- Gold rises due to higher demand for safe-haven assets

Market news

Gold rises due to higher demand for safe-haven assets

Gold increased due to higher demand for safe-haven assets as oil prices continued to declined, and the U.S. dollar and global stock markets fell.

Market participants eyed the U.S. economic data. The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation declined 0.1% in December, missing expectations for a flat reading, after a flat reading in November.

The decline was mainly driven by lower energy prices, which slid 2.4% in December.

On a yearly basis, the U.S. consumer price index increased to 0.7% in December from 0.5% in November, missing expectations for a rise to 0.8%.

The U.S. consumer price inflation excluding food and energy gained 0.1% in December, missing expectations for a 0.2% rise, after a 0.2% increase in November.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.1% in December from 2.0% in November, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents and medical care.

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. declined 2.5% to 1.149 million annualized rate in December from a 1.179 million pace in November, missing expectations for an increase to 1.200 million.

The fall was driven by declines in starts of single-family and multifamily homes.

Building permits in the U.S. fell 3.9% to 1.232 million annualized rate in December from a 1.282 million pace in November, beating expectations for a 1,200 pace.

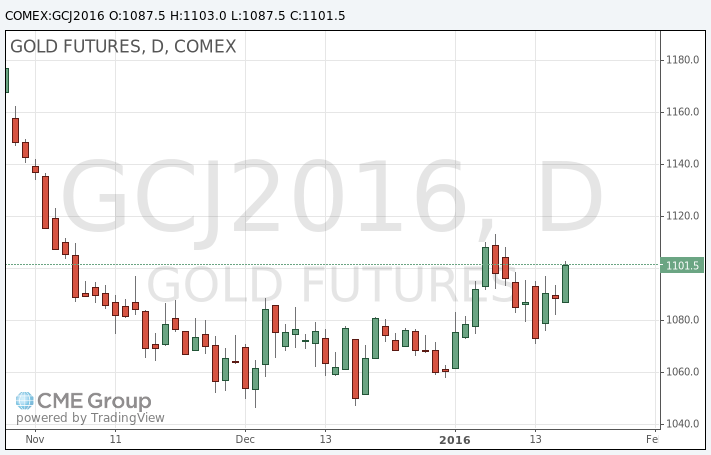

February futures for gold on the COMEX today rose to 1103.00 dollars per ounce.