- Oil prices decline on the U.S. crude oil inventories data

Market news

Oil prices decline on the U.S. crude oil inventories data

Oil prices declined on the U.S. crude oil inventories data as U.S. gasoline inventories and crude stocks at the Cushing rose last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories slid by 5.1 million barrels to 482.3 million in the week to January 01.

Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

Gasoline inventories increased by 10.6 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 917,000 barrels.

U.S. crude oil imports decreased by 382,000 barrels per day.

Refineries in the U.S. were running at 92.5% of capacity, down from 92.6% the previous week.

The weak Chinese services data also weighed on oil prices. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 50.2 in December from 51.2 in November, missing expectations for an increase to 52.3. The index was driven by a subdued client demand.

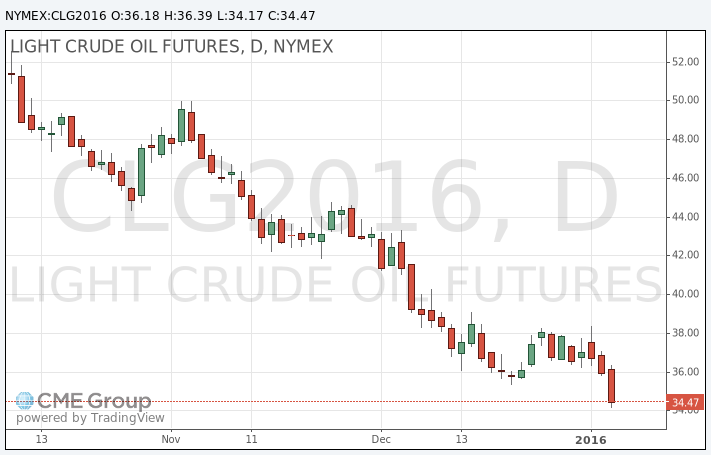

WTI crude oil for February delivery declined to $34.17 a barrel on the New York Mercantile Exchange.

Brent crude oil for February fell to $34.63 a barrel on ICE Futures Europe.