- Foreign exchange market. Asian session: the yen climbed

Market news

Foreign exchange market. Asian session: the yen climbed

The yen rose after the release of minutes of November 18-19 Bank of Japan meeting. Minutes did not signal that the bank intends to take new steps at the next meeting. Most Board members noted underlying trend in inflation had been improving steadily. The minutes supported the yen.

The Australian dollar rose on gains in commodity prices. Declines in U.S. crude oil inventories intensified hopes for a return to a balanced market after the supply glut triggered sharp declines in oil prices.

Trading is not expected to be dynamic in the coming days. Many traders have already closed their positions ahead of the end of the year, which increases market volatility. Today markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

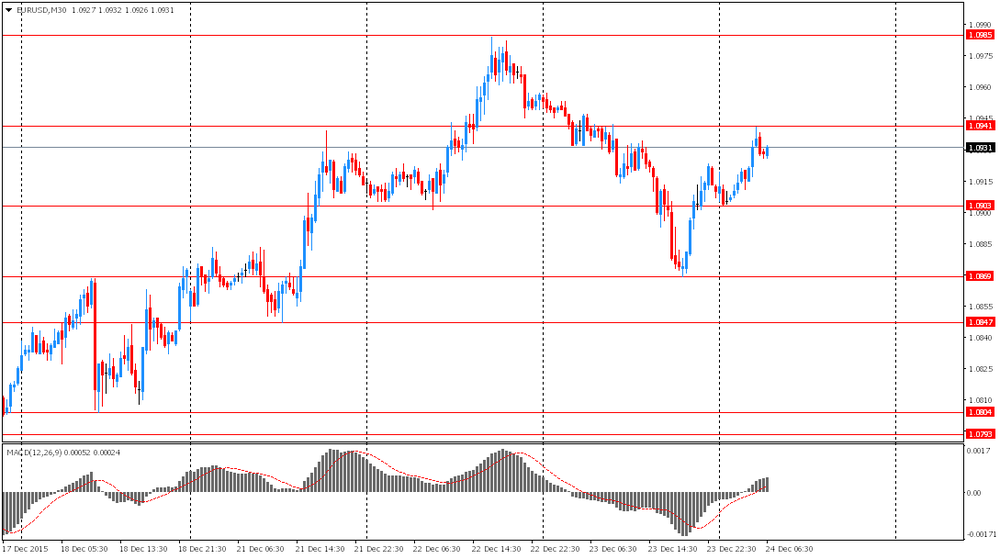

EUR/USD: the pair rose to $1.0940 in Asian trade

USD/JPY: the pair fell to Y120.50

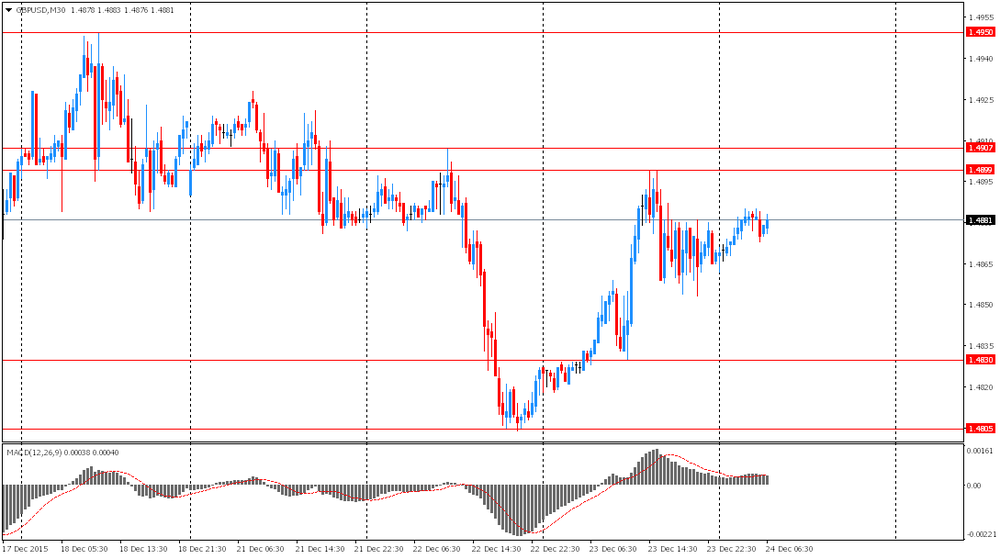

GBP/USD: the pair rose to $1.4885

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom BBA Mortgage Approvals November 45.43 46.2

13:30 U.S. Continuing Jobless Claims December 2238 2210

13:30 U.S. Initial Jobless Claims December 271 270

23:30 Japan Household spending Y/Y November -2.4% -2.4%

23:30 Japan Unemployment Rate November 3.1% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y December 0.2% 0.2%

23:30 Japan Tokyo CPI ex Fresh Food, y/y December 0% 0.1%

23:30 Japan National Consumer Price Index, y/y November 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y November -0.1% 0.0%