- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after a speech by the European Central Bank President Mario Draghi

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after a speech by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October 3.5% 3.5%

00:30 Australia Changing the number of employed October -0.8 Revised From -5.1 15 58.6

00:30 Australia Unemployment rate October 6.2% 6.2% 5.9%

07:00 Germany CPI, m/m (Finally) October -0.2% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) October 0% 0.3% 0.3%

07:45 France CPI, m/m October -0.4% 0.1%

07:45 France CPI, y/y October 0.0% 0.1%

08:30 Eurozone ECB President Mario Draghi Speaks

10:00 Eurozone Industrial production, (MoM) September -0.4% Revised From -0.5% -0.1% -0.3%

10:00 Eurozone Industrial Production (YoY) September 2.2% Revised From 0.9% 1.3% 1.7%

10:30 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded higher against the most major currencies ahead the release of the U.S. economic data and a speech by the Fed Chairwoman Janet Yellen.

The number of initial jobless claims in the U.S. is expected to decrease by 6,000 to 270,000 last week.

Job openings in the U.S. are expected to remain unchanged at 5.370 million in September.

The greenback remains supported by speculation that the Fed will start raising its interest rate next month.

The euro traded lower against the U.S. dollar after a speech by the European Central Bank (ECB) President Mario Draghi. He testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. Draghi said that the central bank will review its monetary policy at its next meeting in December.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

Meanwhile, the economic data from the Eurozone was positive. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the new housing price index from Canada. Canada's new housing price index is expected to rise 0.2% in September, after a 0.3% gain in August.

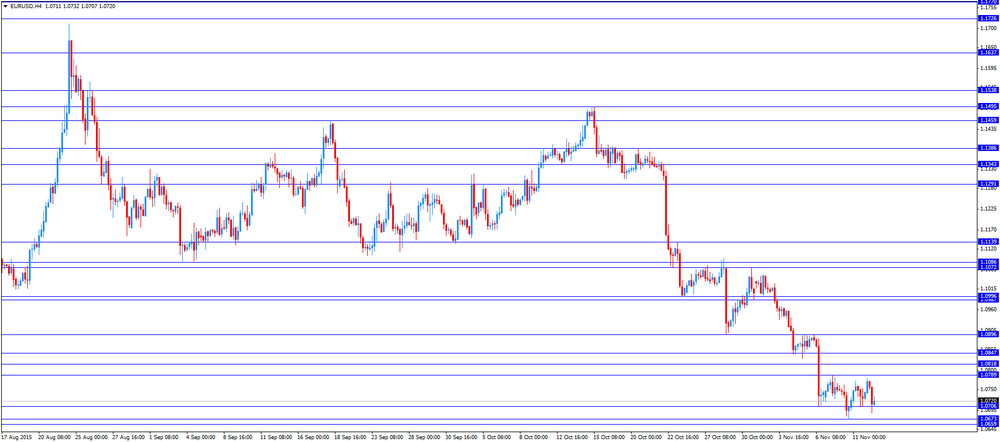

EUR/USD: the currency pair declined to $1.0690

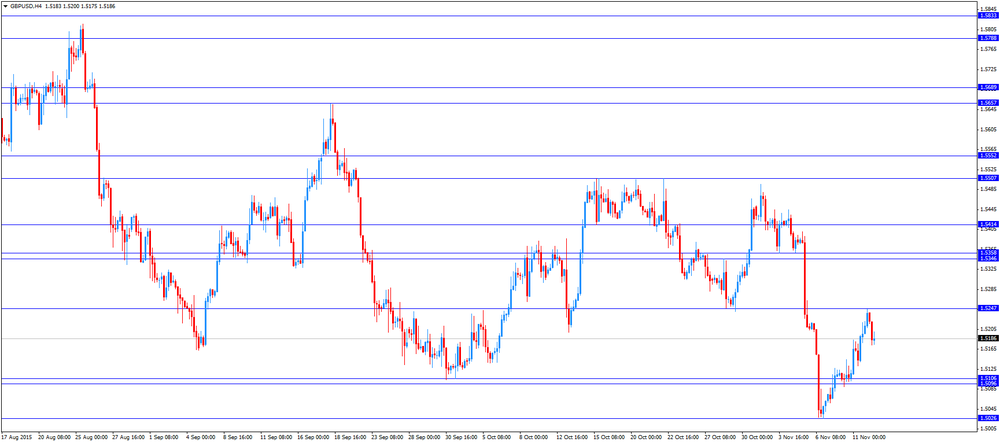

GBP/USD: the currency pair was down to $1.5173

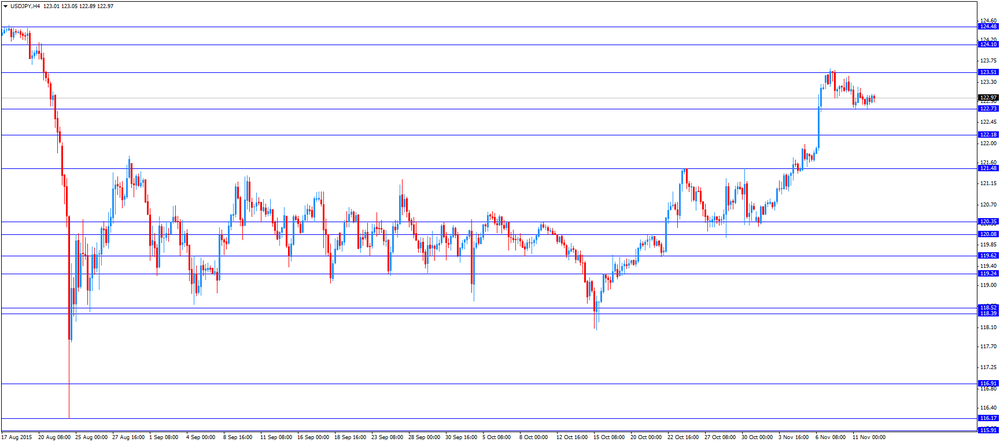

USD/JPY: the currency pair increased to Y123.06

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index, MoM September 0.3% 0.2%

13:30 U.S. Initial Jobless Claims November 276 270

14:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. JOLTs Job Openings September 5.370 5.370

15:15 U.S. FOMC Member Charles Evans Speaks

17:15 U.S. FOMC Member Dudley Speak

23:00 U.S. FED Vice Chairman Stanley Fischer Speaks