- Foreign exchange market. Asian session: the pound declined

Market news

Foreign exchange market. Asian session: the pound declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Wage Price Index, q/q Quarter III 0.6% 0.6% 0.6%

00:30 Australia Wage Price Index, y/y Quarter III 2.3% 2.3% 2.3%

Today investors are focused on the release of minutes of Fed's latest meeting. Market participants want to assess probability of a rate hike in December. A survey by Bloomberg suggests a 66% chance of a rate hike when the FOMC meets next month. At the end of October the probability stood at 50%.

The pound declined against the U.S. dollar ahead of a speech by U.K. Energy Secretary Amber Rudd, who is expected to unveil a new energy strategy for the country.

The New Zealand dollar edged down at the beginning of the session amid declines in dairy prices. Prices have fallen for the third time in a row at a global dairy auction. This means the Reserve Bank of New Zealand may cut its benchmark interest rate next month. Nevertheless the NZD rebounded later in the session.

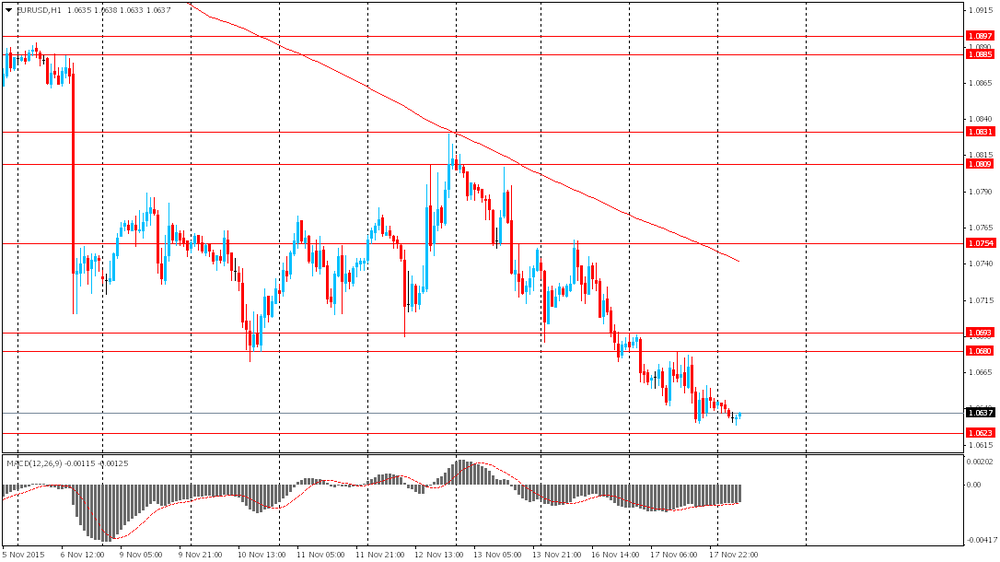

EUR/USD: the pair fluctuated within $1.0630-50 in Asian trade

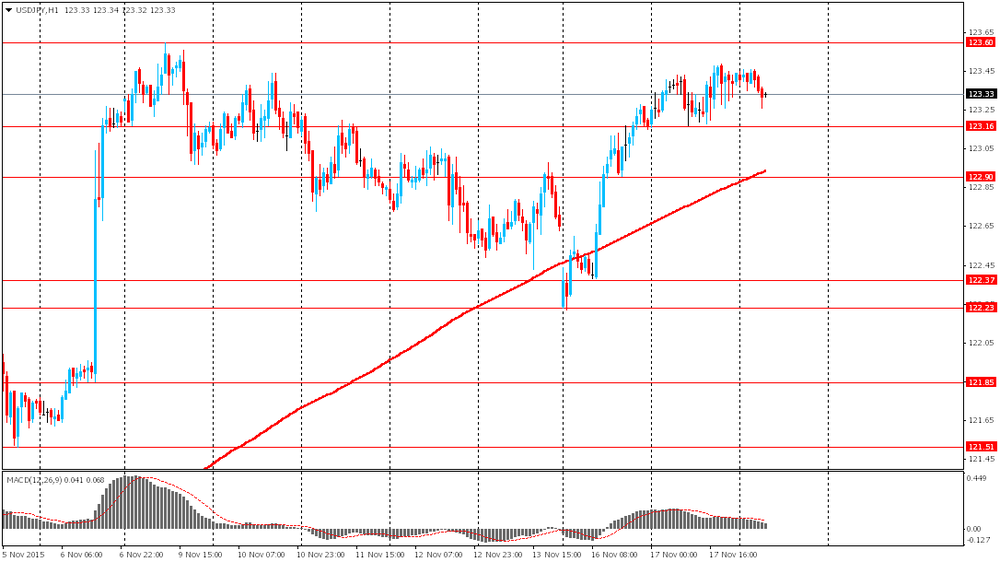

USD/JPY: the pair fell to Y123.25

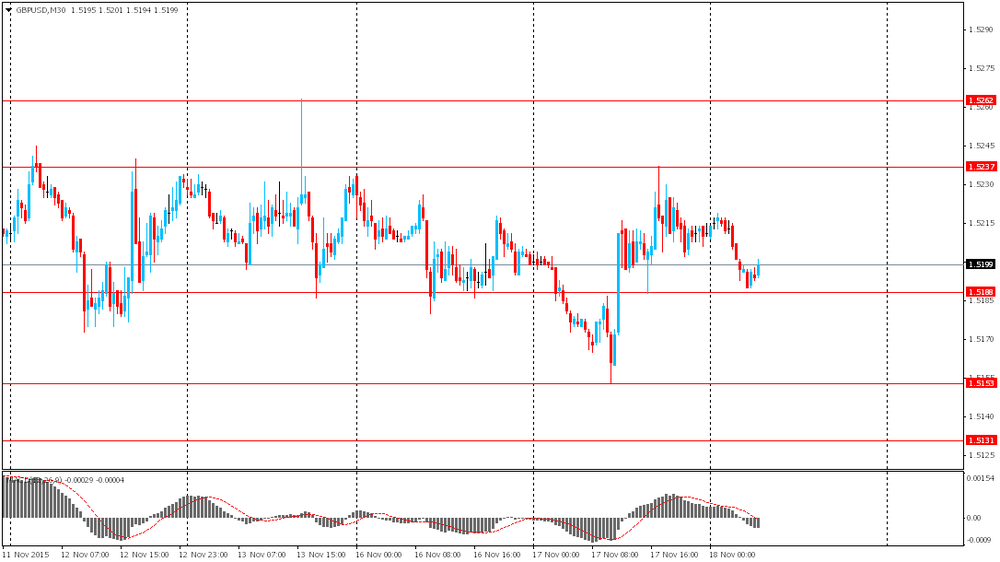

GBP/USD: the pair fell to $1.5190

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Construction Output, y/y September -6.0%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 18.3

12:00 U.S. MBA Mortgage Applications November -1.3%

13:30 U.S. Housing Starts October 1206 1160

13:30 U.S. Building Permits October 1105 1150

15:30 U.S. Crude Oil Inventories November 4.224 1.9

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.2%

23:50 Japan Trade Balance Total, bln October -114.5 -292