- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney

Market news

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Industrial Production y/y December 6.2% 6.0% 5.9%

02:00 China Retail Sales y/y December 11.2% 11.3% 11.1%

02:00 China Fixed Asset Investment December 10.2% 10.2% 10.0%

02:00 China GDP y/y Quarter IV 6.9% 6.8% 6.8%

07:00 Germany CPI, m/m (Finally) December 0.1% -0.1% -0.1%

07:00 Germany CPI, y/y (Finally) December 0.4% 0.3% 0.3%

08:15 Switzerland Producer & Import Prices, m/m December 0.4% 0.2% -0.4%

08:15 Switzerland Producer & Import Prices, y/y December -5.5% -5.5%

09:00 Eurozone Current account, unadjusted, bln November 27.5 Revised From 25.9 29.8

09:30 United Kingdom Producer Price Index - Output (MoM) December -0.2% -0.2% -0.2%

09:30 United Kingdom Producer Price Index - Input (YoY) December -13.1% -11.9% -10.8%

09:30 United Kingdom Producer Price Index - Input (MoM) December -1.6% -1.8% -0.8%

09:30 United Kingdom Producer Price Index - Output (YoY) December -1.5% -1.2% -1.2%

09:30 United Kingdom Retail Price Index, m/m December 0.1% 0.1% 0.3%

09:30 United Kingdom Retail prices, Y/Y December 1.1% 1.1% 1.2%

09:30 United Kingdom HICP, m/m December 0.0% 0% 0.1%

09:30 United Kingdom HICP, Y/Y December 0.1% 0.2% 0.2%

09:30 United Kingdom HICP ex EFAT, Y/Y December 1.2% 1.2% 1.4%

10:00 Eurozone ZEW Economic Sentiment January 33.9 27.9 22.7

10:00 Eurozone Construction Output, y/y November 1.1% 2.1%

10:00 Eurozone Harmonized CPI December -0.1% 0% 0.0%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December 0.2% 0.2% 0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December 0.9% 0.9% 0.9%

10:00 Germany ZEW Survey - Economic Sentiment January 16.1 9 10.

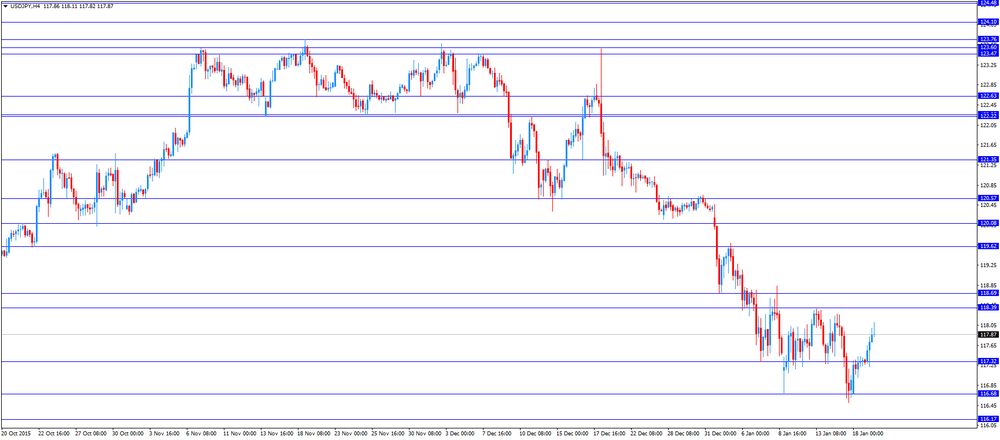

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. NAHB housing market index. The NAHB housing market index is expected to remain unchanged at 61 in January.

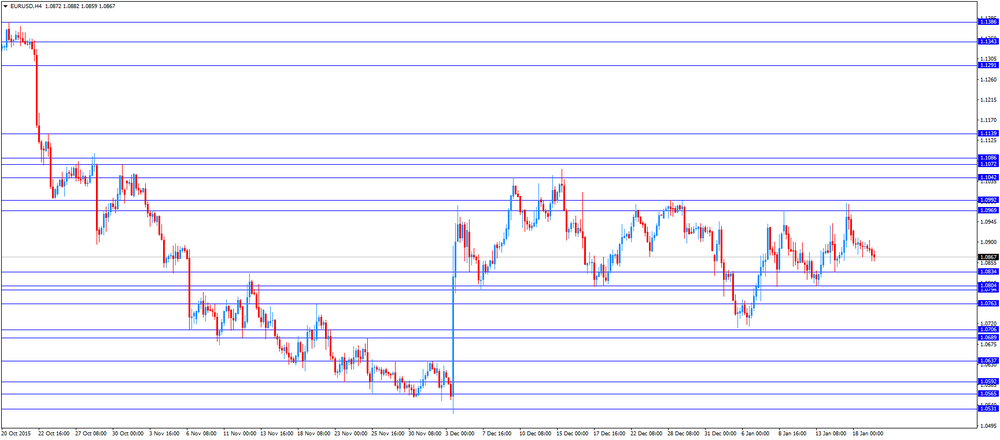

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 10.2 in January from 16.1 in December, beating expectations for a fall to 9.0.

