- Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the U.K. labour market data

Market news

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Producer Price Index (MoM) December -0.2% -0.4% -0.5%

07:00 Germany Producer Price Index (YoY) December -2.5% -2.2% -2.3%

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Average Earnings, 3m/y November 2.4% 2.1% 2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y November 2.0% 1.8% 1.9%

09:30 United Kingdom ILO Unemployment Rate November 5.2% 5.2% 5.1%

09:30 United Kingdom Claimant count December -2.2 Revised From 3.9 2.5 -4.3

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) January 16.6 -3

12:00 U.S. MBA Mortgage Applications January 21.3% 9%

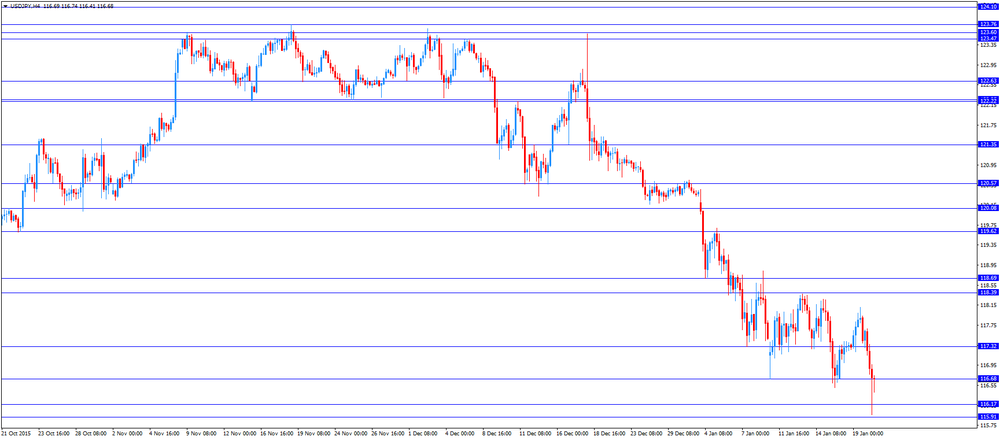

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic index. The U.S. consumer price inflation is expected to rise to 0.8% year-on-year in December from 0.5% in November.

The U.S. consumer price index excluding food and energy is expected to climb to 2.1% year-on-year in December from 2.0% in November.

Housing starts in the U.S. are expected to rise to 1.200 million units in December from 1.173 million units in November.

The number of building permits is expected to decrease to 1.200 million units in December from 1.282 million units in November.

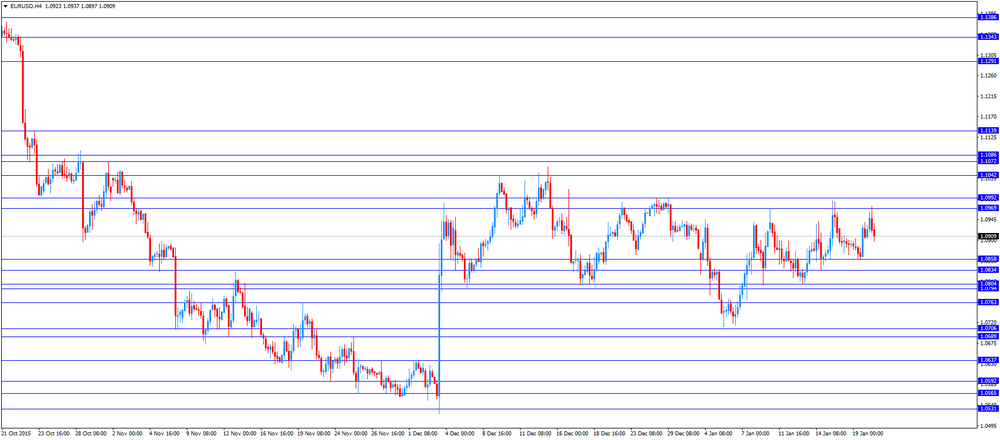

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Wednesday that there are limits to the central bank's monetary policy. He pointed out that the ECB's quantitative easing was working.

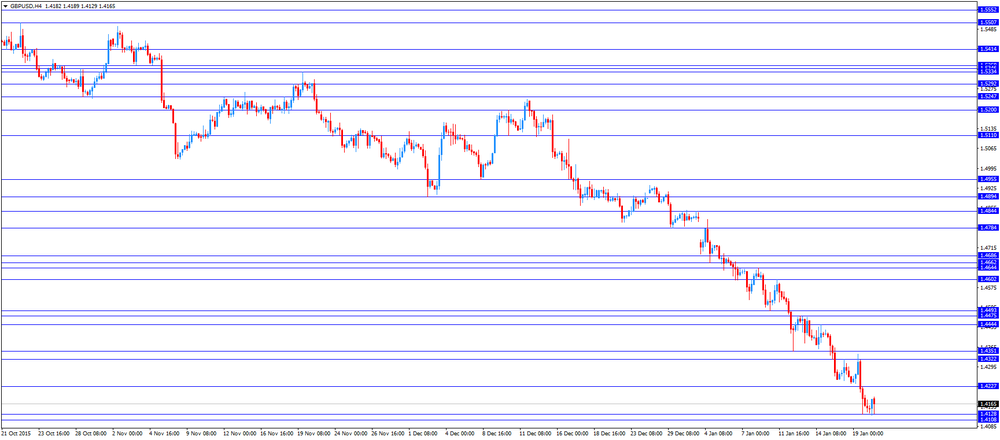

The British pound traded mixed against the U.S. dollar after the release of the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.1% in the September to November quarter from 5.2% in the August to October quarter. It was the lowest reading since three months to October 2005.

Analysts had expected the unemployment rate to remain unchanged at 5.2%.

The employment rate was 74%. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 1.9% in the September to November quarter, beating expectations for a 1.8% rise, after a 2.0% gain in the August to October quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the September to November quarter, missing expectations for a gain of 2.1%, after a 2.4% increase in the August to October quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its interest rate unchanged.

Canadian manufacturing shipments are expected to rise 0.5% in November, after a 1.1% decline in October.

Wholesales sales in Canada are expected to increase 0.5% in November, after a 0.6% decline in October.

The Swiss franc traded lower against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index plunged to -3.0 in January from 16.6 in December. It was the lowest reading since July 2015.

"Half of the analysts surveyed expect economic growth in Switzerland to stay unchanged. Meanwhile, among the other respondents, the share of analysts who anticipate deterioration exceeds the share of those expecting to see a pickup in economic activity by only three percentage points," the ZEW said.

EUR/USD: the currency pair declined to $1.0897

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) November -1.1% 0.5%

13:30 Canada Wholesale Sales, m/m November -0.6% 0.5%

13:30 U.S. Housing Starts December 1173 1200

13:30 U.S. Building Permits December 1282 1200

13:30 U.S. CPI, m/m December 0.0% 0%

13:30 U.S. CPI, Y/Y December 0.5% 0.8%

13:30 U.S. CPI excluding food and energy, m/m December 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y December 2% 2.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories January 0.234

16:15 Canada BOC Press Conference

21:30 New Zealand Business NZ PMI December 54.7