- WSE: Session Results

Market news

WSE: Session Results

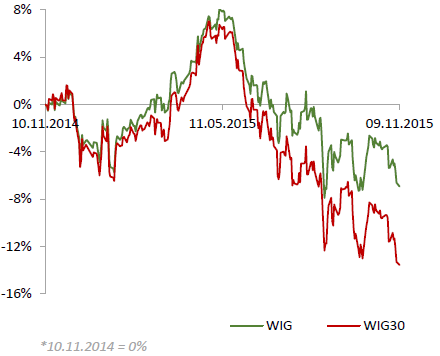

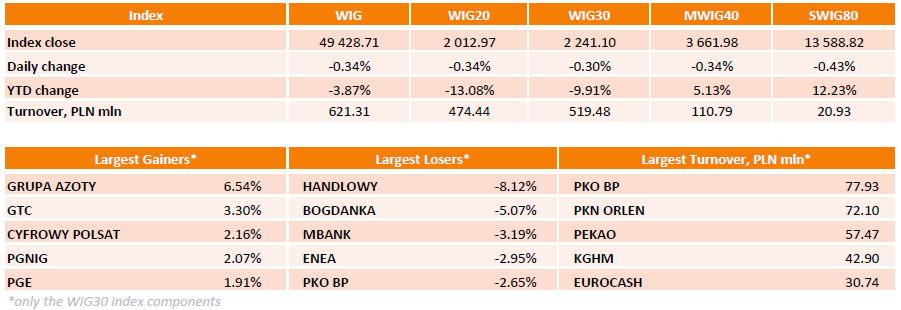

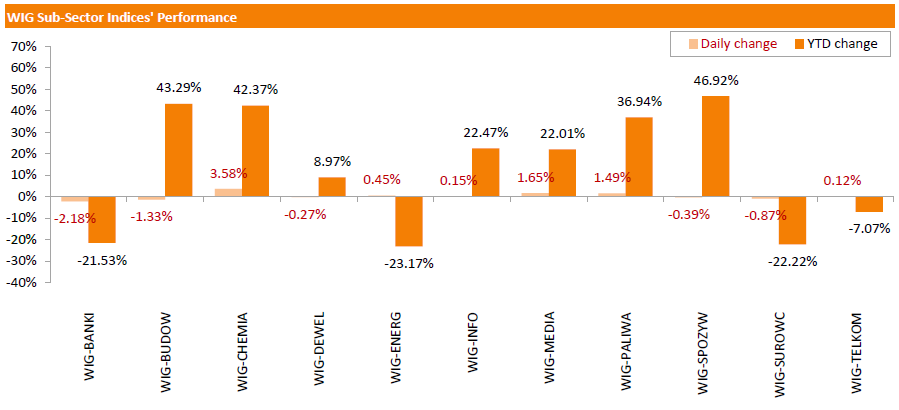

Polish equity market declined on Monday. The broad market measure, the WIG Index, slumped by 0.34%. Sector performance in the WIG Index was mixed. Banking sector (-2.18%) recorded the sharpest decline as the Polish president's office announced on Friday that President Andrzej Duda believes it would be equitable if banks bore between 50% and 90% of the cost of conversion of Swiss franc-denominated mortgages into zlotys at historical rates.

The large-cap stocks fell by 0.3%, as measured by the WIG30 Index. Within the index components, HANDLOWY (WSE: BHW) led the decliners, tumbling 8.12% on the back of worse-than-expected 3Q earnings (its Q3 profit was PLN140.9 mln versus consensus of PLN145.6 mln). It was followed by BOGDANKA (WSE: LWB), sliding down 5.07%. The other biggest losers were MBANK (WSE: MBK), ENEA (WSE: ENA), PKO BP (WSE: PKO), KERNEL (WSE: KER) and CCC (WSE: CCC), losing 2.24%-3.19%. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) led the risers, climbing by 6.54% as the company's 3Q results beat analysts' expectations (its revenues accounted PLN 2401 mln versus consensus of PLN 2179 mln and its net income was PLN 73.6 mln versus consensus of PLN 39.8 mln). GTC (WSE: GTC), CYFROWY POLSAT (WSE: CPS) and PGNIG (WSE: PGN) were also noteworthy performers, gaining 3.3%, 2.16% and 2.07% respectively.