"The beginning of the new year is characterised by capital market turmoil in China, which has also led to significant share price declines in Germany. As in the previous year, weak economic growth in China and other important emerging markets puts a strain on Germany's economic outlook," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 22.7 in January from 33.9 in December, missing expectations for a decline to 27.9.

Eurostat released its final consumer price inflation data for the Eurozone on Tuesday. Eurozone's harmonized consumer price index was flat in December, in line with expectations, after a 0.1% decrease in November.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco remained unchanged at an annual rate of 0.9% in December, in line with the preliminary reading.

Construction production in the Eurozone increased 0.8% in November, after a 0.6% rise in October.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus increased to a seasonally adjusted €26.4 billion in November from €25.6 billion in October. October's figure was revised up from a surplus of €20.4 billion.

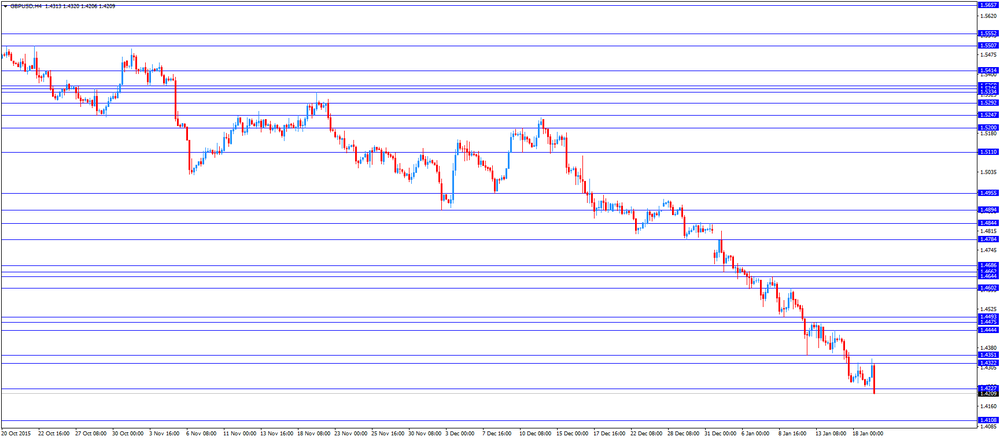

The British pound traded lower against the U.S. dollar on comments by the Bank of England (BoE) Governor Mark Carney. He said in a speech on Tuesday that "now is not yet the time to raise interest rates".

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.2% year-on-year in December from 0.1% in November, in line with expectations. It was the highest reading since January 2015.

The rise was driven by an increase in air fares, which climbed 46% in December. It was the highest rise since 2002.

On a monthly basis, U.K. consumer prices increased 0.1% in December, beating expectations for a flat reading, after a flat reading in November.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% year-on-year in December from 1.2% in November, beating expectations for a 1.2% gain.

The Retail Prices Index climbed to 1.2% year-on-year in December from 1.1% in November, exceeding expectations for an increase to 1.1%.

In 2015 as a whole, consumer price inflation was 0%, down from 1.5% in 2014. It was the lowest level since 1950.

The consumer price inflation is below the Bank of England's 2% target.

The U.K. house price index rose at a seasonally adjusted rate of 0.8% in November, after a 0.8% increase in October.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.7% in November, after a 7.0% in October. It was the highest rise since March.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. Foreign investors are expected to add C$12.1 billion of Canadian securities in November, after an investment of C$22.08 billion in October.

The Swiss franc traded higher against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices fell 0.4% in December, missing expectations for a 0.2% gain, after a 0.4% increase in November.

The decrease was mainly driven by lower prices for mineral oil products.

The Import Price Index decreased by 0.8% in December, while producer prices fell 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in December, after a 5.5% drop in November.

The Import Price Index fell by 9.7% year-on year in December, while producer prices dropped 3.6%.

EUR/USD: the currency pair mixed

GBP/USD: the currency pair rose to $1.4322

USD/JPY: the currency pair increased to Y118.11

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases November 22.08 12.10

15:00 U.S. NAHB Housing Market Index January 61 61

21:00 U.S. Net Long-term TIC Flows November -16.6

21:00 U.S. Total Net TIC Flows November 68.9

21:45 New Zealand CPI, q/q Quarter IV 0.3% -0.2%

21:45 New Zealand CPI, y/y Quarter IV 0.4% 0.4%

23:30 Australia Westpac Consumer Confidence January -0.8%