- Oil prices rise after hitting 7-year lows on concerns over the global oil oversupply

Market news

Oil prices rise after hitting 7-year lows on concerns over the global oil oversupply

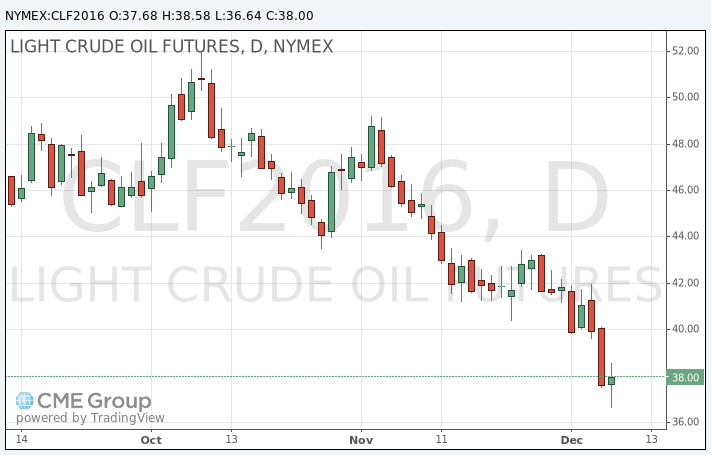

Oil prices pared some losses after hitting 7-year lows on concerns over the global oil oversupply.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The weaker-than-expected Chinese economic data also weighed on oil prices. The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion. Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

WTI crude oil for January delivery rose to $38.58 a barrel on the New York Mercantile Exchange.

Brent crude oil for January climbed to $41.27 a barrel on ICE Futures Europe.