- Foreign exchange market. European session: the euro traded higher against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Market news

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (MoM) (Finally) October 1.4% Revised From 1.1% 1.4% 1.4%

04:30 Japan Industrial Production (YoY) (Finally) October -0.8% -1.4% -1.4%

04:30 Japan Tertiary Industry Index October -0.4% 0.9%

10:00 Eurozone Industrial production, (MoM) October -0.3% 0.3% 0.6%

10:00 Eurozone Industrial Production (YoY) October 1.3% Revised From 1.7% 1.3% 1.9%

11:00 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom MPC Member Shafik Speaks

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday. Analysts expect the Fed to raise its interest rate.

The euro traded higher against the U.S. dollar on comments by the European Central Bank (ECB) President Mario Draghi. He said on Monday that inflation in the Eurozone will reach 2% target "without undue delay".

Meanwhile, the economic data from Eurozone was positive. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in October, exceeding expectations for a 0.3% increase, after a 0.3% fall in September.

The increase was driven by rises in durable consumer goods, non-durable consumer goods, energy and capital output. Durable consumer goods output jumped 1.8% in October, non-durable consumer goods were up 0.4%, capital goods output climbed 1.4%, while energy output rose 0.6%.

Intermediate goods output declined 0.1% in October.

On a yearly basis, Eurozone's industrial production gained 1.9% in October, exceeding expectations for a 1.3% rise, after a 1.3% increase in September. September's figure was revised down from a 1.7% gain.

The increase was mainly driven by rises in durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 4.2% in October from a year ago, capital goods rose by 3.5%, while intermediate goods output increased by 1.5%.

Energy output was up by 0.2% in October from a year ago, while non-durable consumer goods gained by 0.7%.

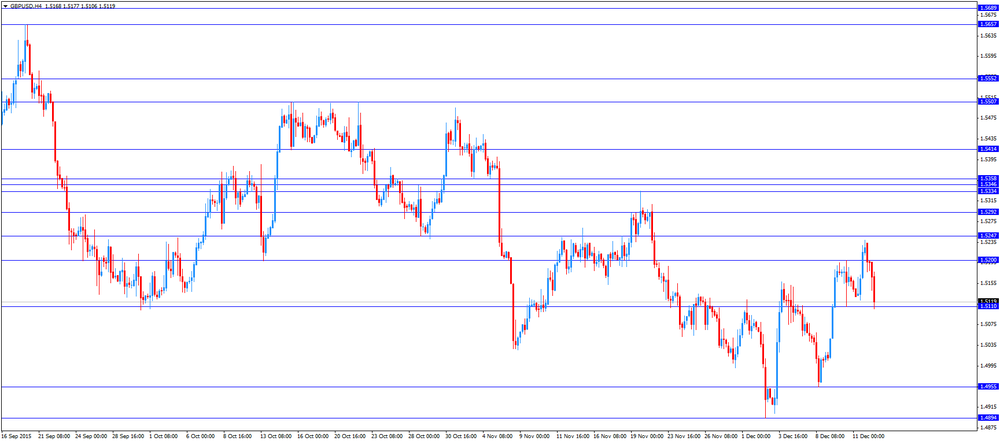

The British pound traded lower against the U.S. dollar. According to property tracking website Rightmove, U.K. house prices declined 1.1% in December, after a 1.3% drop in November. The latest decline was the smallest fall since 2006.

The decline was mainly driven by falls in prices in the East of England, the South West, Wales, the East Midlands and the North East.

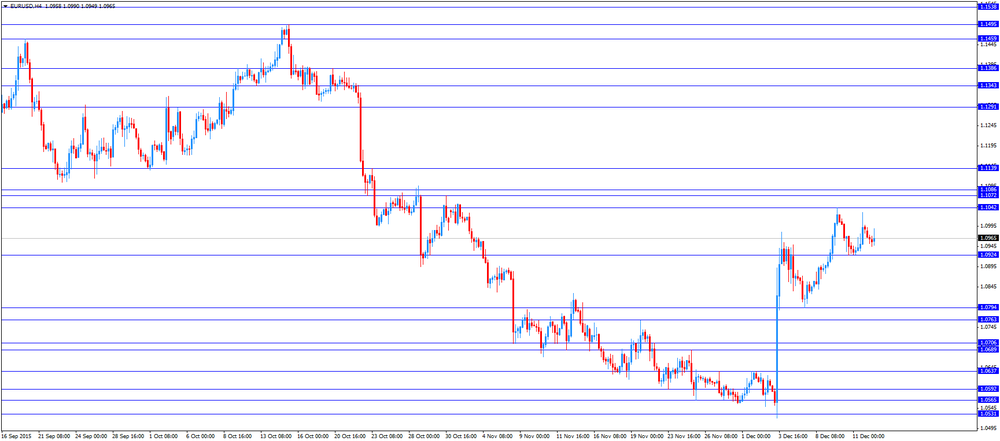

EUR/USD: the currency pair rose to $1.0990

GBP/USD: the currency pair declined to $1.5106

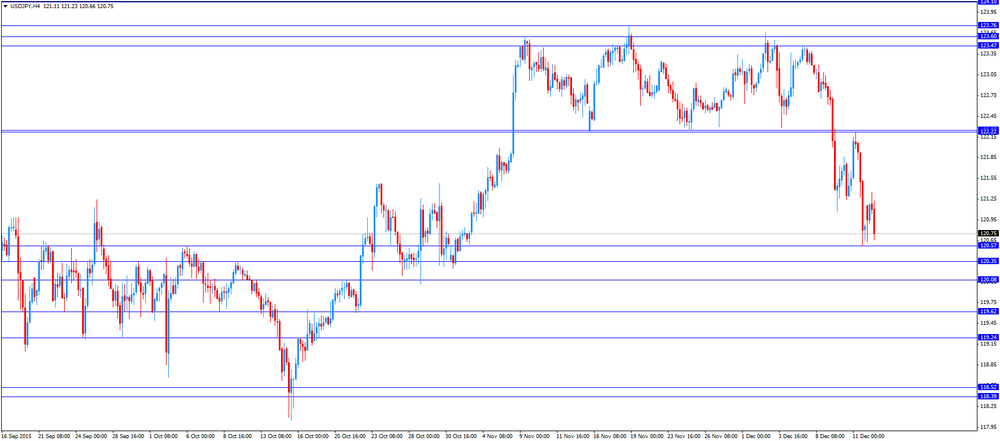

USD/JPY: the currency pair decreased to Y120.66