- Foreign exchange market. Asian session: the Australian dollar declined

Market news

Foreign exchange market. Asian session: the Australian dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans November -0.3% Revised From 2.0% -0.5% 1.8%

The Australian dollar declined amid news from China. Today the yuan declined by 0.3% against the U.S. dollar outside mainland China. Now the offshore yuan is cheaper than the mainland. The gap continues to expand, that's why the People's Bank of China might take steps again. The Chinese currency weakened amid declines in the Shanghai Composite index.

Earlier the Australian dollar was supported by home loans data. Home loans rose by 1.8% in November compared to October on a seasonally adjusted basis. The value of loans to investors rose by 0.7%, marking the first increase in seven months. In October they declined a revised 5.8%.

The yen rose after Bank of Japan Governor Haruhiko Kuroda said that the central bank was not considering further monetary policy easing. Kuroda reiterated that the price trend excluding temporary factors remained stable.

EUR/USD: the pair rose to $1.0890 in Asian trade

USD/JPY: the pair fell to Y117.60

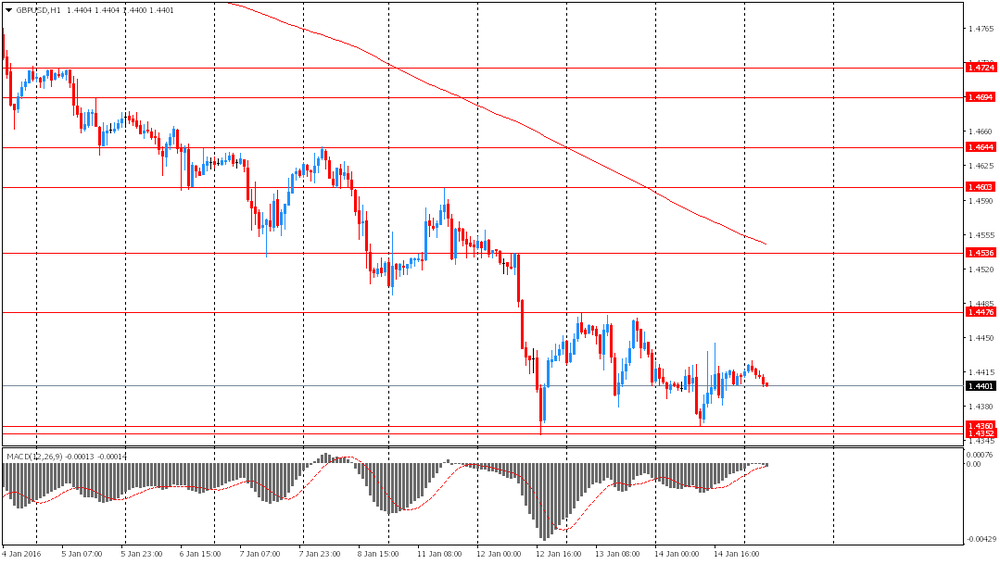

GBP/USD: the pair traded within $1.4400-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade balance unadjusted November 24.1

13:30 U.S. Retail sales December 0.2% 0%

13:30 U.S. Retail Sales YoY December 1.4%

13:30 U.S. NY Fed Empire State manufacturing index January -4.59 -4

13:30 U.S. PPI, m/m December 0.3% -0.2%

13:30 U.S. PPI, y/y December -1.1% -1%

13:30 U.S. PPI excluding food and energy, m/m December 0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y December 0.5% 0.3%

14:00 U.S. FOMC Member Dudley Speak

14:15 U.S. Industrial Production (MoM) December -0.6% -0.2%

14:15 U.S. Industrial Production YoY December -1.2%

14:15 U.S. Capacity Utilization December 77% 76.8%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 92.6 93

15:00 U.S. Business inventories November 0% -0.1%