S. dollar rose against the euro after the Federal Reserve left its key interest rate unchanged, but gave a hint that a rate hike in December would still be possible. Fed's statement did not mention a concern seen in September that market turbulence and worldwide events might hold back economic activity in the U.S. This does not guarantee a rate hike in the current year, but it signals that obstacles mentioned in September decreased.

The yen advanced against the U.S. dollar amid Japanese industrial production data. The Ministry of Economy, Trade and Industry reported that the country's industrial production rose by 1.0% in September compared to a 1.3% decline reported previously and a 0.5% fall expected by economists. On a y/y basis the index came in at -0.9%. The unexpected rise in September gives hope for a stronger growth of the country's economy despite China's economic slowdown.

Tomorrow the Bank of Japan will hold a meeting and revise inflation and economic growth forecasts. Inflation forecasts are likely to be revised down.

The New Zealand dollar declined after the Reserve Bank of New Zealand left it benchmark rate at 2.75%, but signaled that it might be lowered later on. A rate cut would depend on economic data. The RBNZ's inflation target is 1%-3%, while the CPI is currently at 0.4%.

EUR/USD: the pair fluctuated within $1.0900-35 in Asian trade

USD/JPY: the pair fell to Y120.60

GBP/USD: the pair fell to $1.5250

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Nationwide house price index, y/y October 3.8% 3.8%

07:00 United Kingdom Nationwide house price index October 0.5% 0.5%

08:55 Germany Unemployment Change October 3 -4

08:55 Germany Unemployment Rate s.a. October 6.4% 6.4%

09:30 United Kingdom Consumer credit, mln September 860 1100

09:30 United Kingdom Mortgage Approvals September 71.03 72.45

09:30 United Kingdom Net Lending to Individuals, bln September 4.3

10:00 Eurozone Economic sentiment index October 105.6 105.2

10:00 Eurozone Consumer Confidence (Finally) October -7.1 -7.7

10:00 Eurozone Business climate indicator October 0.34 0.32

10:00 Eurozone Industrial confidence October -2.2 -2.7

11:00 United Kingdom CBI retail sales volume balance October 49

12:30 Canada Industrial Product Price Index, m/m September -0.3% -0.1%

12:30 Canada Industrial Product Price Index, y/y September -0.4%

12:30 U.S. Continuing Jobless Claims October 2170 2160

12:30 U.S. Initial Jobless Claims October 259 263

12:30 U.S. PCE price index, q/q (Preliminary) Quarter III 2.2% 3.2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter III 1.9% 1.4%

12:30 U.S. GDP, q/q (Preliminary) Quarter III 3.9% 1.6%

13:00 Germany CPI, m/m (Preliminary) October -0.2% -0.1%

13:00 Germany CPI, y/y (Preliminary) October 0% 0.2%

14:00 U.S. Pending Home Sales (MoM) September -1.4% 1%

14:10 U.S. FOMC Member Dennis Lockhart Speaks

21:45 New Zealand Building Permits, m/m September -4.9% 0.2%

23:30 Japan Unemployment Rate September 3.4% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.2% -0.1%

23:30 Japan National Consumer Price Index, y/y September 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y September -0.1% -0.2%