- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) December 1.1% Revised From 1.3% -0.1%

02:00 China New Loans December 708.9 700

08:15 Switzerland Retail Sales (MoM) November 0.3% -0.8%

08:15 Switzerland Retail Sales Y/Y November -0.6% Revised From -0.8% 0.3% -3.1%

09:30 Eurozone Sentix Investor Confidence December 15.7 9.6

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports from the U.S.

Market participants continued to eye Friday's labour market data. According to the U.S. Labor Department's labour market data, the U.S. economy added 292,000 jobs in December, exceeding expectations for a rise of 200,000 jobs, after a gain of 252,000 jobs in November. November's figure was revised up from a rise of 211,000 jobs. The U.S. unemployment rate remained unchanged at 5.0% in December, in line with expectations.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 9.6 in January from 15.7 in December.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The shakeup at Chinese stock exchanges is perceived more than a "technical issue" by investors. Economic ex-pectations for Asia ex. Japan show the strongest nosedive ever recorded. Yet, economic expectations for the US economy are negative, the first time since October 2012," Sentix said in its statement.

German investor confidence index dropped to 18.1 in January from 22.7 in December.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the release of the housing market data from Canada. Housing starts in Canada are expected to rise to 213,000 in December from 211,900 in November.

The Swiss franc traded lower against the U.S. dollar after the weak retail sales data from Switzerland. The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were down at an annual rate of 3.1% in November, missing expectations for a 0.3% rise, after a 0.6% decrease in October. October's figure was revised up from a 0.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4% in November, while non-food sales dropped 1.9%.

On a monthly basis, retail sales slid by 0.8% in November, after a 0.3% rise in October.

Sales of food, beverages and tobacco rose 0.1% in November, while non-food sales decreased 1.3%.

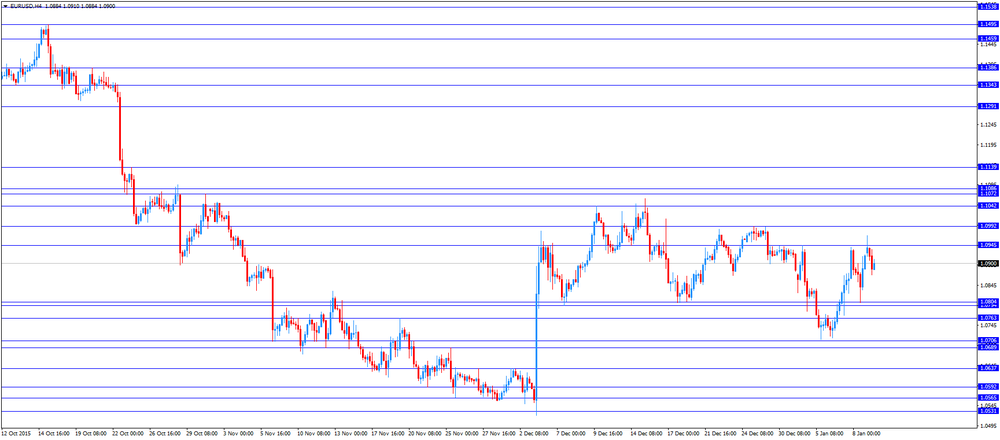

EUR/USD: the currency pair declined to $1.0871

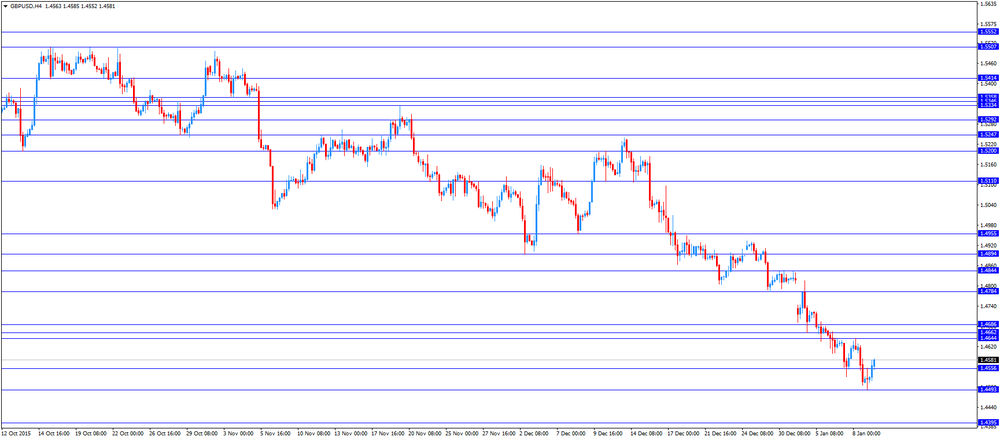

GBP/USD: the currency pair rose to $1.4585

USD/JPY: the currency pair increased Y117.92

The most important news that are expected (GMT0):

13:15 Canada Housing Starts December 211.9 213

15:00 U.S. Labor Market Conditions Index December 0.5

15:30 Canada Bank of Canada Business Outlook Survey

23:50 Japan Current Account, bln November 1458.4 858.5