- Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the Bank of England's interest rate decision

Market news

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Changing the number of employed December 75.0 Revised From 71.4 -12.5 -1.0

00:30 Australia Unemployment rate December 5.8% 5.9% 5.8%

06:00 Japan Prelim Machine Tool Orders, y/y December -17.7% Revised From -17.9% -25.8%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:30 Eurozone ECB Monetary Policy Meeting Accounts

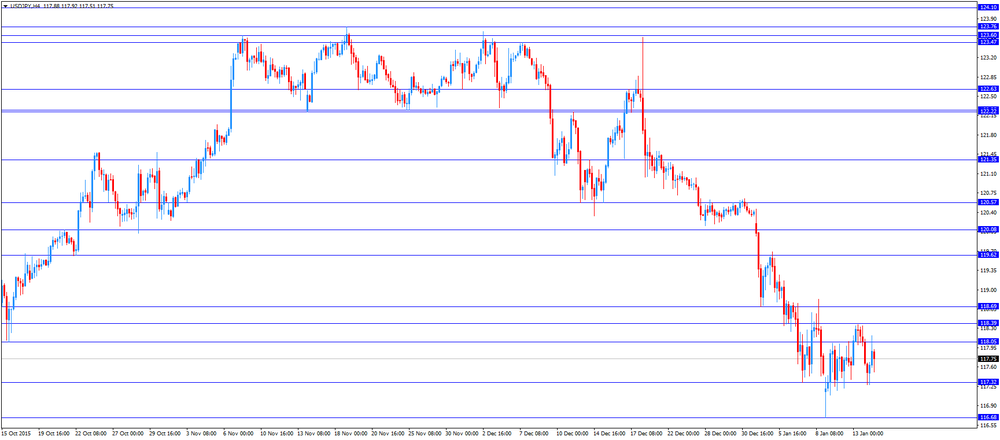

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 2,000 to 275,000 last week.

The U.S. import price index is expected to decline 1.4% in December, after a 0.4% fall in November.

The FOMC member James Bullard is expected to speak at 13:30 GMT.

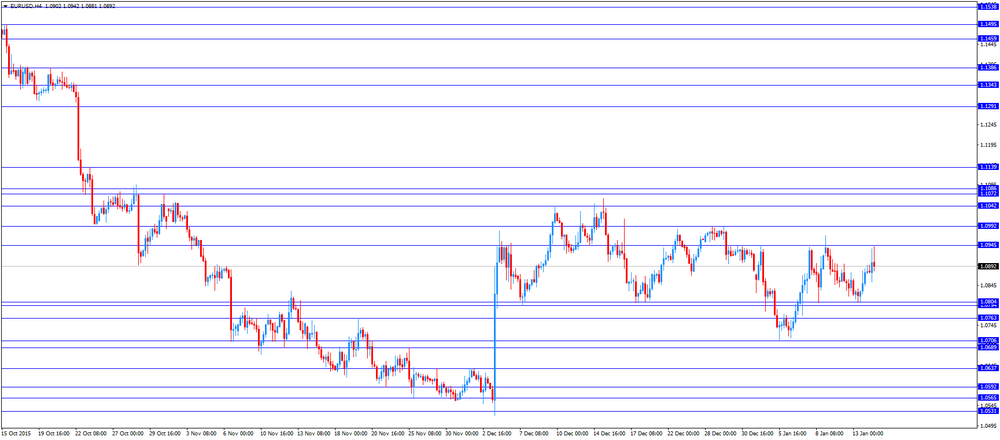

The euro traded higher against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The minutes showed that some members wanted a 0.2% cut of the deposit rate.

The ECB kept its interest rate unchanged at 0.05% in December, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. Earlier, the asset buying programme was intended to run until September 2016. The volume of the monthly purchases remained unchanged.

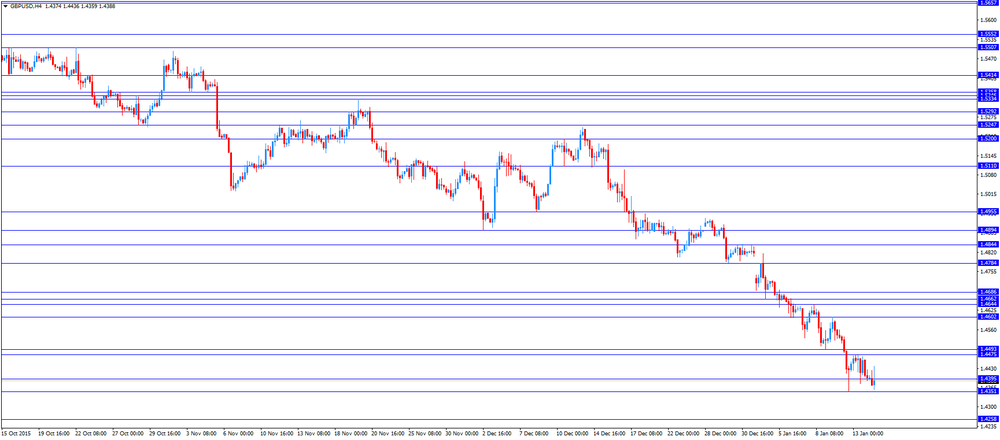

The British pound traded mixed against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its January meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in November, after a 0.3% gain in October.

EUR/USD: the currency pair rose to $1.0942

GBP/USD: the currency pair dropped to $1.4379

USD/JPY: the currency pair fell to Y117.51

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index, MoM November 0.3% 0.2%

13:30 U.S. Import Price Index December -0.4% -1.4%

13:30 U.S. Initial Jobless Claims January 277 275

13:30 U.S. FOMC Member James Bullard Speaks